Hungary: Industry is back in business

After a disappointing April, industry was able to bounce back in May despite the supply side bottlenecks. Car manufacturing is leading the way, but other sectors are expanding too

| 40.2% |

Industrial production (YoY, wda)ING forecast 40.4% / Previous 59.2% |

| As expected | |

Unlike the May retail sales data, industry was able to meet high expectations. The 3.4% month-on-month increase in industrial production roughly matched market estimates. What is more important here is that with this strong May performance, industry is back in an upward trajectory.

Performance of Hungarian industry

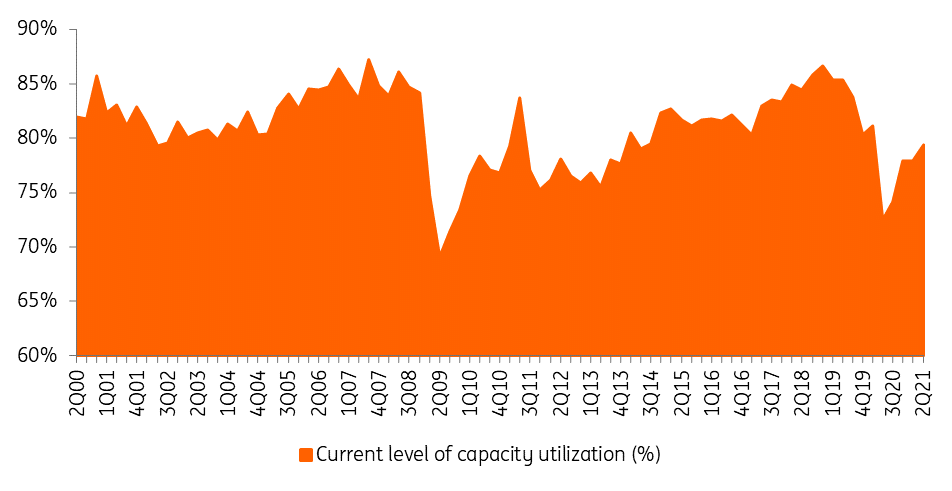

Obviously, the year-on-year reading looks much more compelling with its 39% growth rate. However, this is more a reflection of how deep the crisis was a year ago, as manufacturers scaled back or entirely closed their production lines due to the pandemic. So this year looks much better than 2020, however other types of challenges have arisen with supply side bottlenecks increasing backlogs. In this respect, May's performance looks even better as car manufacturing, which has suffered from a scarcity of semiconductors, was able to ramp up production. With this in mind, it’s worth noting that capacity utilisation moved higher in 2Q21 to 79.4%, the highest in the last five quarters.

Capacity utilisation in Hungarian manufacturing

According to the Statistical Office, the manufacture of transport equipment (representing the largest weight in local industry) increased a lot in May. The manufacture of computer, electronic and optical products and the manufacture of food products, beverages and tobacco rose at a rate below the elevated industrial average. This shows a well-rounded growth profile for industry.

Over the coming months, year-on-year indices will slowly normalise as the base itself rises. However, we continue to put emphasis on the monthly growth numbers. Based on these, we expect sustained but rather moderate growth until the problems with supply chains and difficulties in sourcing raw and intermediate products are resolved. In the meantime, growing global demand is expected to further expand order books, but due to the scarcity of inputs (whether it is about materials or labour), we can expect longer delivery times. This is well represented in the manufacturing PMI data, which shows an improving trend despite challenges.

Manufacturing PMI and industrial production trends

All this means a great deal of uncertainty for market players over the near future. But given that industrial output was almost 18% higher in the first five months of 2021 than a year earlier, we see double-digit growth in Hungarian industry for this year as a whole.

Download

Download snap