Hungary: Buying frenzy in non-food shops continues

Retail sector turnover rose at a slower-than-expected pace but a significant increase in real disposable income is driving people to non-food stores to buy more

| 6.1% |

Retail sales (YoY, wda)Consensus (7.4%) / Previous (7.7%) |

| Lower than expected | |

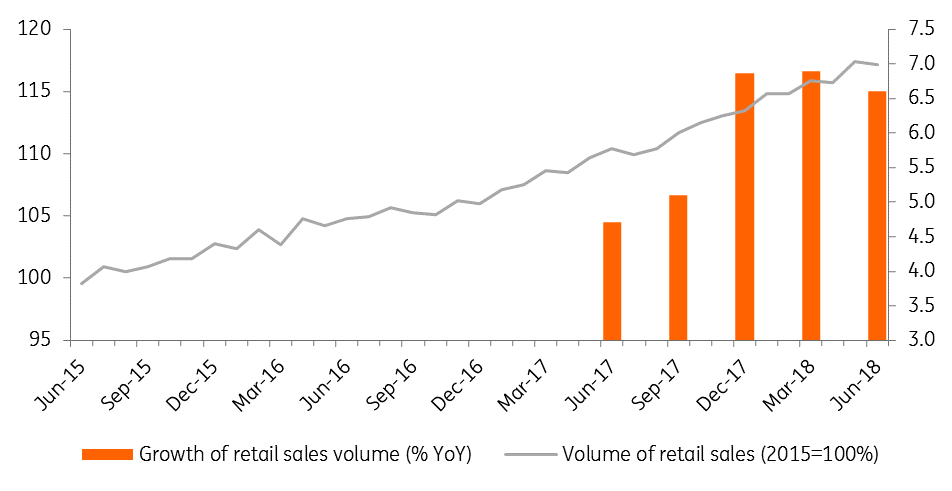

Working days-adjusted retail sales turnover increased by 6.1% year-on-year in June, thus the roller coaster continued. After a weak April and a surprisingly strong May, we are back to the lowest growth rate for this year. But that's still much stronger than last year’s average at 5.4% YoY. As regards the second quarter, the average quarter-on-quarter and year-on-year growth rates decreased, suggesting a lower but still remarkable contribution of consumption to GDP growth. This picture fits our view of a slight deceleration of economic activity to 4% YoY in 2Q18.

Volume of retail sales

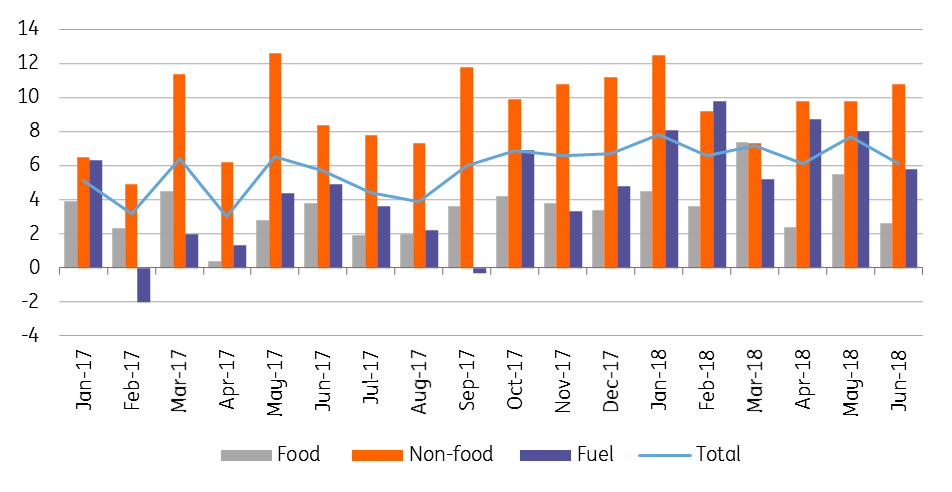

The retail sector’s slowdown is mainly related to fuel prices, as higher prices discouraged fuel consumption, showing only 5.8% YoY growth, the second lowest rate for this year. Turnover in food shops also increased at a below-average pace (2.6% YoY). In the meantime, people are still buying in non-food shops like there is no tomorrow: the 10.8% YoY increase is the second highest rate this year. This could be due to the 2018 FIFA World Cup and related sales at electronic retailers.

Breakdown of retail sales (% YoY, wda)

We have to wait until next week for a more complete picture of 2Q18 economic activity but so far, we have at least one good reason to stick to our view regarding a mild deceleration. In any event, consumption will remain at the forefront of growth momentum as long as the labour market continues to strengthen.

Download

Download snap