Hungarian real wages continue to plunge as inflation bites

Although average gross wages rose by 16.6% year-on-year in March, sky-high inflation is eating into household purchasing power. Looking ahead, we do not expect a turnaround until the fourth quarter of this year

| 16.6% |

Gross earnings growthING Forecast 11.9% / Previous 0.8% |

| Higher than expected | |

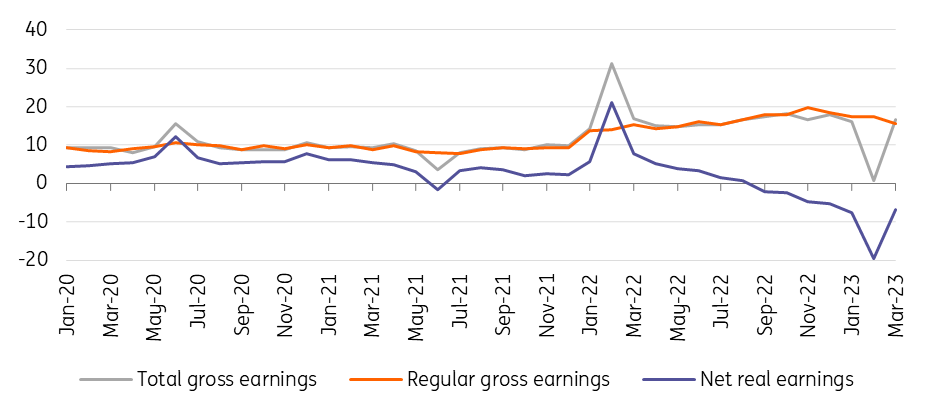

The Hungarian Central Statistical Office (HCSO) has just released March’s wages data, which was expected to display a rebound after February’s distorted picture. However, the official average gross wage growth exceeded even the most optimistic expectations, as the yearly based figure surged to 16.6% in March. Nevertheless, we believe that regular gross earnings which grew by 15.7% year-on-year are more meaningful, as they exclude bonuses and thus provide a clearer picture of the true dynamics of wage growth. In this regard, we can see that there has been a slow deceleration in the growth rate of regular gross earnings since the peak in November 2022.

Median wage growth in March was 16.3% YoY, which is slightly lower than the growth rate of average gross wages, thereby signalling that bonus payments favoured higher earners, as one would expect. As positive as these figures look, the purchasing power of wages has nevertheless declined, with real wages shrinking by 6.9% in March, as sky-high inflation continued to dampen households’ purchasing power. March is the seventh consecutive month in which real wage growth has been negative, and we believe that this trend will continue at least until the end of the third quarter.

Nominal and real wage growth (% YoY)

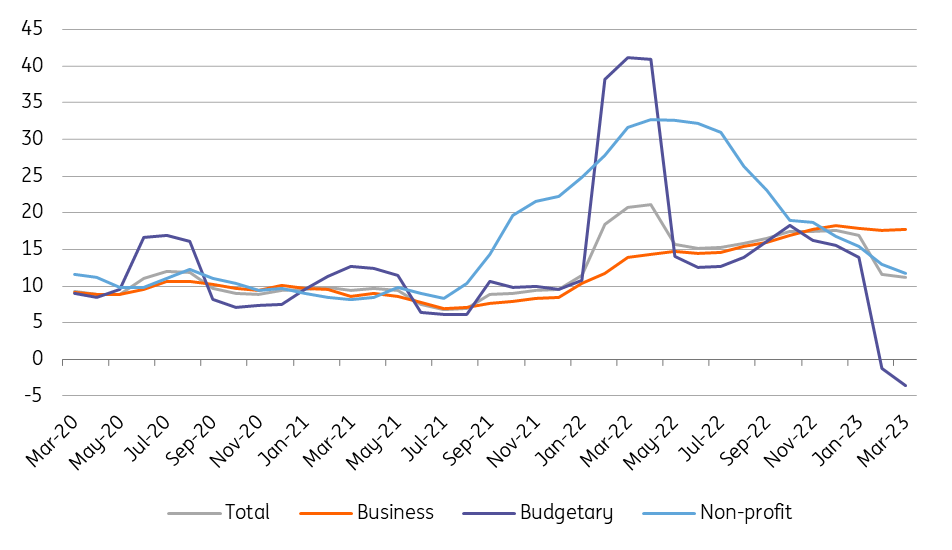

Looking at the divergence in wage growth between the private and public sectors, the impact of bonuses is clearly visible. While public sector wages grew by only 10.4% year-on-year, average wages in the private sector surged by 18.7%. Across economic branches, wages grew at the highest pace in agriculture, mining, and in manufacturing. As the latter is known to have been struggling with labour shortages for some time, this may be partly the effect of bonus payments and partly a boost from labour shortages.

Wage dynamics (three-month moving average, % YoY)

Going forward, we expect the 2023 full-year wage growth to be around the March level. However, this is likely to be closer to the lower end of the forecast range, given the peculiarities of this year. For example, many companies only signed new wage agreements in the spring, which could push up average wage growth further. Similarly, wage settlements over the course of the year could have the same effect in some areas of the public sector.

In our view, even though the pace of wage growth could be around 16-17% this year, we still expect households’ purchasing power to fall. As per our latest forecast, we expect inflation to average around 19% for the full year, and thereby real wages to fall by 2-3% on an annual basis. However, as inflation will display a downward-sloping trajectory this year, we believe that the story of real wages will follow a similar profile.

This means positive real wage growth could return toward the start of the fourth quarter of this year, as inflation moderates. The main question remains whether this will fuel consumption and thus elevate inflationary risks, or boost savings and thereby lower growth prospects. In our view, the latter is more likely, given that households have already tapped into their savings significantly to offset the impact of extreme inflation. This is the reason why we believe that the forthcoming positive income shock at the end of the year implies less upside impact on inflation and more downside on growth.

Download

Download snap