Hungarian inflation drops further than expected

While we flirted with the idea of calling for negative monthly inflation in May, we've now seen a sharper drop than anybody expected. Non-core factors were the key drivers, and we now see the National Bank of Hungary sticking to its May playbook in easing

| 21.5% |

Headline inflation (YoY)ING estimate 22.1% / Previous 24% |

| Lower than expected | |

A sharp drop in both headline and core inflation

For Hungary, the potential of further easing in inflationary pressures in May has been on everyone's minds recently. We all saw last year’s speedy acceleration in inflation (especially in food products) and this time around, we knew that base effects would play a crucial role. The main question remained the month-on-month print.

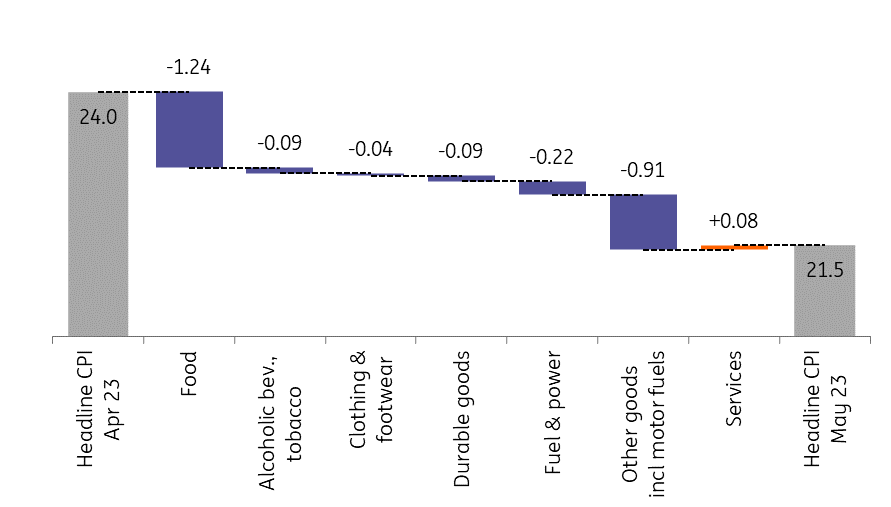

The inflation print came in at –0.4% MoM in May, marking the first price drop since November 2020. With the help of base effects, headline inflation decelerated by 2.5ppt to 21.5% year-on-year. There is one exception in items where inflation hasn't eased, which also caused some downside surprises.

Main drivers of the change in headline CPI (%)

The details

- Food inflation came in at just 0.1% on a monthly basis, which reflects pricing changes in both unprocessed and processed food items. Here, the reading retreated to 33.5% YoY. This easing in price pressure is responsible for half of the deceleration in inflation from April to May. Both core and non-core items showed easing price changes, helping prompt the drop in core inflation.

- Motor fuel prices declined by 6.6% from April to May – slightly more sharply than our forecasts. A fixed price for almost the entire year in 2022 – thanks to the fuel price cap measure – also resulted in a significant reduction in the YoY inflation index.

- Household energy prices fell by 3% MoM, yet another downside surprise to our expectation of a weaker drop in prices. This easing price pressure is a result of an ongoing decrease in household energy consumption, combined with some seasonal factors as the heating season came to an end in May. This created a lower weighted average unit price of piped gas, the most important factor behind the drop.

- We'd also like to point out one exception where inflation wasn’t able to ease. For services, prices rose by 0.9% MoM on average in May, moving the yearly index up to 14.3% – though still a weaker acceleration than we expected. There is still a significant repricing of other services (financial and insurance services mostly), but holidays have also become more expensive, along with cultural and leisure services.

The composition of headline inflation (ppt)

Underlying price pressures begin to calm

Though the May deceleration of headline inflation was mostly driven by non-core factors, we saw some positive developments in underlying price pressures as well. This means falling inflation in durables, clothing, and processed food. As a result, core inflation came in at 0.5% MoM, the lowest repricing since autumn of 2021.

Significant easing of monthly repricing is a result of collapsing domestic demand, with households facing the biggest drop in their purchasing power since the 2008-2009 crisis. Thus, the combination of the eased repricing and higher base ended up in a 2ppt lower YoY core inflation at 22.8%. Other underlying indicators – like declining sticky price inflation – are showing some promising signs that Hungary's economy could soon be out of the woods.

Headline and underlying inflation measures (% YoY)

Further easing in price pressures ahead

Moving forward, we expect both headline and core inflation to continue to retreat over the coming months – perhaps at a slightly slower pace without a significant downward impact on fuel. Domestic demand will remain constrained, especially given the shortfall in savings.

On the energy front, seasonality might help further reduce the average amount printed on overhead bills. The forint is getting stronger, which also helps to reduce imported inflation. The mandatory price cuts on some basic food items by large retailers could boost a reduction in food inflation – although we have some reservations about the overall impact, given the methodology of inflation calculation. Services might remain the only area where we can still expect some further acceleration in inflation.

Lower inflation forecast, no change in monetary policy view

In light of today's surprise, a single-digit inflation rate at the end of the year seems almost certain. In fact, barring an energy and fuel price shock, a sub-10% rate could even be within reach by November. Considering the May inflation print, we have also revised our full-year inflation forecast for this year. We now expect the headline reading to be around 18% rather than 19% on average.

When it comes to the monetary policy implications of the May inflation reading, it will lend more confidence to the National Bank of Hungary to continue its gradual and cautious easing cycle. However, we maintain our view that the central bank will not change its playbook, and we expect to see a copy-and-paste version of the May rate decision on 20 June when decision makers gather for the June rate setting meeting. This means that, in our view, the effective interest rate (the overnight quick deposit rate) could be cut by 100bp to 16%.

Download

Download snap