Hungarian industry runs into trouble again

Despite the rosy picture painted by the past three months of PMI readings, industry is struggling to rebound. As such, the decoupling between the soft and hard data continues

| 0.8% |

Industrial production (YoY, wda)Consensus 4.1% / Previous 5.0% |

| Worse than expected | |

The November industrial performance further increases the odds of a technical recession in Hungary. According to the latest data release, the volume of industrial production rose by 0.8% on a yearly basis, adjusted for working days. However, if we consider the -0.7% Month-on-Month (MoM) industrial performance, which comes after a truly disappointing October data release (-3.5% MoM), we can say that the underperformance of industry did little to improve the big picture about the Hungarian economy in the fourth quarter of 2022.

Volume of industrial production

Even though the Hungarian Central Statistical Office will only release the detailed data at the end of the week (13 January), the preliminary statement indicates which subsectors underperformed the most. The food industry (including beverage and tobacco production), along with electronics, posted a Year-on-Year slump, which could not be counterbalanced by a significant expansion in car manufacturing.

The exceptional lack of efficacy and resiliance of agriculture puts downward pressure on the food industry, which has been underperforming for the last three months. Furthermore, we believe that high energy prices have set off overarching demand destruction among companies, which in turn negatively impacts the energy production subsector. If we want to point to any silver linings besides car manufacturing, Electric Vehicle battery production is one driving force in November.

Volume of industrial production

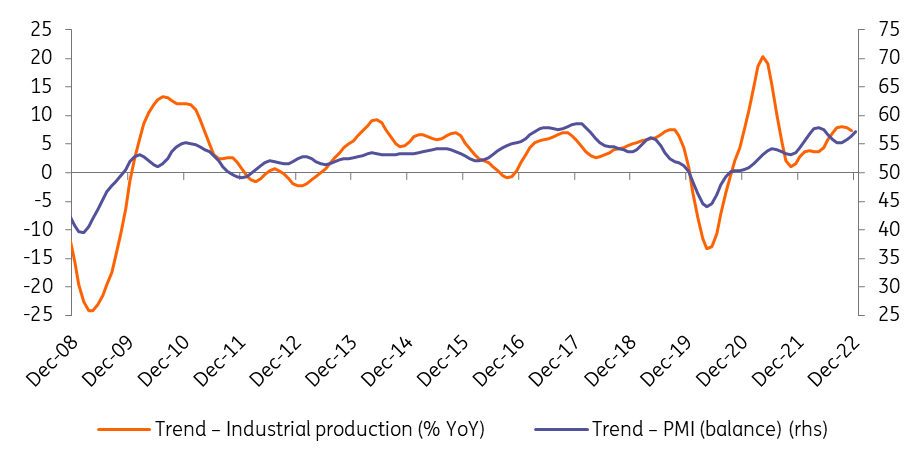

After three consecutive PMI readings of 55+ (63 in December) and two consecutive drops in the volume of industrial production on a monthly basis, we can see a substantial divergence between PMI and industrial production trends. This means that we can rely less and less on the predictive power of this soft indicator. The surprisingly robust December PMI figure is based on the rising volume of new orders and quantity of output subindices. Considering that driving forces are few and far between in the local manufacturing (and focused on car manufacturing and battery production), we think that the PMI is vastly overweighting these sectors.

Manufacturing PMI and industrial production trends

A possible green shoot

Speaking of which, as far as order levels are concerned, based on previous months' detailed data, the volume of stock of orders was almost 20% higher than a year earlier, which signals that industry does have some reserves to tap into, though possibly this is true for only specific sectors. Against this backdrop and despite the October and November downturns, we remain optimistic about industry’s longer-term outlook. If new waves of supply and energy shocks don't affect the sector, industry could remain a green shoot in a stumbling Hungarian economy.

Regarding the short-term outlook, we see no clear signs of further improvement in December, which used to be a weak month from a seasonal perspective. With winter shutdowns in car manufacturing and related suppliers, we might see the negative trend continuing. However, as domestic demand is dropping, reducing the economy’s import needs, car and battery manufacturing might be able to produce enough export capacity to create some positive net effect, reducing the hit to GDP growth. Nonetheless, it won’t be enough to avoid a quarterly drop in real GDP, and that's why we are pencilling in a technical recession for the second half of 2022.

Download

Download snap