How Petro FX could react to the OPEC meeting

In short: there's limited upside, only downside

Hamza Khan, ING’s Head of Commodities Strategy, notes that while initial plans were to discuss a 3-to-6 month extension, the conversation now seems to be centred on a 9-month extension (until March 2018). Oil markets have already priced this in.

Bar headline driven volatility, the meeting should be a formality for petro FX. A bigger story was the fact that the rest of the commodity universe had been catching a (potentially unrelated) bid after a tough couple of months; both AUD & NZD were the outperformers in the G10 FX space this week prior to the sharp reversal in Asia overnight. The combo of higher metals, a ‘flight-to-quality’ yield and a short positioning adjustment may have all been valid contributing factors.

The meeting should be a formality for petro FX

But for the AUD$, the China downgrade – and its possible knock-on effects for steel prices – highlights the fickle nature of chasing short-term upside in commodity FX (without a positive local story).

Overall, oil markets are gradually moving towards a more balanced level – but the path seems to be much longer than anticipated and riddled with short-term obstacles. This does not bode well for any lasting commodity FX impact. We think the focus should remain on idiosyncratic fundamentals; RUB & COP are those that remain sensitive to oil.

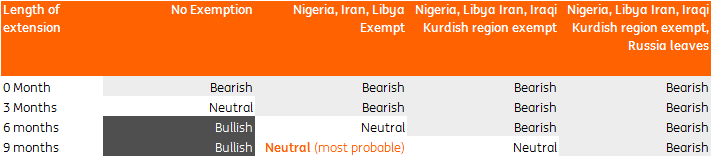

Possible outcome scenarios for the OPEC meeting

Download

Download snap