Does higher FX purchases mean more rouble dependence on OFZ flows?

FX purchases in May were less than expected, probably due to temporary issues with the Druzhba oil pipeline, but suggest an increase vs. April and imply complete sterilisation of the current account. We think this favours RUB depreciation in the months ahead unless foreign capital continues to flow into Russia's rouble-denominated local state bonds

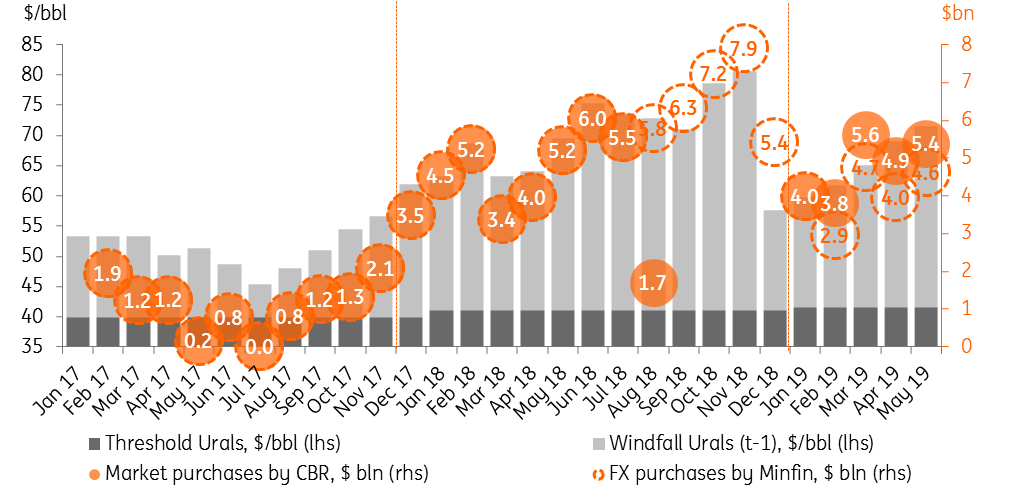

The Russian finance ministry announced that it will spend RUB 301 billion (an equivalent of $4.6 billion at the current FX rate) for FX purchases between 14 May and 6 June, as per the budget rule.

Even though below expectations, the volume of total FX purchases will still be a $0.5 billion increase in May vs April

The amount includes the RUB 314 billion in extra fuel revenues of the budget expected in May and the RUB 14 billion downward revision in the extra fuel revenues for April. Combined with the August-December 2018 backlog, when the Bank of Russia put market purchases on hold, the total amount of FX purchased on the market will be $5.4 billion in May, up from the $4.9 billion seen in April.

| 301 bn |

Minfin's FX purchases for May in roublesUp from RUB 255 billion in April |

| Lower than expected | |

In our view, the oil and gas revenues expected by the ministry of finance for May are lower than what the oil prices suggest. In part, this deviation may be partly explained by the temporary outages in the crude oil supply to Europe at the end of April and early-May via the Druzhba pipeline, which accounts for 20% of Russia's oil exports. According to our estimates, those delayed exports have cost the budget up to RUB 25 bn of undercollected revenues. However, given the substitution of the supplies with the sea tankers and the gradual return of the Druzhba, export deliveries and the budget revenues may catch up later.

Monthly FX purchases by Russian Finance Ministry/Central Bank

Even though below expectations, the volume of total FX purchases will still be a $0.5 billion increase in May vs. April amid the likely seasonal shrinking of the current account surplus. We continue to expect Russia's current account surplus to decline from $10-11bn per month in 1Q19 to $4-6bn per month in 2-3Q19, which suggest a near 100% sterilisation vs. just 40% in 1Q19.

This increases RUB's dependence on the portfolio flows into the Russian local state bonds, which so far have been favourable. According to official data, Russia's rouble-denominated OFZ market saw net capital inflows of c.$4 billion in 1Q19, and might have seen another $2-3bn in April, or up to 50% of the supply during the jumbo auctions, helping the rouble to appreciate by 8% in 4M19, significantly outperforming EM peers.

However, further prospects are less clear, as foreign investors have largely restored Russia's positioning in their portfolio after the 2018 sell-off, while the overall emerging-market risk appetite seems to have saturated amid the more balanced Fed rhetoric and prolonged US-China trade negotiations.

Unless there are positive surprises in the market mood and a change in Russian corporates and households preferences, that so far have been accumulating foreign assets, USD/RUB should trade in the 65-67 range in the coming months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap