Briefing Romania

Ministry of Finance tapping the local market in euro

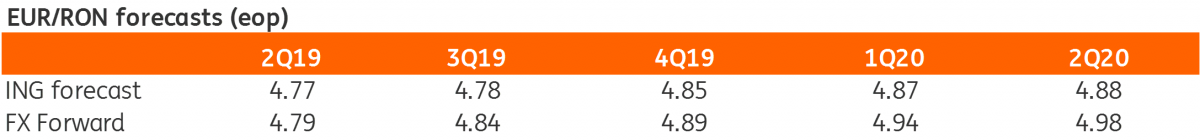

EUR/RON

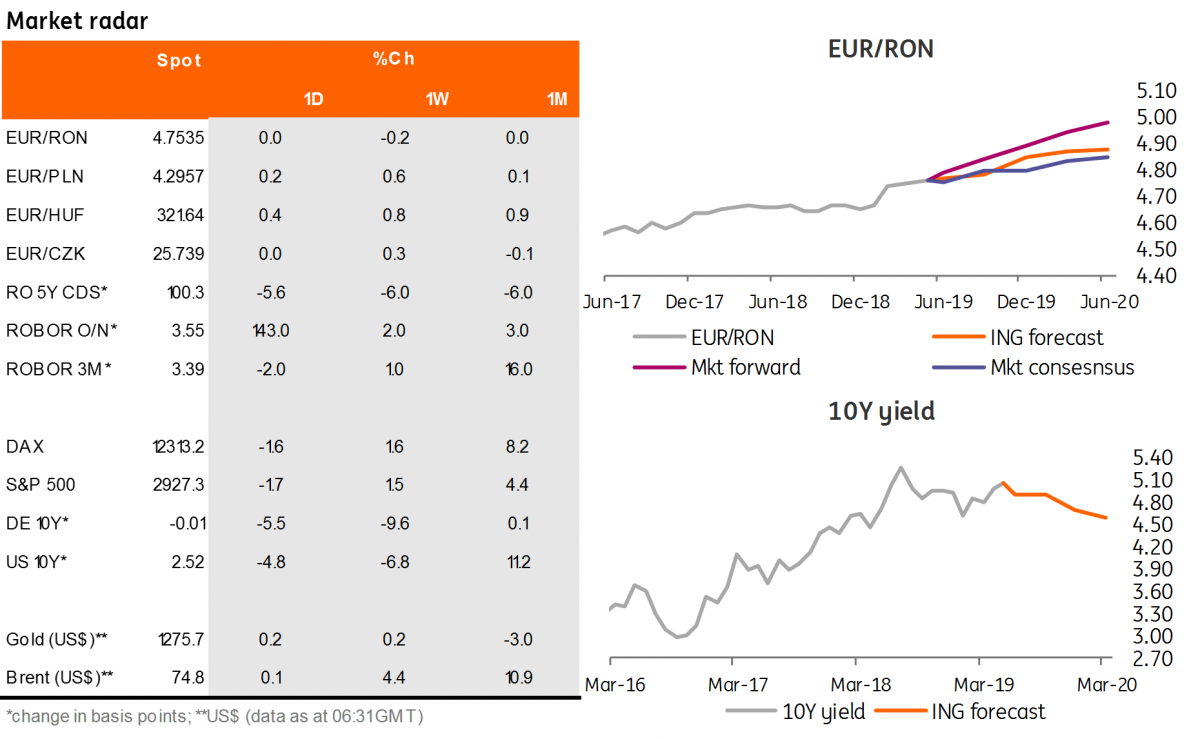

The marked deterioration in the risk backdrop following escalating trade tensions has started to bite into emerging markets FX as well. As usual, the Romanian leu looks to be the last one to follow the trend, but we think it’s only a matter of time before the EUR/RON corrects higher. Today we could see a test above 4.7600 after the quiet trading around 4.7550 we’ve had in the last few days.

Government bonds

Romanian government bonds continued to trade rather thinly as the curve remained broadly unchanged. Today the Ministry of Finance plans to tap the local market with two euro denominated bond auctions. The indicated target amounts are EUR100 million in Feb-2021 and EUR150 million in Dec-2023. We expect decent demand around 0.20% for the 2Y and 0.85% for the 5Y bond.

Money Market

Cash rates settled slightly below the 2.50% key rate yesterday. Banks have likely been very prudent in placing their surplus at the central bank’s deposit auction held on Monday. Hence, we could see slightly lower funding rates for the rest of the week.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap