Gold wants to break free

Gold has remained disappointedly range-bound through equity turmoil and rising geopolitical tensions. A flirt above $1360/oz last week was cut short by hawkish Fed minutes but more positive inflation prints could yet kick-start the returns needed to entice meaningful inflows

Inflation, Inflation, Inflation

Our bullish gold call centres on the belief that precious metal markets are still underpricing the full potential for inflation to pick up this year. Whilst this also raises the likelihood of a further three rate hikes in 2018, it will be the front-loading of inflation data that could spur gold’s long-awaited breakout, along with a little help from continued weakness in the US dollar and equity volatility. Establishing itself cleanly above $1350/oz is proving gold's biggest hurdle, but when it is done, gold stands its best chance to capture further flows from funds stuck on the sidelines.

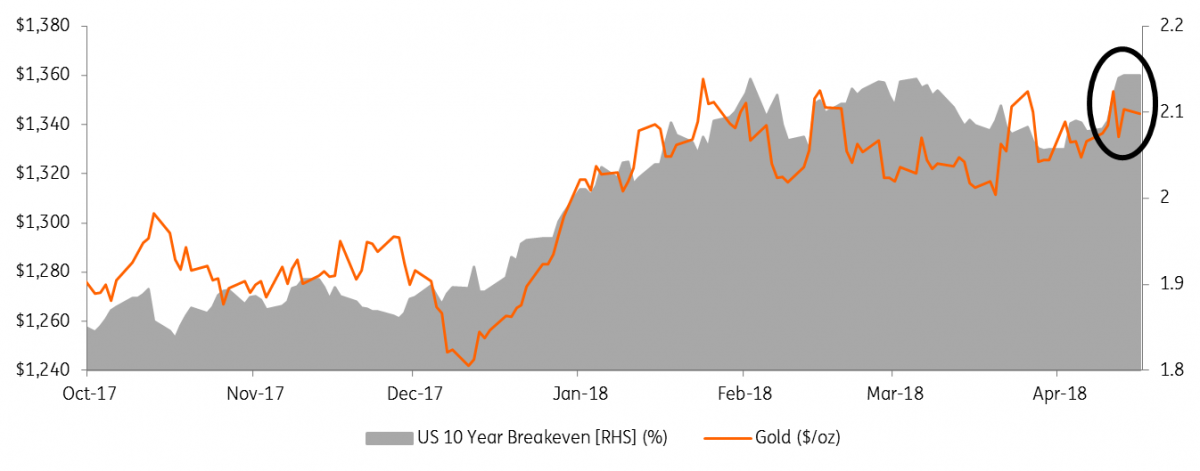

Higher inflation is coming. Last week’s core inflation (ex-food, energy) registered a one-year high of 2.1% and the US 10-year breakeven rallied to a fresh high of 2.14%. Our economists expect inflation prints to remain high and nudge closer to 3% into summer now that a distortion from cell phone data pricing drops out of annual comparisons as well as support from a weaker dollar, rising housing/medical costs, and wage growth from a tightening labour market. Each positive data print will tempt gold closer to its higher range.

Wednesday's rising core inflation figure spurred only the briefest inflows into gold but were it not for Fed minutes being released so soon after, gold could well have gone on to accomplish its long-awaited breakout. On Wednesday, prices hit an intraday high of $1365, a level surpassed only once this year, but gains were not solidified as nervousness from the Fed minutes spurred a wave of profit-taking. Open interest on the Comex ended its three-day uptick and fell 4% through to Friday as the liquidation dragged prices back below $1350. The Commitment of Traders positioning report showed a continual lack of conviction from the fund community as net positions were almost flat in the week ending April 10th.

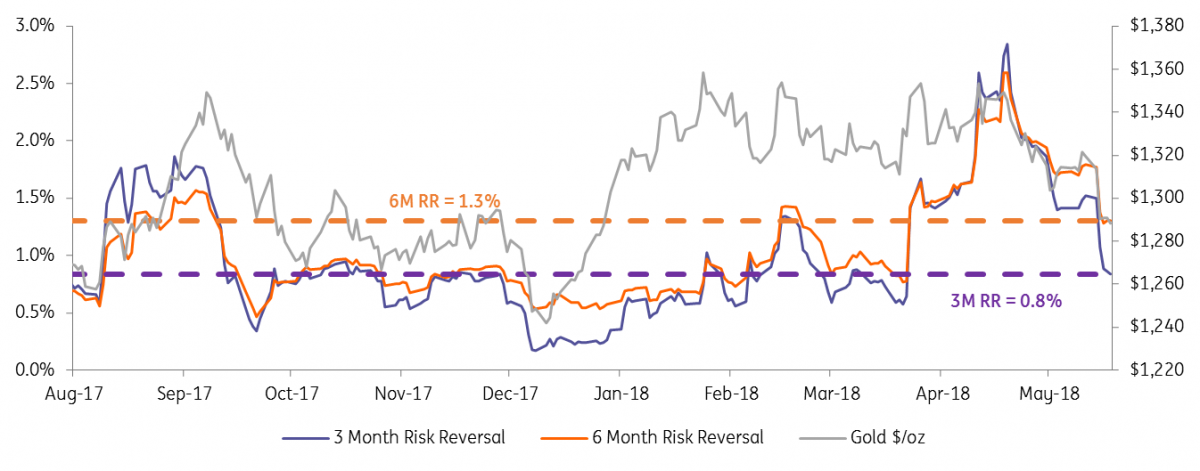

Look beyond outright positioning in futures/currency markets however and signals suggest the general positioning on gold is indeed bullish, albeit on the sidelines. ETF gold holdings are up by over 1Moz in the first two weeks of April (highest since 2013), short interest on the SPDR Gold ETF is down to its lowest for 12 months, and the risk reversals (25 delta 3M calls- puts) have surged to the highest since they briefly spiked after the 2016 US election. The market is increasingly skewed to the upside but it will need to be nudged into taking outright positions through an initial breakout in prices.

Today’s flat performance- even after an easing in Syria fears following missile strikes at the weekend- reaffirms an underlying support for the yellow metal and it’s likely that the re-emergence of geopolitical tensions (Syria, Russia, trade wars), a weaker dollar (ING forecasting 1.3 by year end), and equity volatility (VIX at 17%), could spark those enticing returns.

Breakeven nudges up with inflation expectations but gold stays in range ($/oz)

Options have biggest upside skew since 2016

Silver's fundamentals support a turn in the gold-silver ratio

The gold-silver ratio has averaged 81x to date in April, a level only briefly surpassed in 2016 and otherwise unseen since the global financial crisis. Our conviction that this ratio is too high and set to turn was reinforced by the 2018 GFMS silver survey published last week. The report shows that the silver market recorded a deficit last year for a fifth consecutive year, even as retail investment (coin and bars) fell 27% YoY. A 4% decline in mine supply this year will probably recover somewhat next year but a continued recovery in industrial demand (+4% in 2017 and growing for the first time since 2012) is expected to support the fundamentals. We also note that the lowest coins and bars investment since 2010 is likely to have bottomed given the correction in equity markets and crypto-currencies. Silver ETF holdings have jumped 820koz in April showing the allure of a cheap silver-gold ratio is indeed attracting investor holdings.

An abundant supply of liquid above ground stocks will nonetheless see flows dictate prices over fundamentals and we think the net short position in silver is unsustainable, prompting a recovery. CFTC data shows money managers remained a net short of 14.8k lots as of April 10th, the fourth net short position in a row, and at the largest portion of open interest since 1987. This leaves the market extremely vulnerable to short covering although time could be running out. Open interest has already retreated 10% from its April 6th high as prices remain range-bound. A sharp gold-silver ratio reversal will likely take gold’s initial uplift to squeeze out the silver shorts before the funds show further fatigue.

Gold-Silver ratio poised to turn with silver money managers most short since '97,

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap