Czech Republic: Housing loan standards tighten in 1Q

The first quarter bank lending survey suggests tighter standards and conditions for housing loans due to higher market rates and CNB macroprudential measures

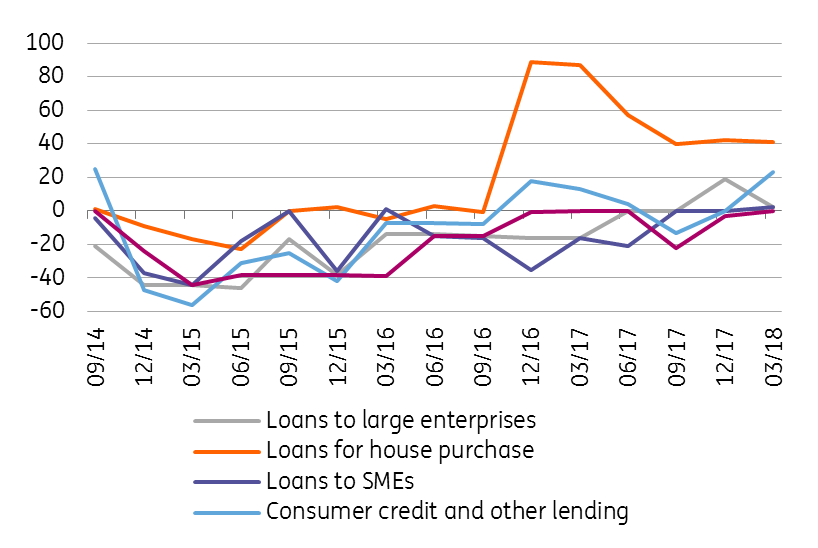

Housing loan credit standards and conditions tighten further...

As in previous quarters, the trend of tightening credit standards for housing loans continued in 1Q18. This was a result of higher market rates, but especially the tighter loan-to-value ratio demanded by the Czech National Bank (CNB). Credit standards also tightened slightly for consumer loans in 1Q18.

By contrast, credit standards stagnated for non-financial companies, while conditions slightly decreased, mainly due to the further decline in banks’ margins. In the case of large corporates, there was a decline in credit conditions in the area of credit maturity and quality of collateral.

Banks expect credit standards to develop in the same direction in the next quarter for all credit segments, with the exception of large corporate loans, where tighter standards are expected by a minor share of the banking sector.

Credit standards (% share of the banking sector)

This leads to weaker housing loan demand, along with high residential property prices

Demand for housing loans was lower in the first quarter compared to the 4Q17, which is also reflected in the Jan-Feb credit statistics published by the CNB. According to banks, weaker demand for housing loans is related to stricter LTV limits, high real estate prices and higher interest rates. In the case of consumer credit, demand basically stagnated in QoQ terms, still driven by households’ demand for durable goods. On the other hand, corporate loan demand increased, evenly driven by investment loans, M&S and corporate restructuring loans, but also the need for working capital.

Mortgage rates are likely to rise gradually

The result of the latest survey indicates the reduced availability of housing loans, which is related to the stricter recommendations of the CNB focusing on the residential real estate market, but also to the rise in market interest rates. Although the market rates of longer-maturities started to fall slightly in recent months- as the market is repricing the pace of CNB rate tightening- we believe it is just a temporary phenomenon and longer maturities will return to gradual growth. As such, we also expect mortgage rates to continue to rise this year.

The CNB is most likely satisfied with its macroprudential recommendations

Due to higher interest rates, high real estate prices and CNB recommendations limiting the LTV ratio, the volume of new housing loans will weaken this year and will not exceed the record volume of the past year. The slowdown in housing loans is desirable from the CNB's point of view and, if it continues, should prevent the CNB from further increasing the countercyclical capital buffer for the banking sector this year. This will most likely depend on credit dynamics in the next few months, but so far, the CNB might well be satisfied with its stricter recommendations on the residential market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap