Foreign reserves pile up by strong yuan

We expect foreign reserves to rise to $3165.0bn in January 2018 from December's $3139.9bn because of fast appreciation of the yuan in the month as well as from a currency valuation perspective. Though regulators are still worried about capital outflows, we expect more capital inflows later in the year. We keep our forecast of USD/CNY at 6.10 by end-2018.

China foreign reserves build up with strong yuan

Foreign reserves would keep rising, thanks to currency appreciation

We expect foreign reserves to rise to $3165.0bn in January 2018 from December's $3139.9bn. The increase should not be a surprise given the fast appreciation of the yuan against the dollar by 3.46% in the month. We expect more capital inflows attracted by the appreciating yuan.

The argument is even stronger if we look at the foreign reserves from a valuation perspective, as the British pound rose 5.1% and the euro rose 3.35% in January 2018. That implies investment gains of the foreign reserves simply by currency appreciation as the foreign reserves are denominated in dollars.

PBoC continues to worry about capital outflows, but not so for us

PBoC continues to worry about capital outflows as we do not see any relaxation of restrictions on outward investments by corporates.

However, we are not particularly worried about capital outflows,except from the fact that there would be capital outflow needs from the anti-corruption campaign in the Mainland.

We have started monitoring to see if the capital flow begins to change direction. Put simply, we believe that with expectations of a strong yuan more money would be coming into China for direct investments and also for portfolio investments.

Some of this could be hot money from the regulators's perspective. And it would be interesting to see how regulators react.

Would the regulator stem hot money inflows through currency intervention in the market or through window guidance? These two would yield different results.

The impact from the first measure (the steps usually hurt the long yuan investors and then after a while hurt the short yuan investors) would be more short-term but those actions could rock the market for a couple of months.

The effect from window guidance could be mild depending on the scale of expected hot money inflows but window guidance usually lasts longer, and is less predicatble from the degree of tightness of the measures.

The sell-off of US Treasuries has not affected the Chinese market so far

The dollar rises when the market has started to sell off US Treasuries. Though this affects exchange rates globally, it has little impact so far in the Mainland onshore bond market. Sovereign yields have not moved much.

This should not be explained by the PBoC's liquidity injection, because that aims to smooth short-term rates rather than sovereign yields.

Money freed up from the sale of US Treasuries needs to be reinvested somewhere in the world, and we would keep an eye on the China sovereign and quasi-sovereigns for changes in demand.

Recent sell-off of US Treasuries do not have an impact on the China sovereign curve

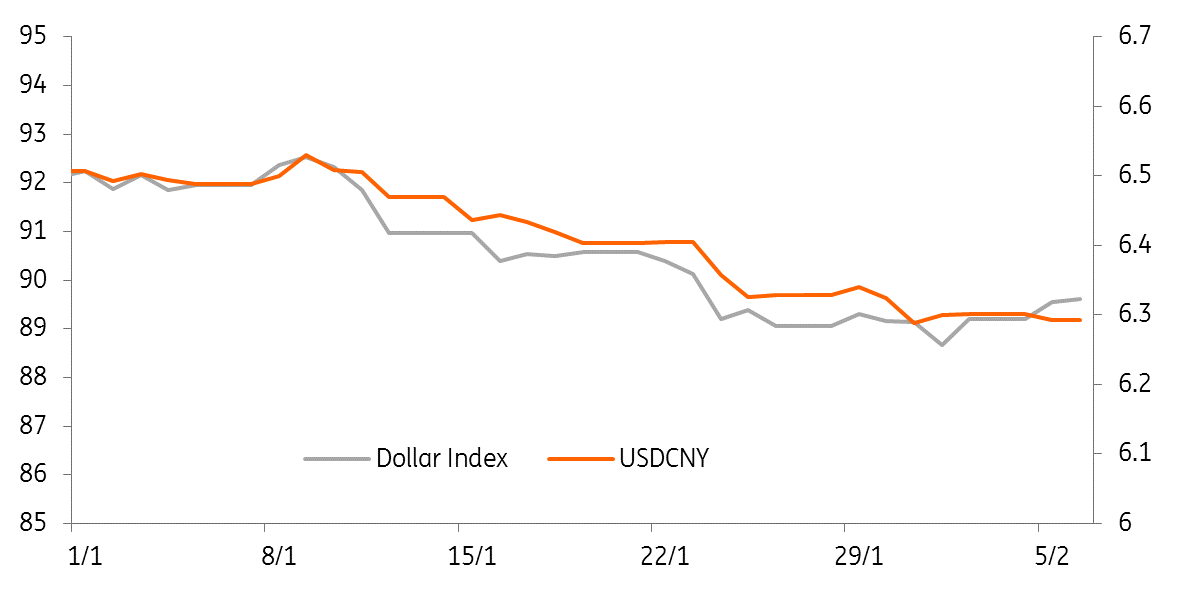

We keep our forecast of USD/CNY at 6.10 by the end of 2018

Despite the recent rise of the dollar trend, we believe that it is short-lived. Though we expect that the Fed to hike rates in March, we do expect the PBoC to follow the Fed with a slight move of 5bp as interest rates in China are already under upward pressure during the financial deleveraging reform.

Therefore we keep our forecasts of USD/CNY at 6.10 by the end of 2018.

Yuan would keep its strong trend though there are times of reversals from dollar hiccups

Download

Download snap

7 February 2018

Good MornING Asia - 7 February 2018 This bundle contains {bundle_entries}{/bundle_entries} articles