Fed tells markets they’re too complacent about hikes

Our key takeaways from September's Fed meeting

Very limited dot diagram changes sends market clear signal

As expected, the Federal Reserve has kept interest rates on hold this month. But as the Fed's preferred core PCE measure of inflation fell off a cliff in recent months, it wouldn't have been surprising to see some voters scaling back their expectations for rate hikes in the latest dot diagram. And even though the bar to see a downshift in the median dots for 2017 and 18 was relatively high (five voters would have needed to change to see 2018 move lower), markets were left slightly taken aback by the distinct lack of any major changes in thinking.

This lack of movement in the dots signals the committee is still fairly comfortable that the recent dip in inflation is largely a blip. The Fed has often said it believes much of the weakness to be down to temporary factors, and we also expect the pickup in fuel prices and fall in the US dollar to give inflation renewed impetus into the end of this year.

Upbeat economic assessment puts December hike firmly in play

Like the dots, the Fed's economic assessment remains fairly upbeat with the latest 2017 growth forecast revised up to 2.4%. We're expecting growth in the 2.5-3% region again in the third quarter, despite the major hurricanes in recent weeks (more here). This latter point was made explicitly by the Fed in the latest statement.

So take all of this together and throw in a potential (albeit gradual) pickup in wage growth given the tight labour market, then we suspect the Fed will be confident enough to hike rates again in December.

But don't ignore debt ceiling risk

But as ever, there are risks, and like so many times in recent years, the biggest one is political. The recent three-month extension of the debt ceiling means the new deadline is set to fall right around the Fed's December meeting. Barring an early deal on the issue, the risk of a government shutdown could create market volatility at an awkward time for the Fed and we could conceivably see the committee hold fire on a rate hike until early next year (though that's not our base case).

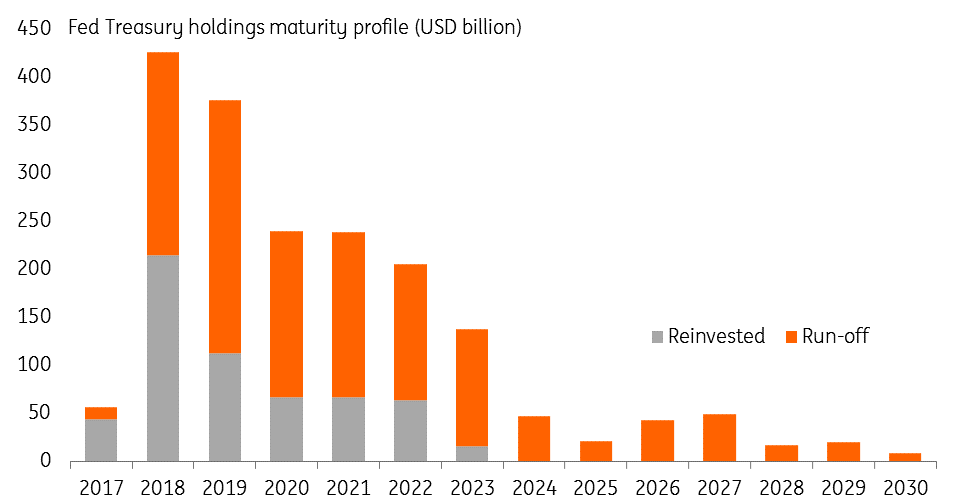

Long-awaited balance sheet unwind to commence in October

Finally, having released the bulk of the details in June, the Fed's announcement today that it will begin shrinking its $4.5 trillion balance sheet in October is more or less a formality. But while markets have been relatively calm about it all so far, our debt strategy team still think the curve could still come under some steepening pressure, given the sizeable chunk of additional Treasuries private investors will need to absorb over the next few years.

How the Fed will shrink the balance sheet

Download

Download snap