Czech wage growth remains strong

Nominal wages grew by 8.5% year-on-year in the third-quarter. Wage growth slightly exceeded the consensus and the central bank estimates of 8.2%, mainly due to higher wage growth in non-market sectors

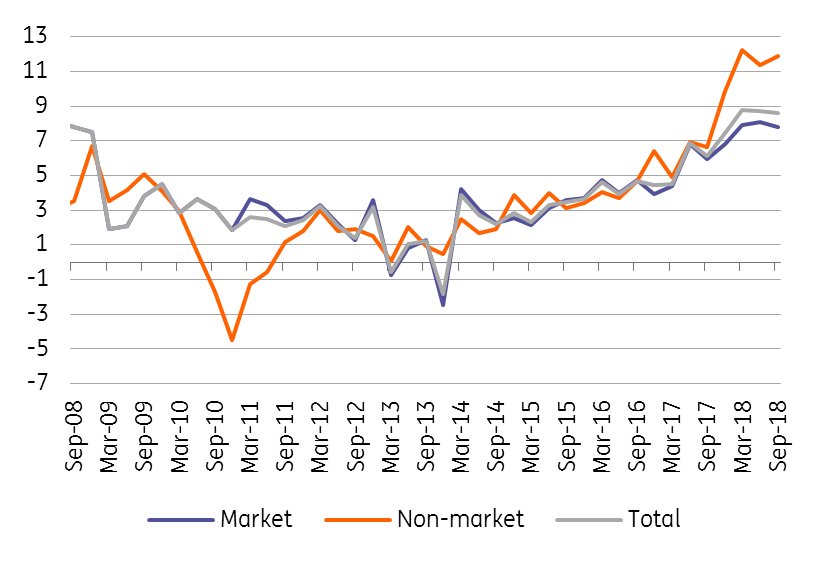

Wage growth in non-market segments accelerated in 3Q

As in the previous quarter, wage growth was faster in the non-market sector, as a result of wage hikes for civil servants and teachers in the second half of 2017. Year-on-year wage growth in non-market sectors continued to accelerate further from 11.4% in 2Q to 11.9% in 3Q, despite expectations for some deceleration due to the base effect (public sector salaries had already been raised in the third quarter of last year).

| 8.5% |

Nominal wage growth in 3Q189.8% YoY median wage growth |

| Better than expected | |

Market wages slightly decelerated due to industry wages

In contrast, wage growth in market sectors moderated slightly, from 8.1% to 7.8% compared to the previous quarter. In particular, wages in industry slowed down from 8% to 7% YoY most likely due to the fact the 2Q figure was affected by one-off bonus payments in the automotive sector. However, wages in many market sectors further accelerated, e.g. construction (8.7% YoY), accommodation and food service activities (8.2% YoY) and real estate activities (10.8% YoY).

Wage growth in (non)market segments (% YoY)

Real wages continue to be strong

In real terms, wages grew by 6.2% YoY in 3Q- still one of the highest year-on-year rates over the last ten years. This year, nominal wage growth will surpass 8% but we expect some deceleration next year towards the 6-7% level. While the labour market is expected to remain tight, we think higher labour costs will decrease the profitability of companies and thus put pressure on wages.

Wage growth broadly in line with the CNB forecast

The deviation from the Czech National Bank's forecast is negligible (8.5% in nominal terms vs the 8.2% estimate). The CNB expected a stronger deceleration in non-market wages in 3Q18 (8.8% estimate vs 11.9% actual), but slightly higher wages in the market segment (8% estimate vs 7.8% actual), though the total difference is relatively small and it is no game changer for the latest CNB forecasts. Strong wage growth supporting household consumption, in combination with a weaker-than-expected Czech koruna, will be the main reasons why the central bank continues to raise rates gradually next year, in our view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap