Czech wage growth disappointed at the end of 2018

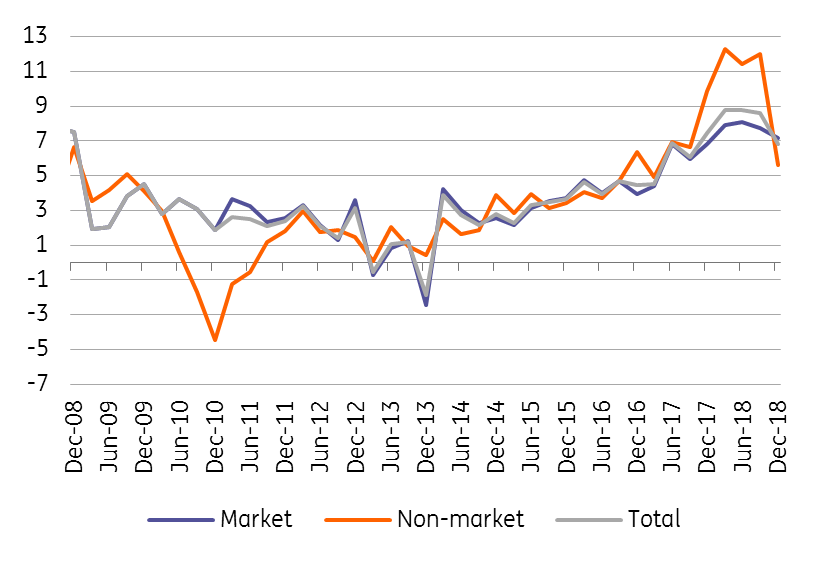

4Q18 wage growth slowed to 6.9%, from 8.6% in the last quarters of 2018. This was driven mainly from a high base in 2017 when wages increased in the public sector, but wage growth in the private sector disappointed too. This is another argument for the central bank to wait for the new forecast in May before any more rate hikes

Average wage growth weaker than expected

Average nominal wages grew 6.9% YoY in 4Q18. Wage dynamics slowed from the level of previous quarters (8.6%), but also by more than expected by the market. For the whole of 2018 wage growth reached 8.2%, its highest since 2001. This year's wage growth should slow as the 4Q18 figures indicate.

| 6.9% YoY |

average wage growth in 4Q18below the CNB forecast of 7.9% |

| Worse than expected | |

Public sector wages decelerated due to high base

While wage growth was faster in public sectors in previous quarters, reflecting an increase in government sector salaries, wage dynamics slowed markedly from 12% in Q318 to just 5.6% in the last quarter of 2018. This is due to the fact that there was a significant increase in public sector wages in November 2017, lowering YoY dynamics in 4Q18 due to a high base.

Slowdown apparent in almost all market sectors

Wage growth in the private sector also slowed, from 7.7% to 7.2% Interestingly, almost all sectors slowed. Wage growth in manufacturing stagnated at 7.1%, with slightly improved wage growth in transport and storage (7.2%). For all other sectors, especially those where wage growth has been robust in previous quarters, there has been a solid slowdown at the end of the last year.

Wage growth in (non)market segments (% YoY)

After a record 2018, we expect weaker wage growth this year

For all of 2018, wage growth reached 8.2%, its highest since 2001. As such, this is a very positive development for household income. By contrast, the profitability of a number of companies is declining due to rising wage costs. This will cause a further slowdown in wage growth this year, despite the labour market remaining overheated. 4Q18 figures offer the first signals of forthcoming developments. From this reason we expect wage growth to slow this year to close to 5-6%. On the contrary, wage growth in 2019 will be supported by a further 9.4% increase of the minimum wage and by a further increase in the salaries of state employees.

Another reason for the CNB to wait

In its latest forecast, the CNB expected wage growth of 7.9% YoY in 4Q18, mainly due to higher wage growth in non-market sectors (CNB: 8.6%, actual: 5.6%). But private sector wage growth also disappointed the CNB expectations (7.8% vs. 7.2%YoY). The weaker wage dynamics at the end of the year, coupled with a lower household consumption dynamics, and undergoing global uncertainty underlined by a more dovish ECB suggest that the CNB might not rush with hikes this month and will wait until May, when the new forecast will have been prepared. This is even more likely, particularly as there is only one month difference between the March and May meetings (one being at the end of the month and the other at the beginning).

Download

Download snap