Czech Republic: The CNB delivered hike as expected

Although the CNB delivered a 0.25ppt hike as expected, its new interest rate forecast assumes only one more hike this year given the assumption of a stronger koruna

Hike as expected, but interest rate outlook dovish

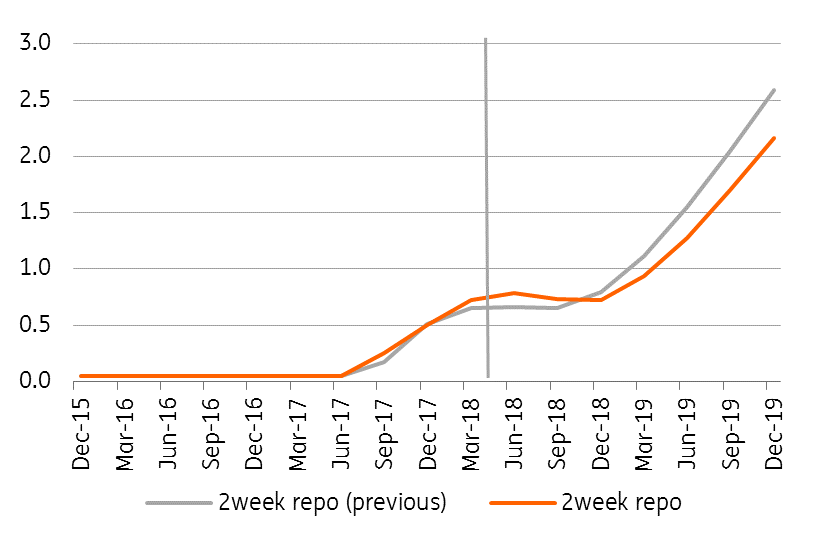

The CNB delivered a 0.25ppt hike during its Thursday monetary meeting, which was in line with market expectations. What surprised the market, however, was a new projection of interest rates, which hardly indicates one more hike this year, while the market expects at least another two. Though Governor Rusnok acknowledged a high likelihood of one more rate hike this year, he also pointed at uncertainty about its timing.

| 0.75% |

2-week repo rate after the CNB February meeting |

| As expected | |

The CNB's 2-week repo rate (%)

Dovish rates outlook given by bullish CZK forecast

While the interest rate forecast seems dovish, it is driven by CNB’s bullish CZK forecast. Indeed, the CNB renewed publishing its model assumption of EUR/CZK developments and expects EUR/CZK to get to an average level of 24.6 in 4Q18. This means that the CNB expects monetary tightening to be more delivered by a stronger CZK than interest rates this year.

Although the bulk of monetary tightening is expected to be delivered via the exchange rate in the CNB forecast, we doubt the EUR/CZK will reach 24.60 by year-end in the absence of no more (or one) rate hikes, particularly when two more hikes are already priced in by the market for this year.

We expect slightly different mix of monetary tightening

We differ from the CNB on two accounts: we expect more rate hikes than currently indicated (we look for additional two hikes this year); and we expect a less strong CZK (ING year-end forecast 24.80 vs CNB at 24.60). We note that both variables are key to determine the tightness of monetary conditions and should not be seen in isolation. Within the realm of monetary conditions, they are a substitute for one another. Still, we look for a mix of higher rates (two more hikes this year) and a less strong CZK vs the CNB forecast.

Should EUR/CZK continue declining meaningfully in the coming weeks/months (with the market pushing the cross lower in line with the latest CNB forecast), then there is a high risk of a delay/pause in the current CNB tightening cycle. The market cannot have its cake and eat it (all) – ie, look for both too strong CZK and an aggressive pace of rate hikes, becasue one is a substitute for the other.