Czech Republic: PMI slightly lower but still solid

Conditions in the Czech manufacturing segment deteriorated slightly last month. But the PMI reading of 58.8 is still one of the best in the last seven years

Slightly lower but still favourable

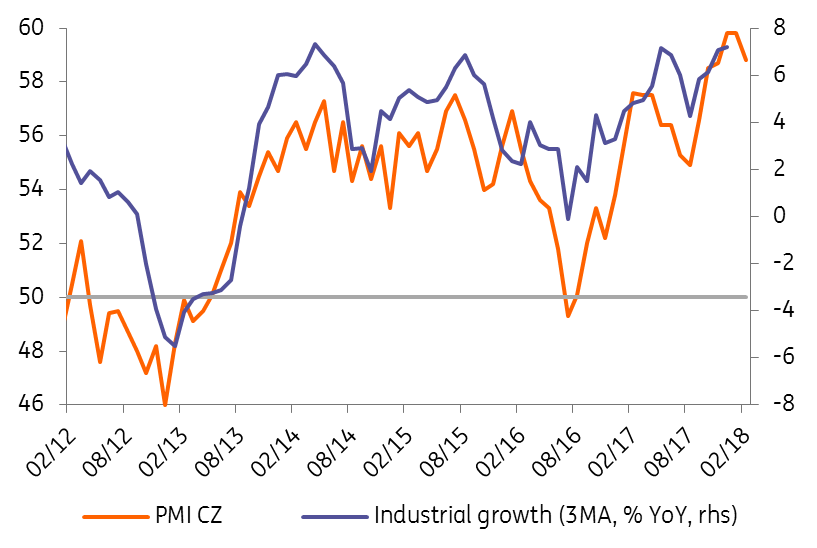

The Czech PMI fell to 58.8 in February, a slightly weaker print than in the past two months. This was slightly below analysts' expectations but still well above the average of the last year of 57.5 points. Despite a slight slowdown, production growth in February was the second highest in the last seven years.

| 58.8 |

Czech manufacturing PMIabove the one-year average |

| Lower than expected | |

Price pressures mounting

According to IHS Markit, output and new orders saw a solid expansion last month. New orders grew less than in the previous two months, but growth was still strong due to solid global demand. Capacity in the supply chain remained stretched, which led to a further increase in input prices, but due to strong demand, these prices were passed on to customers. As such, output prices soared by the most since April 2011.

Manufacturing PMI and Industrial production

Favourable beginning of 2018

Although the PMI slowed moderately in February, the outlook remains optimistic and the data confirms strong growth in domestic manufacturing. The slight decline is not so surprising after the record levels of previous months. Similar developments were also recorded in the Euro area, Germany and neighbouring countries and a PMI above 50 still indicates improving conditions. The 58.8 print points to strong output growth and is one of the highest figures since April 2011, suggesting a favourable start to the year for Czech industry. Company surveys also signal mounting price pressures, which should feed through to headline inflation and encourage the central bank to continue with the gradual tightening of monetary policy this year.

Download

Download snap