Czech Republic: Inflation at a new peak but there’s more to come

Inflation has reached a new peak but we expect it to rise further, mainly due to the announced energy price hikes for July and August. However, we believe that inflation near 20% year-on-year will not push the Czech National Bank (CNB) into raising rates in August. But further pressure on the koruna's depreciation could be a trigger

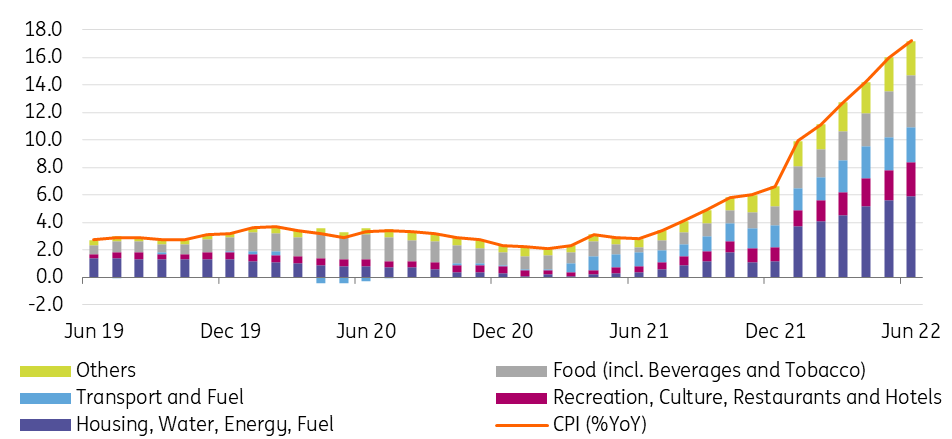

Food, energy and fuel prices are the main drivers again

Unsurprisingly, food, housing, energy and fuel prices drove inflation again in June. However, the month-on-month rate of headline CPI slowed slightly from 1.8% to 1.6%. The picture also remains the same from an annual perspective. The growth of consumer prices amounted to 17.2% year-on-year in June, which was 1.2pp up on May. Prices of goods in total went up by 19.3% and prices of services by 13.9%.

| 17.2% |

June inflation (YoY) |

| Higher than expected | |

The CNB expected 15.0% YoY for June in its spring forecast, which implies another widening of deviation from 1.1pp to 2.2pp. From a market perspective, the result is 0.1pp above expectations. According to our calculations, core inflation also rose further from 13.9% to 14.5%. As always, the official numbers will be released later today alongside CNB commentary.

Contributions to year-on-year inflation (pp)

Inflation to accelerate further due to newly announced energy price hikes

Although the CNB's spring forecast shows June inflation as a peak, we expect inflation to rise further not only because of continued general inflationary pressures but mainly because of the recently announced energy price increases by major suppliers in the Czech Republic. These changes should feed through to inflation mainly in July and August, but given the uncertain mix of fixed and floating contracts, we can expect a second round of this effect in the coming months and a further jump in the New Year repricing in January. Our current nowcast shows inflation rising further to 17.8% in July, however, given the above we could see a much bigger jump and we could see inflation very close to 20% YoY over the next three months.

Higher inflation won't push the CNB to raise rates, but pressure on the koruna could be a trigger

We expect the new CNB forecast published in early August to show a similar trajectory, which may be one of the reasons for the central bank's currently more aggressive approach to FX interventions. Despite this, for now, we still believe that the CNB will leave rates unchanged in August. However, this will lead to renewed pressure on the koruna, which may ultimately lead to an exit from FX interventions or a shift to a more flexible regime compared to the current commitment style, and an additional rate hike in September or at an unscheduled meeting if needed.

Download

Download snap