Czech producer prices accelerated in 2018

Even though the industrial producers price index fell in December due to the fall in oil prices, average growth in producers prices was the highest in a decade in 2018 and should continue to contribute to inflation growth

Fall in industrial producers prices was because of oil

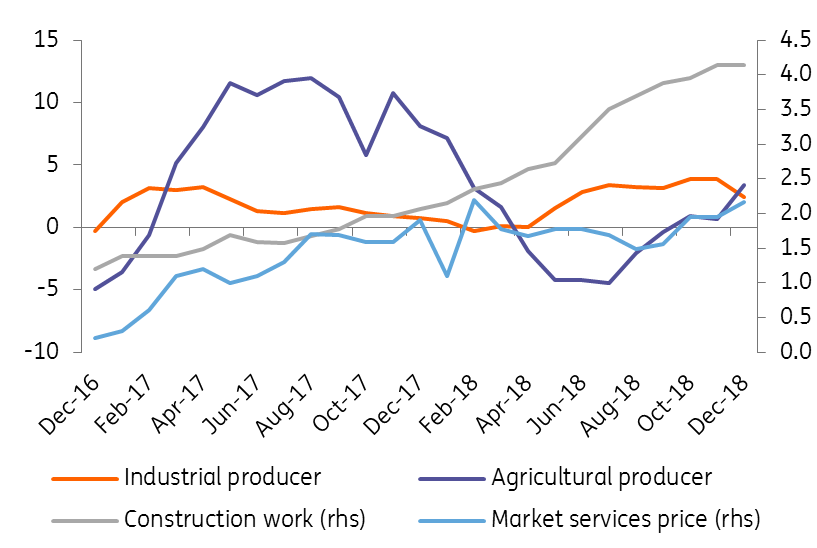

The industrial producers price index declined by 1.1% month on month in December. From the perspective of annual growth, price growth slowed down from November's 3.9% to 2.4% YoY. The main reason behind such a slowdown was the drop in oil prices at the end of 2018.

Other producer prices followed the trend of the last few months in December, with construction work prices growing by 4.1% YoY, service prices by 2.2% YoY and agricultural producer prices accelerating strongly by 3.4% YoY.

Producers prices (% YoY)

Average prices accelerated in 2018

For 2018, producer prices continued to accelerate slightly in comparison to previous years, except for agricultural producers, where prices just stagnated after the strong growth in 2017. Generally, however, producer prices had begun to grow again in the last two years after their decline or stagnation between 2012-2016. Their growth for the whole year was the highest in a decade in the case of market service prices and construction works prices and the highest in the past six years for industrial producers’ prices.

Producers prices growth should remain pro-inflationary this year

Producer prices are expected to grow this year. Agricultural prices due to poor harvests last year, in the case of services and construction, due to lack of capacities and wage growth. Industrial producers’ prices are likely to decelerate due to lower oil prices, but overall, producer prices will be a pro-inflation factor this year.

Unless there is a significant slowdown in the global economy, the Czech central bank will be able to continue tightening monetary policy, albeit at a significantly slower pace compared to 2018. Although the market expectations are rather pessimistic at the moment regarding more hikes, we still believe at least two hikes in 2019 are a likely scenario.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Czech RepublicDownload

Download snap