Briefing Romania

EUR/RON testing new highs

EUR/RON

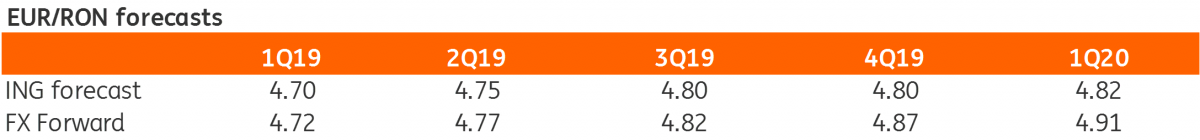

The EUR/RON tested the 4.69 level yesterday but likely ran into official offers as suggested by clustered trading and a spike in turnover around fixing time. Nevertheless, the official fixing once again marked a historic high, which could suggest that the central bank is aiming to smooth the speed of the Romanian leu's weakening, rather than stop/reverse it. Apart from the high FX pass-through, the National Bank of Romania is likely tormented by memories of the past when domestic savings were highly euroized.

Government bonds

ROMGBs had a relatively better day with mixed interest, though buyers seem to have dominated judging by the 2-3 basis point drop in the yield curve, similar to regional local currency sovereign debt markets. Today, the Ministry of Finance plans to sell on the local market EUR100 million December 2023. The context doesn’t seem supportive for accumulating low yielding assets, but given the large redemption of EUR929m on 21 January, we could see some roll-over demand.

Money Market

Cash rates have resumed a downward trend as we approach the end of the minimum reserve period. Overnight implied yields closed around 1.70% while longer dated tenors remained unchanged.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap