Czech industry solid in February

After a weak January, driven mainly by a slump in car production, February industrial production grew 1.5% YoY. The level of car production has stabilized

Relatively positive figures helped by some one-offs

Iindustrial production added 0.5% month-on-month in February, and 1.5% year-on-year. These figures surprised somewhat favourably, especially in the context of weaker leading indicators and data from abroad. However, the relatively strong figure is partly due to the lower comparative base in electricity production last year that was caused by a shutdown at the Temelin nuclear power plant. This accelerated the year-on-year growth in electricity production to almost 7%, contributing 0.8ppt to the 1.5% YoY industrial growth. Manufacturing itself added less than one percent year-on-year in February, but still at least positive after January's 3.3% YoY decline.

| 1.5% YoY |

Industrial production growth in Februaryvs. -1.0% in January and 3.3% avg growth for 2018 |

Car production stabilized - stagnation this year would be positive

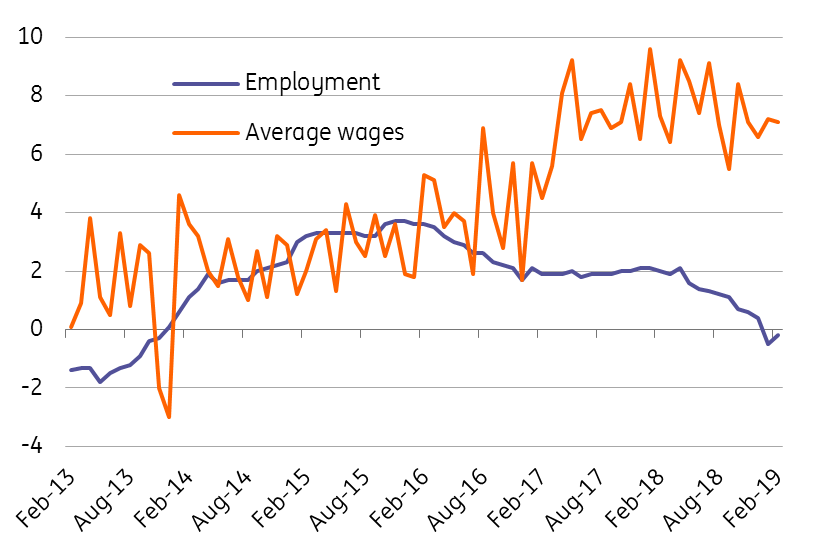

Car production fell 7.4% in January, the main reason behind the negative industrial result then. In February, car production broadly stagnated, falling by just 0.8% YoY. The automotive sector has grown by 2% in 2018 - following double-digit annual growth since 2014, and so the weakest dynamics since 2013. Recent data suggest the car sector will at best stagnate this year. New orders in industry have grown at just over one percent this year, and in the case of cars domestic orders are falling slightly. Employment fell slightly YoY for the second consecutive month.

Average wage and employment in industrial companies with 50+ employees (% YoY)

Data from abroad remains challenging

Although today's numbers from domestic industrial production have not disappointed, data from abroad, mainly Germany, have not added much optimism yet. February new factory orders in Germany fell significantly (by 4.2% MoM, vs. expectations of moderate growth). While February industrial production grew slightly month-on-month, this was mainly thanks to construction, while manufacturing fell by 0.2% MoM. The picture was completed by the 1.3% MoM fall in German exports released today. Though there are some signs of stabilization, we believe that Czech industry will slow close to 2% YoY this year, after 3.3% growth in 2018. Further downward revisions are not ruled out, particularly if forthcoming global data does not start to improve.

Download

Download snap