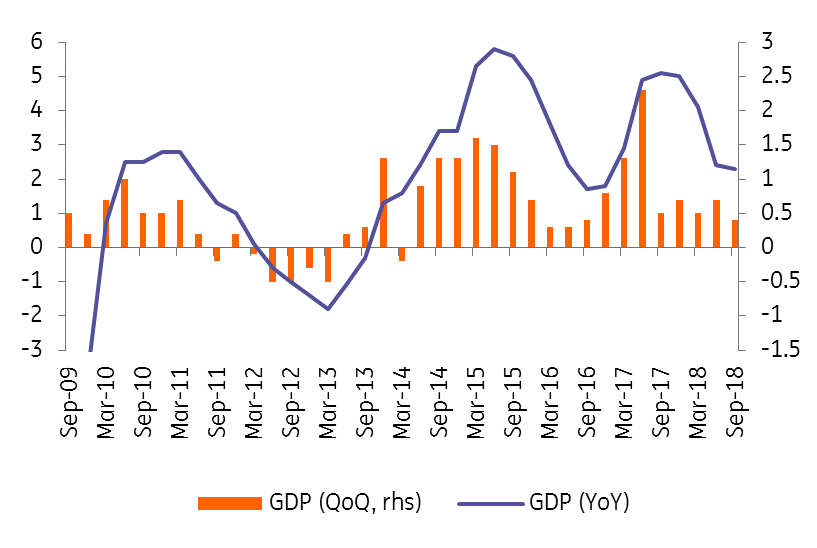

Czech GDP growth disappoints in 3Q

Czech economic activity in the third quarter disappointed, slowing to 2.3% YoY. The main growth driver was private consumption while investment probably grew less than expected. GDP growth will end slightly below the 3% mark this year

Growth missed expectations

3Q GDP ended below both the market and Czech National Bank estimate (2.6/2.7% YoY). No details have been released yet; they will be available at the end of November but the Czech statistical office (CZSO) noted that growth was driven by both domestic and foreign demand, though mainly household and government consumption.

| 2.3% |

SA YoY growth in 3Q18Below the CNB and MinFin estimate |

| Lower than expected | |

Various reasons behind the weaker result...

We expected private consumption to be one of the main contributors to growth due to the overheated labour market and solid wages. However, strong investment activity was also supposed to provide strong support to growth, and this was not mentioned by the CZSO in its note today. As such, weaker than expected growth of GDP in 3Q was most likely related to:

- A negative contribution of inventories due to a high base, which was also an important factor in the last quarter

- Weaker than expected investment activity. This is often a volatile, hard-to-predict item due to government investments related to EU funds withdrawal. In 2Q, government investment accelerated by more than 20% YoY but might not maintain such a pace in 3Q.

…and some one-offs related to emission standards

Last but not least, emission norms impacted the whole car segment in 3Q in the EU, which was also visible in German GDP growth in 3Q. This was below the market consensus, reaching -0.2 QoQ. This is the first QoQ decline since 1Q 2015. Part of the story is related to the new emission standards starting in September, which hindered sales and production of many car models. This might also partially effect figures for the final quarter of the year but should normalise next year, based on expert opinions.

see Germany: Wake-up call https://think.ing.com/snaps/germany-wake-up-call/

Czech GDP growth (%)

Economy will grow slightly below 3% this year

All in all, we need to wait for detailed figures because the structure of growth will be important, mainly from the central bank's perspective. As weaker growth will most likely be related to volatile investments/inventories and household consumption should remain strong, this should be no game changer for our CNB policy outlook of gradual monetary tightening next year.

Download

Download snap