Czech GDP growth accelerated to 2.9% at the end of 2018

Another surprise from the Czech economy. After January inflation accelerated to 2.5%, Czech GDP growth for 4Q18 surpassed both market and CNB expectations and hit almost 3%.

Markets expected weaker print due to foreign slowdown

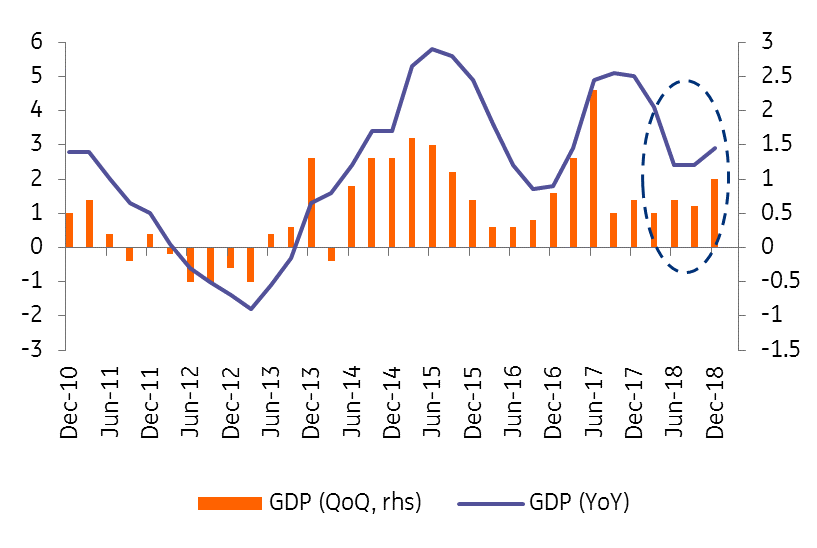

Flash 4Q18 GDP growth recorded an above-consensus 2.9% YoY. Up 1% QoQ, this represents the highest QoQ growth for a year and a half. The market had expected growth of 2.4%, with the CNB expecting 2.3%. The Czech Statistical Office (CZSO) has not given a detailed GDP structure yet, but confirmed that investments were a strong growth factor in 4Q18. This is most likely on the back of soaring government investment, financed from EU-funds last quarter. Foreign demand was also important, with the CZSO is using the concept of contributions after excluding imports for final use. Using a more traditional approach, we believe that household consumption was also an important contributor to growth. The 4Q18 figure will be likely affected by some one-offs (most likely investments) as monthly data related to industry and services does not support such strong acceleration. For more information, however, we need to wait until the beginning of March.

| 2.9% YoY |

in 4Q18 YoY (SA WDA)3.0% for the whole 2018 |

| Better than expected | |

The whole 2018 growth get to 3.0%

Though preliminary estimates can be revised slightly, economic growth last year most likely reached 3.0%. With estimates at the beginning of 2018 at around 3.5%, this suggests a slightly weaker print. The slowdown of the domestic economy last year is related not only to the high base of 2017 and to the limited capacities of domestic producers, but also to weaker foreign demand and, last but not least, to some one-off factors, especially in the automotive industry. In general, however, the 3% value from today's perspective is a positive surprise as both the CNB and MinFin expected 2018 growth below 3%, mainly due to weaker developments abroad in 2H18.

Czech GDP growth (%)

This year GDP should slow further

This year, domestic economic growth should slow slightly, with consensus expectations gradually shifting towards 2.5%. The latest CNB forecast stands at 2.9%. The main driver of growth should be, as in the previous year, domestic demand, particularly household consumption and investment by companies and governments. Household consumption will be supported by solid wage growth, but also by a number of social-benefit changes that will increase household income.

Arguments for interest rate rise have increased although foreign uncertainity remains.

Today's GDP figure and the January inflation rate confirm that CNB rate normalization is likely to continue this year. Foreign risks cannot be ignored. As such, two CNB hikes delivered this year still sounds a likely scenario. The first could probably come during the May meeting, when the CNB Board will have a new forecast in hand and also more data regarding the more uncertain foreign developments. The CNB's latest forecast appears to be quite optimistic regarding the foreign outlook. But, as in the latest CNB Minutes published today, the next hike decision might came during any forthcoming meeting. Important to note is that CNB rates will likely go up already in the first half of the year, contrary to market expectations before this week’s data.

Download

Download snap