Czech confidence declined in March

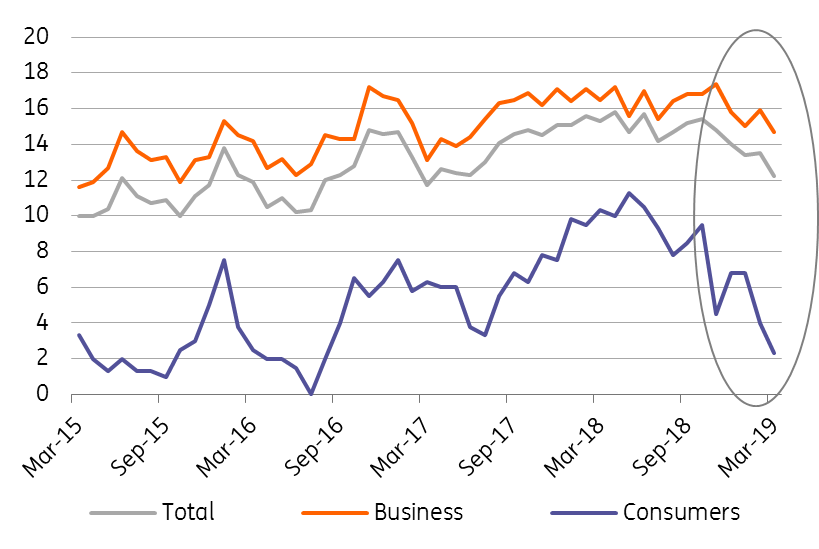

March confidence declined to the lowest level since mid-2017, with households becoming more concerned about their future financial situation amid the prospect of an economic slowdown. Businesses are also less optimistic about the future

Household confidence declines further

Household confidence continued to decline in March, reaching its lowest level since mid-2016. Although households were increasingly worried about slowing economic activity in previous months, assessments of their own financial situation remained positive. However, continued worries about the economic slowdown have started to weigh on sentiment, and households' concern about their own financial situation has reached the lowest level since mid-2017.

Business followed

Business confidence also decreased in March, driven mainly by weaker sentiment in industry and services, while confidence in construction rose further. The decline in confidence in both industry and services was driven mainly by worries about future developments, while the assessment of the current situation has not changed much compared to February.

Confidence Indicators (SA, diffusion ind)

Given global developments, weaker confidence is not surprising

Domestic confidence largely followed developments abroad in March and confirms that the situation abroad remains challenging. A further decline in Germany's Manufacturing PMI this month does not bode well for Czech industry. The participants in the German PMI survey pointed out that lower orders were due to both weaker demand from the automotive sector and clients postponing decisions due to higher uncertainty. Uncertainty surrounding Brexit and the escalation of trade wars is beginning to have clearer negative consequences for economic activity.

This might affect households spending behaviour

Although household confidence is the weakest in the last two and a half years, it is still at a relatively favourable level from a longer-term perspective. Households continue to benefit from rising wages and the overheated labour market, and this year, household consumption should be one of the main growth drivers of the domestic economy. However, a prolonged period of uncertainty could raise concern further and reduce consumers' appetite to spend, which represents a clear risk for the future outlook.

The CNB on hold this Thursday

Today’s indicators underline the current uncertainty about the future economic outlook, which should encourage the central bank to remain on hold this Thursday, as we noted in last week's CNB Preview.

Download

Download snap