Copper in a quandary

Copper remains elevated but stuck in a tight range. It seems to be caught in a quandary, with inventories still lending support but high prices making it hard to attract fresh bets. Moreover, Chile and Peru saw their mine production diverge last year, although total world supply is set to see stronger growth in 2022

Copper held firm last week amid thin liquidity during the Chinese New Year. Prices have remained elevated so far this year but have largely traded in a narrow range, mainly oscillating in the upper bound of US$9,000-10,000/t. This is largely due to:

- Broadening inflation pressure and nervousness in the US equity market at the beginning of the year have seen increased tailwinds for copper and the broader commodities basket due to the stronger need for a hedge. Tensions on the Ukraine front have also benefited copper. But elevated energy prices in Europe remain a threat to metals production, including aluminium and zinc, which have borne the brunt. And risks to copper are rising as Aurubis, Europe's largest smelter, just warned that the crisis may start to hurt its bottom line.

- Low inventories have offered solid support, preventing traders from building significant shorts in copper, wary of a squeeze. There were signs of stock building across COMEX and the LME during January, but the trend proved to be unsustainable.

- China has turned more pro-growth, with authorities pledging to front-load infrastructure projects and monetary easing, but these actions are mainly aimed at preventing further downside to growth. The extent and efficacy of the Chinese pro-growth measures remain to be seen.

With these developments in the background, copper has shown resilience, particularly in the face of recent hawkish rhetoric from the FOMC meeting and strong jobs data last Friday, making it more likely that the Fed will embark on aggressive rate hikes. However, current financial conditions remain easy and still supportive of asset prices. In the meantime, we are still a couple of months away from the Fed reducing its balance sheet and hence starting to mop up significant liquidity in the market.

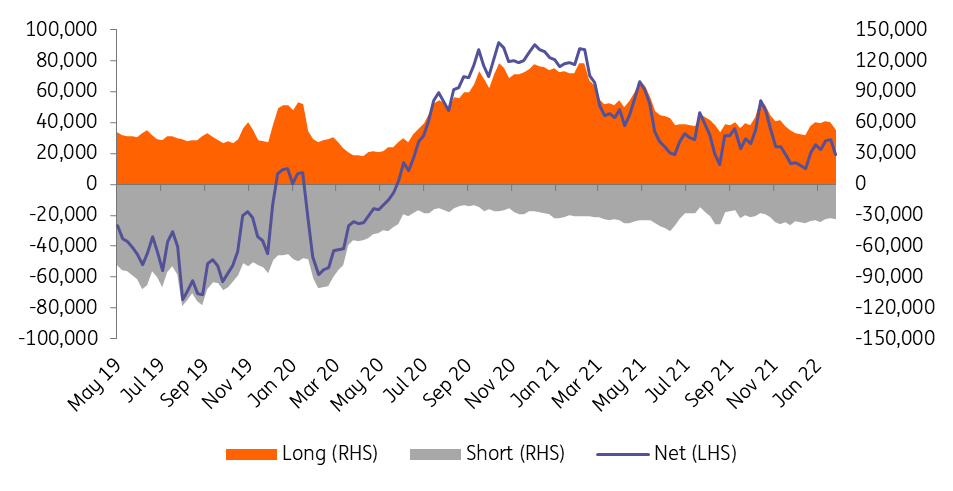

Nevertheless, funds have been trimming their exposure to copper so far this year, according to COMEX data. Net longs have declined to 19,256 lots (as of 1 Feb), mainly driven by the reduction in long positions, while short positions have remained largely flat for quite some time.

The red metal seems to be caught in a quandary. Current prices are too high to attract fresh funds buying, but inventories are too low for bears to dare to short it. Thus, short-term price action will largely be dictated by the dollar's move, without any fresh impetus.

Money managers have been trimming their long positions in copper

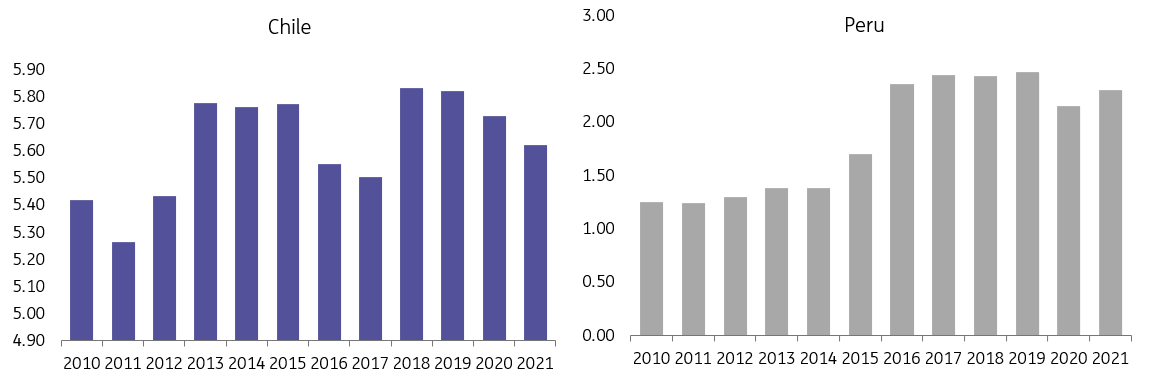

As for mine production, the latest data from major producer Chile shows that total mine production fell by 1.9% year-on-year to around 5.62Mt tonnes in 2021, chiefly due to a 14.8% (-176kt) decline from Escondida. Production was also down from Los Pelambres (-36kt), and Caserones (-17kt). This was partially offset by higher production from Spence (+57kt), Candelaria (+24kt) and Sierra Gorda (+42kt). On the other hand, mine production from Peru, the world’s second-largest producer, has bounced strongly, by 7% to 2.3Mt in 2021 though this is still slightly weaker than the peak before the pandemic.

In 2022, total copper mine supply is expected to see the highest growth of above 4% in the foreseeable future, thanks to several projects coming online, including the brownfield project Escondida striking back up in Chile and the greenfield project Quellaveco set to start in Peru. Meanwhile, Kamoa-Kakula from DRC could add more upside potential. Ivanhoe is now focusing on bringing the phase 2 expansion project at Kamoa-Kakula complex in DRC in 2Q22, three months ahead of schedule. Meanwhile, there were reports recently that Glencore is in talks with the Xiangguang smelter to build a blending plant, which could also help expand clean concentrate supply to Chinese smelters. Should these go smoothly, this may add further upside to spot treatment charges.

Annual Chile and Peru mine production (Mt)