Copper: China October trade snapshot

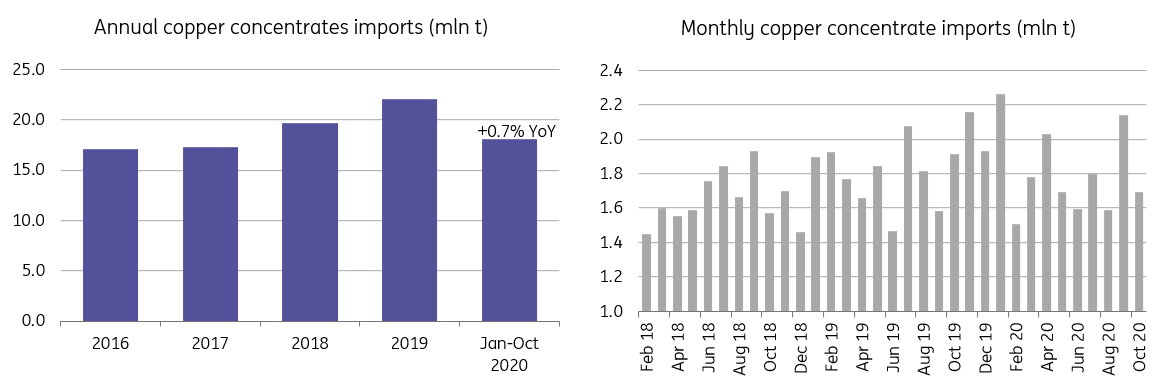

Imports of copper concentrate in October fell by 21% month-on-month to 1.69mln tonnes, but total imports year-to-date have seen moderate growth

Imports of copper concentrate in October fell by 21% MoM to 1.69mln tonnes, and total imports in the first 10 months have registered a small gain year-on-year. According to SMM reports, the reduced imports last month were chiefly due to rejected shipments due to high fluorine content concentrate from Indonesia. Year-to-date, Chile remains the largest copper concentrate supplier to China, accounting for 35%, with exports to China growing by 3% YoY to 6.4mln tonnes. However, imports from Peru, the second-largest supplier to China, have decreased by 19% to almost 4mln tonnes.

It is worth noting that Chinese imports of Australian copper concentrates fell by 54% MoM to 40kt in October (Jan-Oct. 757kt, -8% YoY). However, this coincides with unofficial reports that authorities have told Chinese importers to stop buying concentrate from Australia.

Fig 1. China copper concentrate imports

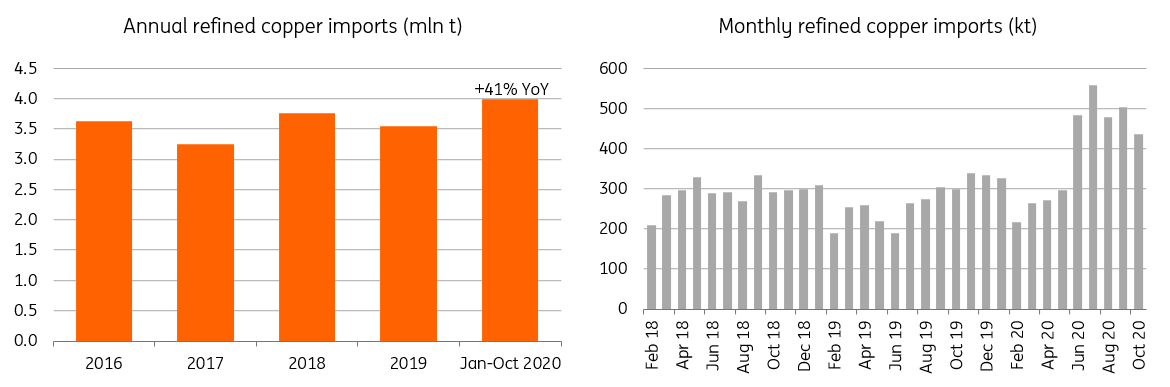

Refined copper imports also fell in October to 437kt (-16% MoM), which is in line with earlier reports of a slower pace in clearing copper as a result of closed arbitrage. Instead, bonded warehouse inventory has grown. Total imports in the first 10 months have increased to almost 4mln tonnes, up by 41% YoY. Imports of alloys such as brass and bronze remain elevated and have jumped by 134% YoY to 306kt; meanwhile during the same period, imports of copper anode have grown by 31% YoY to 804kt.

Fig 2. China refined copper imports

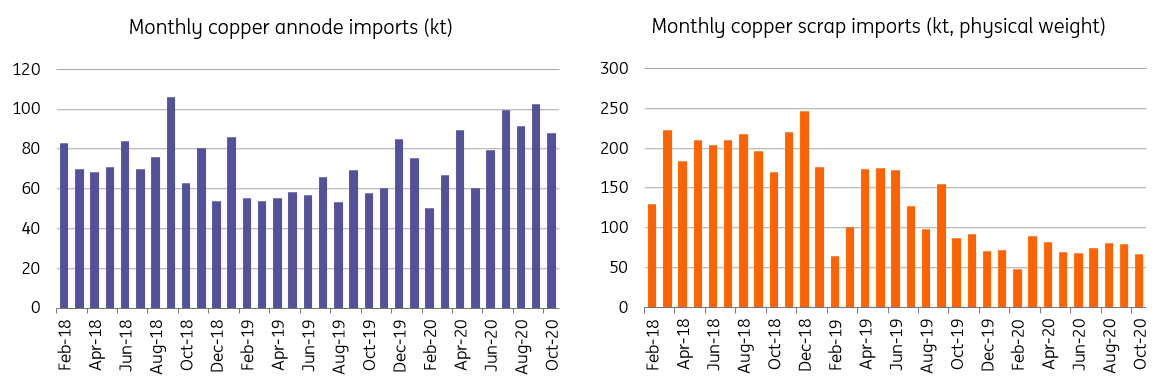

Copper scrap imports continued to fall for a second straight month. Total scrap imports over the first 10 months have fallen by 45% YoY to 734kt (physical weight).

Fig 3. China copper scrap and annode imports

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap