Aluminium: China October trade snapshot

China's strong imports in aluminium-related raw materials, notably bauxite and alumina, continued in the second half. Unusually, primary and alloys together hit record levels. Exports of semi-finished products remain under pressure

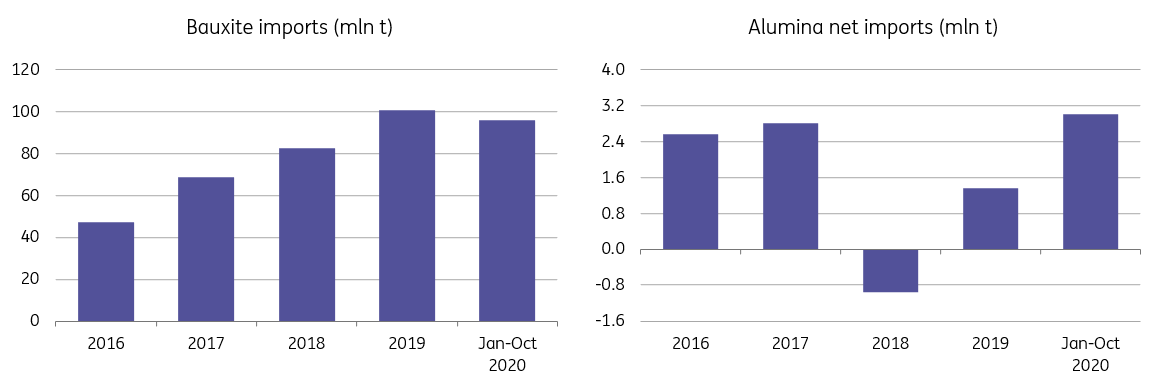

October bauxite imports fell by 4% month-on-month. In the first 10 months, they grew by 14% YoY to around 96mln tonnes. Alumina imports also saw a small dip last month at 174kt. Still, total imports year-to-date have grown by 205% YoY to 3.1mln tonnes reflecting both improved supply overseas and robust Chinese demand as a result of stronger aluminium production.

Fig 1.China aluminium raw material imports

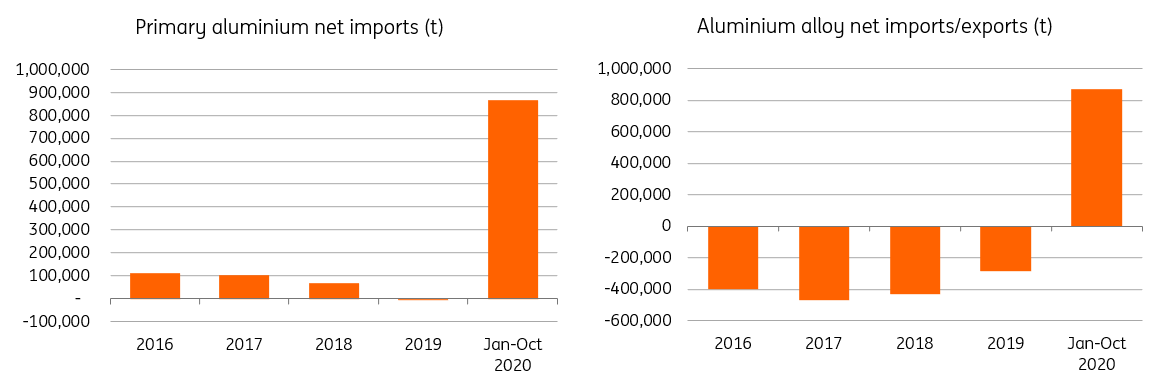

Primary aluminium imports cooled from the prior month but remained elevated. October imports fell by 35% MoM to 112kt. Total imports have jumped to 878kt in the first 10 months, 14 times higher than the same period of last year, with over 30% coming from Russia followed by India with around 28%.

Fig 2. China primary aluminium and alloys net imports

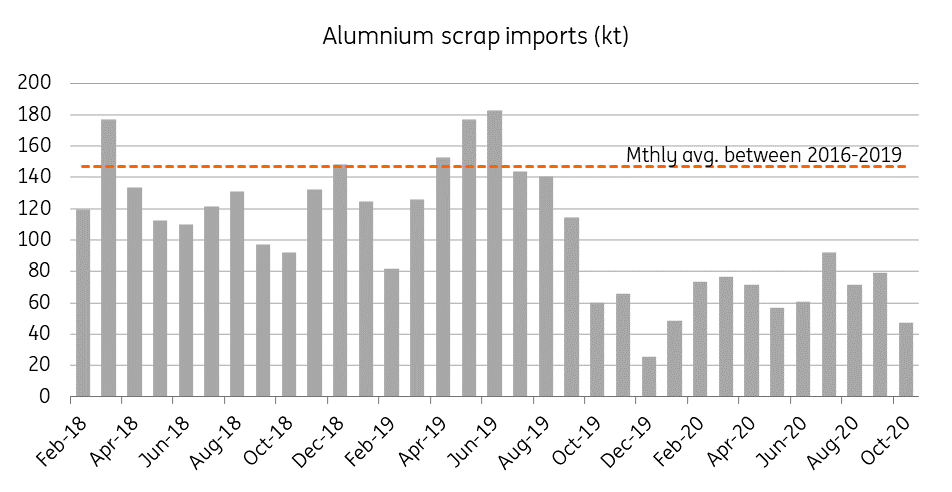

Meanwhile, aluminium scrap imports have declined by almost 48% YoY to 680kt (physical weight) during Jan-Oct. As China customs released their new HS code (7602000020) on 19 October for updated import standards, scrap imports by China should go up once market players have adapted to the new policy. To partially compensate for the reduced scrap imports, China has been importing more unwrought aluminium alloys that are likely to be secondary ingots. Total imports under this category have grown to over one million year-to-date, compared to only 216kt in the full year 2019.

Fig 3. China aluminium scrap imports

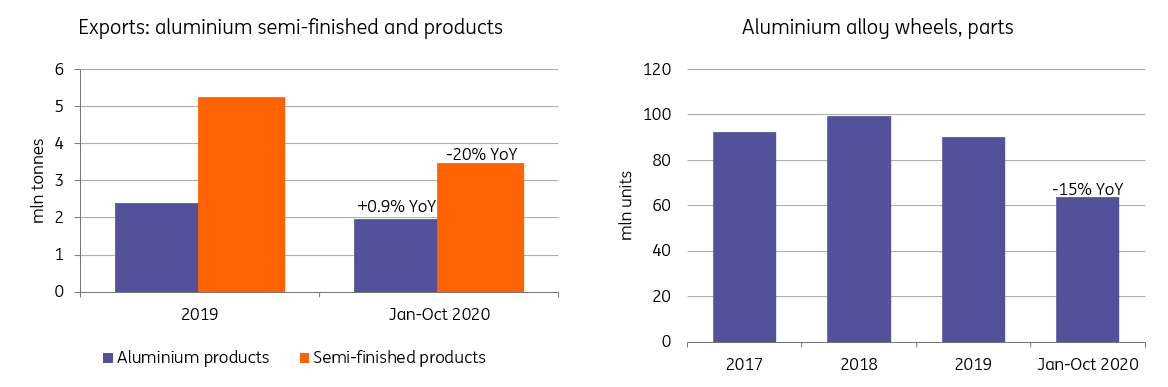

Exports on aggregated aluminium semi-finished products have contracted by 20% YoY to around 3.5mln tonnes (the decline is the same on an annualised basis). However, aluminium bearing products, including door and window frames, have recorded a moderate gain (+0.9% YoY) in the first 10 months. There have also been strong exports in stranded aluminium cables and household aluminium products.

Fig 4. China exports of aluminium semi-finished and aluminium products

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap