Cocoa’s speculative flip

Cocoa has been the best performing commodity this year, with London Cocoa having rallied by more than 30%. The move higher would have seen producers breathe a sigh of relief, with farmers suffering from low prices over 2017. So why the recent strength?

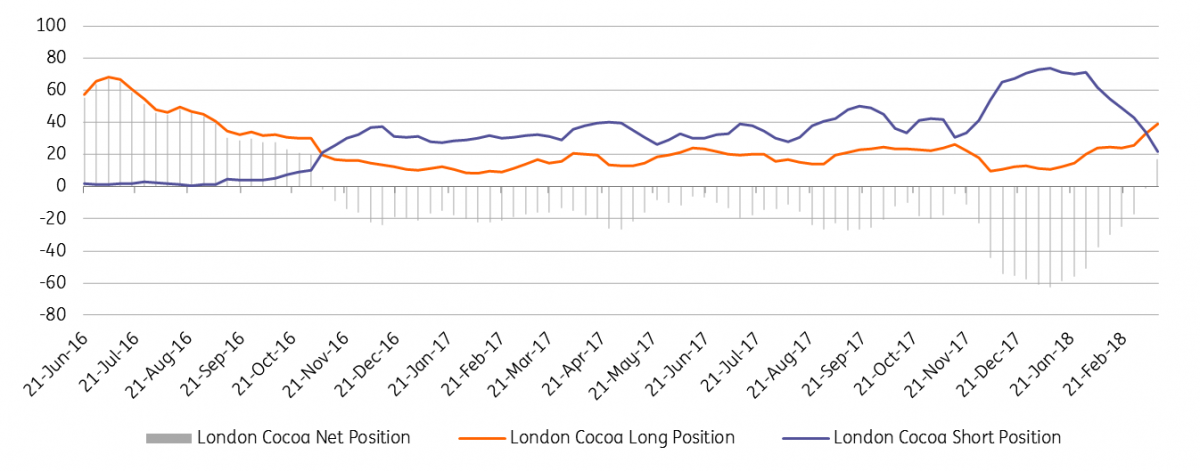

London cocoa managed money position (000 lots)

Cover those shorts

Speculators held a record net short in London cocoa at the beginning of this year, with the managed money net short position standing at 62,570 lots. Expectations of a second consecutive surplus in the global cocoa market this season, meant speculators were comfortable to aggressively sell.

Lower prices have clearly led to a pickup in demand, with grinding data from Europe and Asia showing robust growth, which would have offered some support to the market. The International Cocoa Organization (ICCO) estimates that grindings will rise by around 2% over the 2017/18 season.

However the key driver for speculative short covering has been concerns over weather in West Africa. The largest producer, Ivory Coast, is already expecting to see output fall from the record 2.01m tonnes produced last season. Cocoa arrivals at the port so far this season totals 1.43m tonnes compared to 1.46m tonnes at the same stage last season, according to Bloomberg. This gap is likely to widen as we move through the mid crop. Meanwhile, the second largest producer, Ghana, has said that it looks increasingly unlikely that the country will hit its production target of 850k tonnes due to dry weather.

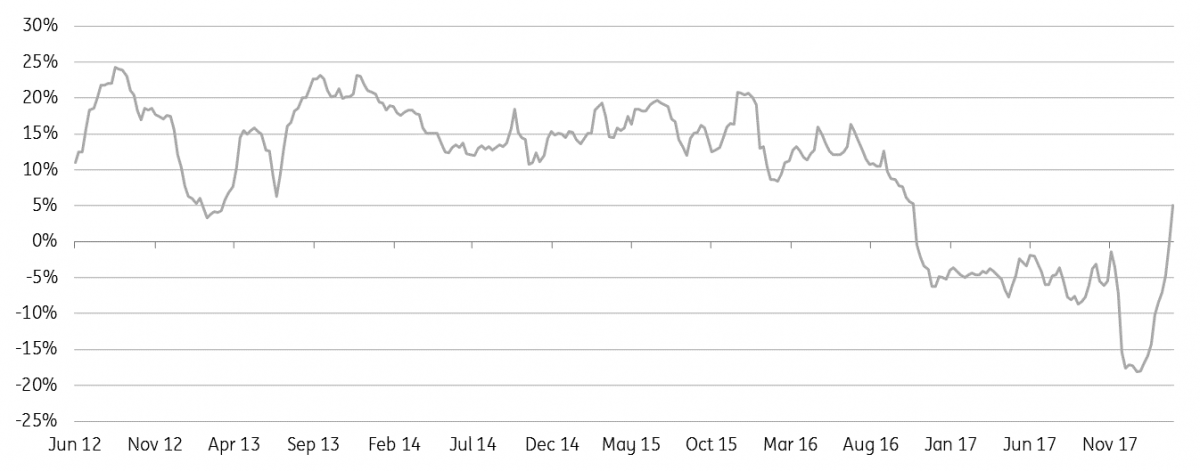

This concern has seen speculators flip their net short position to a net long of 17,011 lots as of the 13 March, and in fact this is also the first time since the end of 2016 that speculators have held a net long position. Whilst weather has played a key role in short covering, it is also important to bear in mind that speculators were significantly overextended to the short side earlier in the year, and so it is no surprise that some moderately bullish news, has had a significant impact on the market. The speculative net short made up a record 18% of total market open interest earlier in the year.

Given that the shorts have largely been flushed out, means it is unlikely that we will see further significant strength. Speculators are likley to be more reluctant to add fresh longs, especially when you consider that for now the global cocoa market is still set to see a surplus of 105k tonnes this season. However keep an eye on West African weather, as this expected surplus could shrink relatively quickly.

London cocoa managed money position as % of total open interest

Download

Download snap