China: A tale of two inflation measures

We expect CPI inflation to edge higher as a result of the continued rise in non-food components while the PPI will be hit by high base effects

CPI probably pushed up by spending spree in December

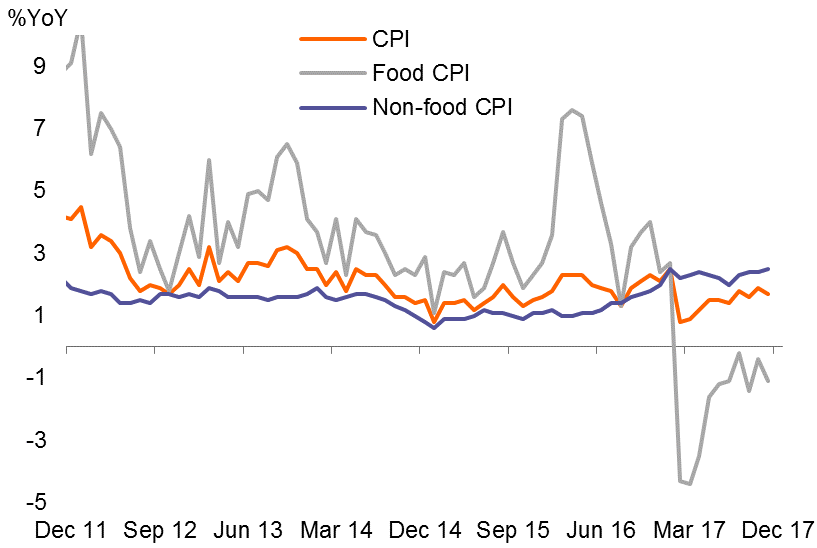

China’s Consumer Price Index and Producer Price Index data for December are due on Wednesday, 10th Jan. Though there were no long holidays in China in December, the holiday atmosphere elsewhere in the world probably fuelled additional spending in China. We expect this to drive the CPI higher, especially the non-food items, to 1.9% year-on-year in December (same as consensus) from 1.7% in November.

Higher CPI from non-food items

PPI deserves more attention

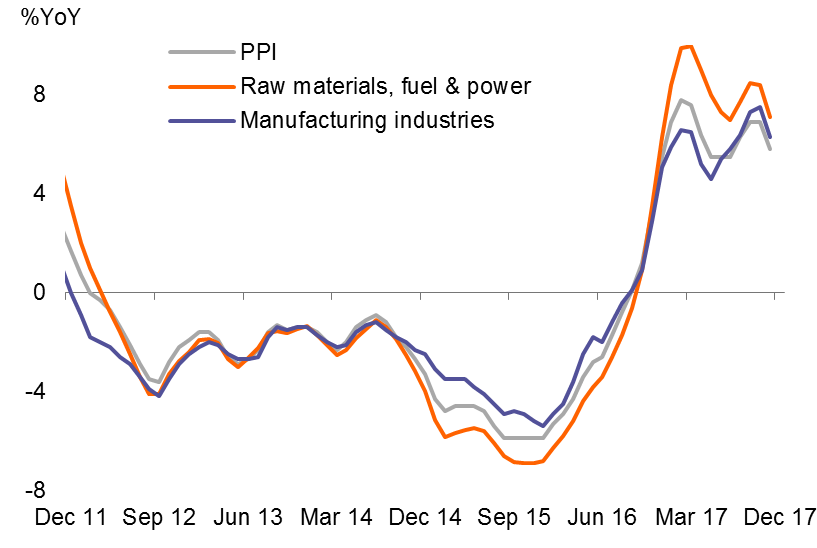

We forecast that PPI inflation will slow from 5.8% year-on-year in November to 4.7% YoY in December (consensus 4.8%). The main reason is the high-base effect from last year. Among the main PPI components, raw material prices, especially coal and copper, stand out because they continue to grind higher on a monthly basis. The government has tightened regulation on the production of these raw materials to protect the environment, sending prices higher.

Corporate profits would be very much affected by PPI, for better or worse

The authorities are likely to implement more environmental protection policies in 2018 as this becomes a greater priority for the government. This is likely to result in sustained upward pressure on raw material prices, with implications for corporate profitability. Producers of the raw materials will enjoy higher profits while companies using these raw materials as inputs will suffer from higher input costs.

PPI affects corporate profits, some better and some worse

Download

Download snap