China data reflects pessimism about trade talks

Strong export data in October shows that Chinese exporters are worried that US tariffs will increase in January 2019. We expect this front-loading behaviour to continue for the rest of 2018, as we don't think the Xi-Trump meeting at the G20 will yield positive results. At the same time, China's fiscal stimulus could boost import growth in 2019

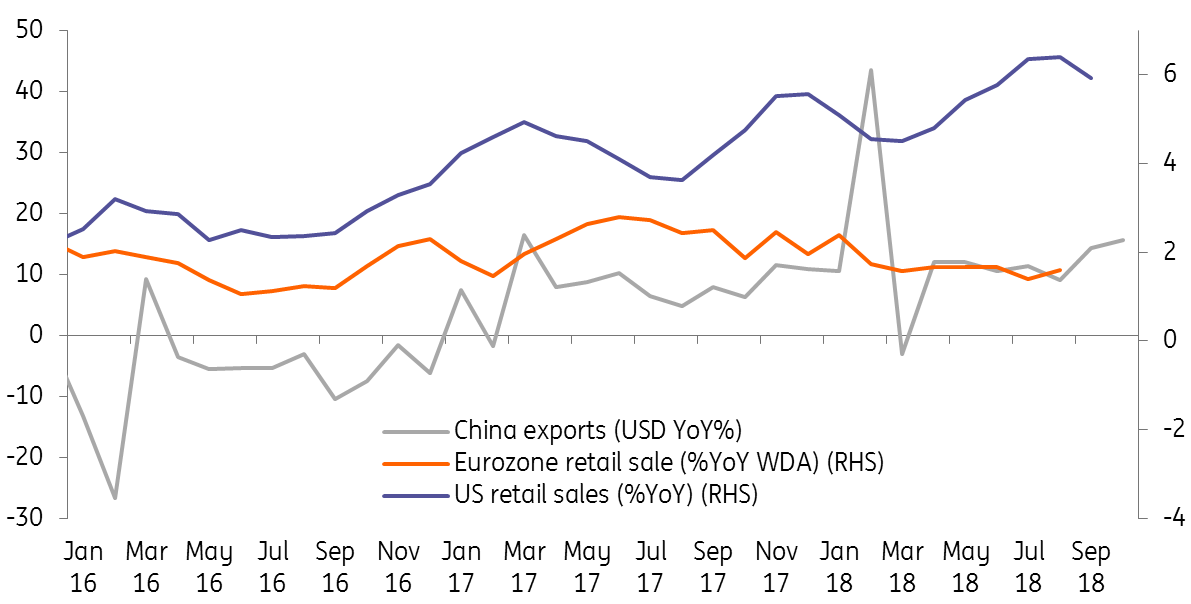

Strong exports due to front-loading activities

Exports grew 15.6% year-on-year, higher than the consensus of 11.7%.

We believe this growth is due to exporters' concern that the 10% tariffs on $200 billion of exported goods to the US will rise to 25% on 1 January 2019, which has led them to front-load exports.

| 15.6% |

China export growth (YoY) |

| Higher than expected | |

Front-loading can't last long

Front-loading export activities should continue in November and December. So export growth data will continue to be stronger than in previous holiday seasons.

We think that President Xi's meeting with PresidentTrump at the end of November will not achieve positive results and as such the increase of the current tariff rate from 10% to 25% on $200 billion of US imported goods from China is highly probable. We're hoping the meeting doesn't damage the trade relationship even further, as Trump once said that if trade talks fail, he could raise tariffs on all Chinese imported goods.

Though US demand will continue to be strong, import tariffs on Chinese goods could have a dampening effect. We expect that some of these exports will be diverted to Europe. Whether they can also be diverted to other Asian economies depends on the extent to which those economies are themselves affected by the trade war.

Strong export growth may not last very long. Export growth should slow under higher tariff rates and, as a result, we are not particularly optimistic on China's export growth in 2019, especially in 2H19.

China may not be able to enjoy strong US demand

Imports could grow faster

Front-loading is also the reason for strong import growth (at 21.4% YoY) though to a lesser extent, as importers worry that future export growth will decline.

Still, China has begun to implement fiscal stimulus and we expect that imports of building materials for infrastructure projects, as well as imports of consumables due to tax cuts, will partly offset slower demand for import materials for export manufactured goods.

Imports could, therefore, grow faster than exports in 2019.

| 21.4% |

China's import growth (YoY) |

Will China strengthen the yuan to facilitate cheaper imports

We do not think so as we believe that the USD/CNY and USD/CNH largely follow the direction of the dollar index. We believe in this trade conflict that China will passively follow the dollar index to avoid being labelled a currency manipulator by the US, and to avoid further possible damage on trade and investments.

Our forecasts on USD/CNY and USD/CNH at 7.0 and 7.30 by end of 2018 and 2019, respectively, are still intact.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

9 November 2018

Good MornING Asia - 9 November 2018 This bundle contains 4 Articles