China manufacturing PMI shrank

China's manufacturing PMI fell from last month's expansion to contraction. Will this become a trend? Is this a result of the trade or technology war? What role does infrastructure play in manufacturing activity? Will China use the yuan to boost manufacturing-related exports?

China's manufacturing activity shrank in May. Is this an impact from the trade or the technology war?

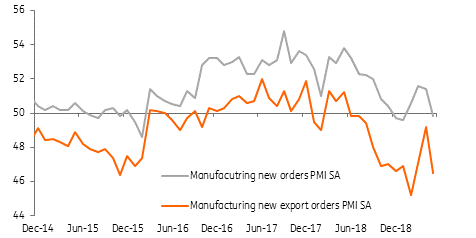

China's official manufacturing PMI for May fell into contraction territory. April's reading was 50.1, which was only marginally above the threshold for expansion, but May's reading was 49.4, which suggests that manufacturing activity in May actually shrank.

The most eye-catching sub-index is the "new orders index", which measures domestic manufacturing activity. This came down drastically from 51.4 in April to 49.8 in May.

We believe that the contraction in new orders means domestic manufacturing activity has been affected by both the trade war and the technology war. From the trade war, export-related domestic activity, like packaging materials, are affected by fewer exports. And, the damage on China’s telecommunication companies has slowed down their production in China as they foresee slower sales globally.

Both new orders and new export orders contracted in May 2019

Will this fall in manufacturing PMI become a trend?

We believe that a contraction trend in manufacturing activity has formed as the manufacturing PMI has now fallen 3 months in a row and now even enters contraction territory.

Our concern is not just on products affected by the tariffs, which we believe could have a longer impact on both the Chinese and US economy unless trade negotiations resume.

We also worry about technology companies' production. It is still too soon to evaluate the technology war's impact on domestic manufacturing activity. The technology war is brewing even faster in May 2019, and could continue for the rest of the year. We expect the technology war to put pressure on manufacturing activity for the whole of 2019.

What role do infrastructure projects play in manufacturing activity?

As manufacturing activity has started to contract, the central government will push local infrastructure projects to speed up their progress.

Stimulus measures should help manufacturing activity to return to growth and a PMI above 50.

The technology war is brewing even faster in May 2019 and could continue for the rest of the year. We expect the technology war to put pressure on manufacturing activity for the whole of 2019.

Yuan is not a weapon for export-related manufacturing

In any case, the central government is not going to use the yuan as a weapon to fight the trade war and the technology war.

For exporters, having more orders is more important than a few points of yuan depreciation. This is why we don't believe that China will depreciate the yuan to boost exports.

Instead, we believe that the Chinese government will help exporters to develop other markets, e.g. domestic markets for high-end goods and use the Belt and Road initiative to support demand for lower-end goods.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap