China: Manufacturers see profits shrink

Chinese manufacturers were far less profitable than a year ago. Both state-owned enterprises and private industrial firms suffered from the ongoing trade conflict. But some industries have started to benefit from infrastructure investment and the overall situation should improve in 2Q19, given the sizeable amount of stimulus

Manufacturers suffer from weak profit growth

Industrial profits shrank by 14% year-on-year, year-to-date in February. Central government-owned firms have been doing well but those companies are not in the industrial sector. According to the Ministry of Finance, state-owned enterprises, including those not in industry, grew their profits by 10.0%YoY YTD in February. Central government-owned SOEs performed even better, with profit growth of 14.3%, while local government-owned SOEs suffered a loss of 0.5%YoY YTD. Most of the profit came from the oil and ferrous metals sector.

Still, the Statistic Bureau reported that SOEs in the industrial sector saw profits fall 24.2%YoY YTD.

Industrial profits at privately-owned enterprises (POEs) fell 5.8%YoY YTD, which suggests that targeted monetary easing by the central bank (PBoC) is having some impact.

Some manufacturing sectors posted decent profit growth

Not every sector in manufacturing experienced difficulties. Profit growth in non-ferrous metal mining (+130.4%YoY YTD) and transportation equipment (+83.7%YoY YTD) was good, supported by infrastructure investment.

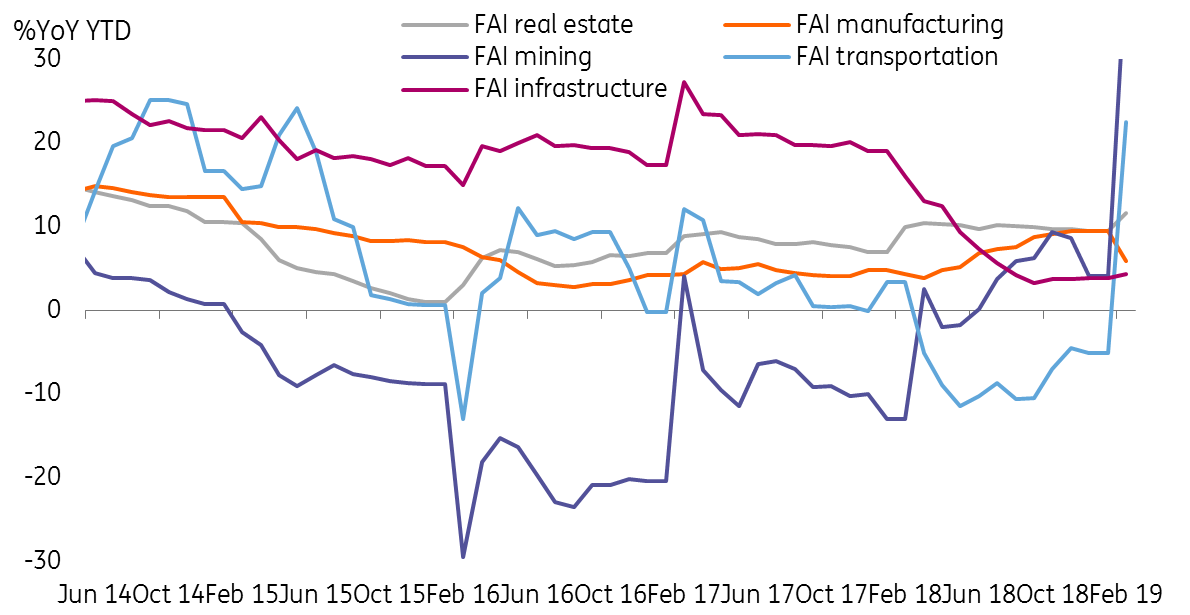

Fiscal stimulus has boosted investment in transportation and mining but investment in manufacturing is still weak

Some industries continued to see profits fall due to industry-specific issues

But industries that don't have any particular support from the government, or are facing specific business difficulties, saw profits fall.

Automobiles (-42.0%YoY YTD) tend to see low demand during an economic downturn and have also faced risks from ride-hailing apps.

Computers, communication and other electronic equipment (-21.6%YoY YTD) have fared poorly. Exports of Chinese-made electronic equipment have been hit by international concerns about security.

These difficulties are likely to persist even there is a large stimulus to support the economy

Situation will improve in 2Q19 given stimulus and monetary easing

We expect that falling profits in the industrial sector as a whole should improve, as fiscal stimulus has started to kick in and monetary easing helps small private firms. More downstream sectors should benefit from the stimulus later in the year, and we expect that an increasing number of sectors will show positive profit growth in 2Q19.

We think the government will be patient and wait until 2Q19 to evaluate if more fiscal stimulus and liquidity are needed to support the economy.

For now, we don't think there is a need to revise our GDP forecast, which stands at 6.3% for 2019.

Download

Download snap

28 March 2019

Good MornING Asia - 28 March 2019 This bundle contains {bundle_entries}{/bundle_entries} articles