China: GDP growth slumps; Retail sales show warning signs

China's GDP growth has slumped to its slowest pace in almost three decades, as trade tensions weigh on sentiment and activity. While retail sales appear to be holding up so far, we see signs that the tech war is starting to affect job security and expected wage growth

Infrastructure stimulates economy

GDP grew by 6.2% year-on-year in 2Q19 as was widely expected. The detailed activity data show that infrastructure investment, which grew by 5.8% YoY in June from 5.6% a month ago, was at the core of economic growth.

Mining and railway investment grew by 22.3% YoY and 14.1%, respectively, helping to drive overall infrastructure investment and, in turn, the entire investment environment in China. Loan data paints a similar picture.

Industrial production also reflects this trend. Ferrous and non-ferrous metal processing grew 10.3% and 10.4% YoY, respectively, while railway-related manufacturing grew 10.6% YoY.

The export environment has been gloomy due to an escalating technology war with the US. From January to June 2019, mechanical and electronic products made up around 55% to 60% of China’s exports, which means the tech war will hurt China’s exports significantly. This may not change in the remainder of the year.

Transport infrastructure projects, especially metro lines, have driven GDP growth

It is infrastructure, not exports, that have been helping manufacturers

Retail sales boom, but for the wrong reasons

With exports no longer the engine of the economy and infrastructure now in the driving seat, we're likely to see some changes in the job market. So how does that affect consumption? Consumers are in fact spending more than usual. But don't get too excited.

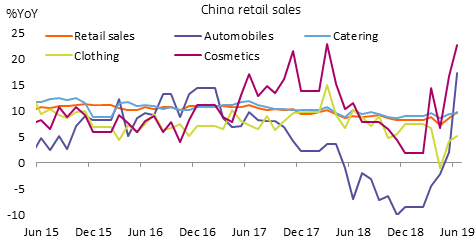

Retail sales boomed by 9.8% YoY in June from 8.6% YoY. This number looks encouraging. But the details tell a different story.

- There are signs that Chinese consumers have become more cautious about spending on leisure trips, signalling that consumers are potentially concerned about their job security and wage growth. Consumer items typically bought on overseas' leisure trips have been bought domestically. For example, cosmetics, usually bought in duty free shop in airports, grew 22.5% YoY in China compared to 13.2% YoY YTD. The current account shows that outbound tourism spending fell 8.7% year-on-year in 1Q19. Another example is that in Hong Kong, retail sales fell 1.3% YoY in May and have shrunk for four months in a row. We expect retail sales in China will continue to grow at a good rate even that growth is coming for all the wrong reasons.

- Another reason for the jump in retail sales in June was that China's car dealers cut prices, which boosted car sales 17.2% YoY after sales growth of just 1.2% YoY YTD. But the price cutting promotion can't last for more than a quarter. And together with shrinking production (by 16.8%YoY in June), corporate earnings of car dealers and car producers will suffer.

There are signs that Chinese consumers have become more cautious about spending on leisure trips, signalling that consumers are potentially concerned about their job security and wage growth

Consumption booms as spenders limit leisure trips

China's future depends on 5G

From industrial production, we know that smart devices fell 6.9% YoY YTD, integrated circuits also fell by 2.5% YoY YTD. This trend will not change unless there is a significant improvement in value add in new smart devices. We strongly believe that will arrive when 5G is ready for commercial use and then for the general public.

However, China faces hurdles in buying technology from its businesses partners and may have to invent the technology itself, be it the nanochips, the operating system or the apps. This is bad news for China although if Chinese technology companies are forced to develop new technologies themselves, investment and production will likely grow.

It is then up to the Chinese consumers to choose which brand to buy. If China's 5G is at the forefront of the world, it should be an easy decision for them.

Before 5G arrives, the economy will continue to be stimulus driven

We will continue to keep an eye on the retail sales data, and the development of 5G to see if we need to fine tune our forecasts later.

Until then, the Chinese economy will need to be driven by stimulus. We expect that infrastructure stimulus will double from 2 trillion yuan to 4 trillion yuan to fill the gap of lost exports and related supply chain disruption. Infrastructure stimulus will keep the economy growing at 6.3% in 2H19.

The People's Bank of China must make targeted cuts to Reserve Requirement Ratios and cut the 7-day interest rate to limit the upward pressure on interest rates brought about by the additional loan demand from infrastructure projects.

We maintain our forecasts that the PBoC will make a targeted RRR cut of 0.5 percentage points with the 7-day rate cut by 5bp in 3Q and 4Q, respectively.

USD/CNY will be fairly stable around the 6.90-6.95 level. Depreciating the yuan can do no good for exporters who may loss the whole export orders if there is a 25% tariffs or they simply can't do businesses with US companies.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

15 July 2019

In case you missed it: Trump, Draghi and Johnson This bundle contains 12 Articles