China changing how it eases

The Chinese central bank has injected liquidity using its medium-term lending facility (MLF) and targeted medium-term lending facility (TMLF), eschewing cuts in its required reserve ratio (RRR) for now. Does this mean the central bank has started its easing cycle?

PBoC's MLF and TMLF liquidity injection is merely liquidity replenishment

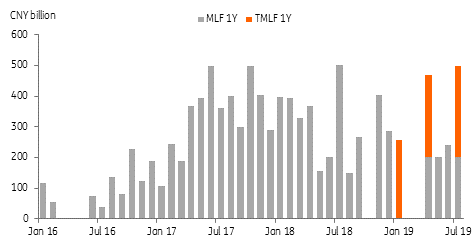

The People's Bank of China added liquidity today using unconventional tools. Its medium term lending facility provided CNY200 billion while its targeted medium term lending facility added CNY297.7 billion, both for one year at interest rates of 3.3% and 3.15%, respectively. TMLF funding can be rolled over twice and so is viewed as a three year liquidity injection with an annual interest rate of 3.15%.

Still, these combined liquidity injections only offset part of the liquidity that matured today. The net result is still an absorption of CNY164.3 billion.

Still an easing signal

We consider this liquidity management exercise to be the start of the easing cycle:

- The newly added liquidity is cheaper in terms of interest costs. Borrowing via MLF and TMLF for one-year at 3.3% and 3.15%, respectively, is cheaper than interbank borrowing at 3.1% for three months.

- The injection via MLF and TMLF, though, was a net absorption of liquidity, and saw the three-month interbank interest rate move lower, from 3.4% on Monday to 3.1% today.

- The use of MLF and TMLF replaces regular open market operations - the duration of the liquidity injection is longer and therefore liquidity in the market should be more stable.

When will the PBoC cut the RRR? Or will it cut at all?

Regular liquidity injections into the system via MLF and TMLF once a quarter are unlikely to be sufficient to suppress the upward pressure on interest rates due to funding demand for infrastructure investment projects.

We have yet to see any RRR cut from the PBoC. But the central bank can't wait much longer if it wants to support the economy, which is being squeezed further by the trade and technology war.

While China has signalled it may be prepared to import US agricultural products again, we still haven't seen concrete action here. And even if there is action, concessions made from the US are likely to be limited. As long as Huawei remains on the US's "entity list", China will continue to set a strong tone in the negotiations. This means the trade truce will likely continue without material improvement.

The Chinese economy will need more liquidity and lower interest rates in 2H19 to support investment in infrastructure projects.

We expect two 0.5 percentage point RRR cuts together with 5bp cuts in the benchmark rate in 3Q and 4Q, respectively. The benchmark rate cuts will send a signal to the market that the PBoC is easing, and could help the market to form self-fulfilling easing expectations, which should push down interest rates further.

It's possible that the PBoC won't cut the RRR as this could result in a large and rigid change in the system's liquidity, which would be very difficult to reverse. More frequent MLF and TMLF injections could replace RRR cuts instead. But equally, RRR cuts would send a strong message to the market that the central bank is serious about easing. The choice will really depend on the pace of growth in 2H19.

USD/CNY won't cross 7

The path of USD/CNY will depend on which liquidity tools are used by the PBoC.

- If there is no RRR cut in 2H19 but more frequent MLF and TMLF operations, the market may not be too alarmed that the PBoC is in fact easing. The USD/CNY will be fairly stable and range bound around 6.90.

- If the central bank cuts the RRR twice in 2H19, as we expect, the market will receive a strong easing signal from the central bank. This will put downward pressure on USD/CNY. But let's not forget that the USD/CNY is not a market driven exchange rate. And, as we have argued, the PBoC has set an invisible line at 7.0 (once in 2016 and once in 2018) because the central bank can't afford the asset market uncertainty that would likely accompany USD/CNY crossing this key level. So USD/CNY could weaken to 6.95 but is unlikely to touch 7.0.

Download

Download snap26 July 2019

In case you missed it: Worse and worse This bundle contains {bundle_entries}{/bundle_entries} articles