China’s aluminium exports flat, for now

Given that Rusal sanctions blew arbitrage bets (Shanghai Futures Exchange-London Metal Exchange) wide open in April, a flat month-on-month figure for aluminium exports (wrought and unwrought) is disappointing. But the May data could actually be much more telling

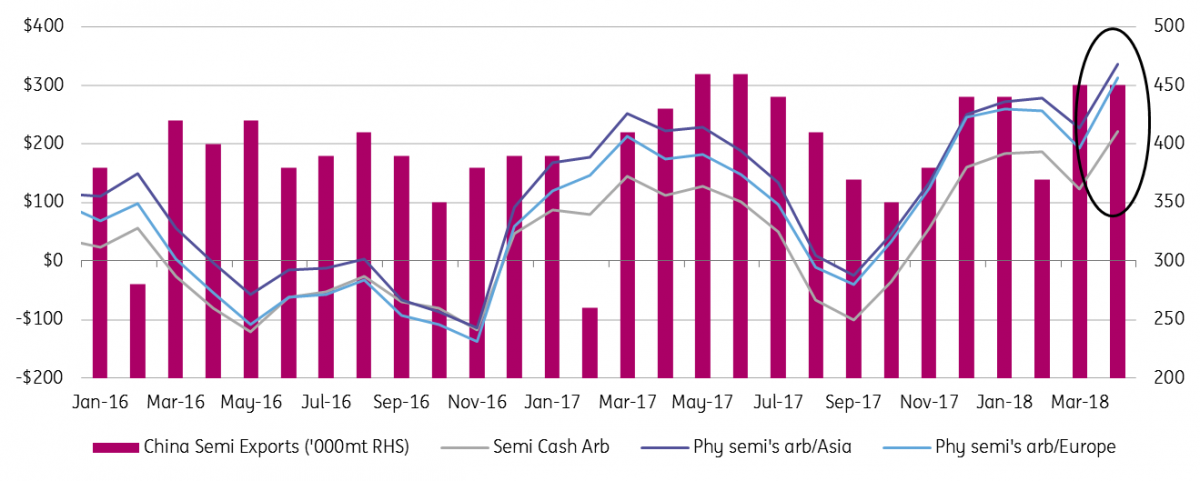

Aluminium semi export profits surge but the tonnage is flat ($/mt, '000mt)

Tracking the arbitrage

The impact of Rusal sanctions (announced 6 Apr) saw LME prices gain 13% last month compared to just 5.4% on Shanghai. Given the 13% rebate for semi-fabricated (semis) Chinese aluminium exports we calculate that, on average, a Chinese semis producer/trader could have yielded profits up to $336/MT by exporting material into Asia. If possible to lock in the spot prices on both exchanges (+ regional premiums) this arbitrage reached highs above $500/mt. The export profit in April was, on average, the highest since November 2014 but China's semi exports were flat month-on-month at 451,000mt. Although closely-watched, the primary metal export arbitrage did not manage to open last month (primary metal exports costs a 15% export tax without a VAT rebate).

Why no increase in exports?

- Loss of US trade. The US section 232 measure has levied tariffs of 10% of aluminium imports on China effective 19 April, and if that wasn’t enough to displace flows there is also section 301 (+25%) expected mid-May. Plus, the International Trade Centre has put anti-dumping on the foils and common alloy sheet that dominate the 670kt of Chinese aluminium imported into the US last year. Altogether, the US is closing as a market for China and based on last year's levels, this could cost around 55kt of exports per month that needs to find a new market.

- A month of two halves for the arbitrage. At the beginning of April, prior to the Rusal sanctions, the semis export arbitrage was actually closed. We had flagged this as a reason why aluminium prices might soon rebound, since semis exports from China were likely to fall. It's likely, therefore, that we are witnessing some delay in the more recently incentivised shipments and it will be May rather than April export data that will show a pick-up. This is especially true when we consider that the extremely high prices seen through April likely deterred many would-be buyers of semis who will have waited to see where prices stabilise. Likewise, any offers from exporters will have been fiercely negotiated away from spot to month -1 averages, or other lagged price formulas, which delays the apparent profitability of the arbitrage based on spot prices.

- Semis vs. a primary metal scramble. The potential loss of Rusal supply has set about a scramble first and foremost for a secure supply of primary metal and value-added products (billet/foundry/slab etc). These non-ingot value-added products do not earn the same export tax exemptions as semi-fabricated products. The effect on semi consumers will be delayed as the tightness filters through the supply-chain. As per point #2 this would allow more semi consumers to wait for more stable prices. Fake semi exports (aka minimally fabricated coil to be re-melted) would be most prone to meet this need and it was indeed reported that offers into areas like South Korea were stepping up. This said, given the high profile closures of big extrusion fake semi trades into Vietnam/Mexico etc, we still doubt if the fake semi flow can surpass historical levels.

Download

Download snap