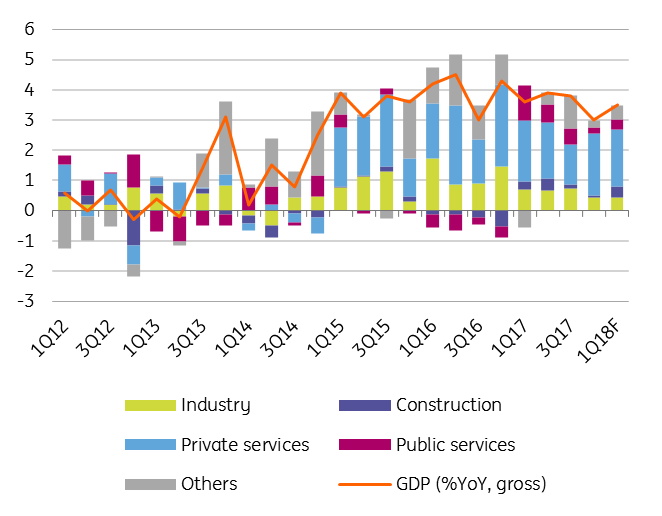

Bulgaria: Broad-based GDP growth

1Q18 GDP expansion was revised 0.1ppt higher to 3.6% YoY with the breakdown data released painting a good economic picture with balanced growth

Private demand slowed to 3.2% YoY from 4.6% in 4Q17 and added 2.4ppt to the 3.6% growth. Gross fixed capital formation accelerated from 4.1% to 10.2% YoY adding 1.9ppt to growth. Net exports was neutral to growth in 1Q18 after a large negative contribution previously. Hence, it is a more balanced picture.

Demand side: an acceleration in investments

On the supply side, the industry decelerated from 2.4% in 4Q17 to 1.9% YoY as weaker external demand from the single market weighs in. Nevertheless, it added 0.5ppt to the 3.6% YoY print. Construction surged by 9.3% YoY in 1Q18 from 2.1% previously and added 0.3ppt to growth. Private service sector remained robust, indicative of the current mature phase of the economic cycle, and continued to have the larger contribution to GDP adding 1.9ppt.

Supply side: broad-based GDP growth

The economy seems to be growing at a quite fast cruising speed with 1Q18 sequential GDP growth consolidating near average QoQ growth registered during the previous two years with a spike in gross fixed capital formation offsetting the slowdown in consumption. Some data revision leading to a lower carryover effect from 4Q17 pushed our 2018 FY growth forecast 0.2ppt lower to 3.5% YoY, but there is plenty of room of upside surprise due to a boost in EU funded investments.

For the first two months of the second quarter, the Economic Sentiment Index (ESI) has improved driven by services sector which points to a rebound in domestic demand.

Download

Download snap