Hungary’s widening budget deficit calls for tougher fiscal measures

Hungary's budget posted a deficit in April, pushing the year-to-date cashflow based shortfall to 84% of the full-year target. This is in contrast with the seasonal pattern of the past three years, A recalibration of the economy is looming as we wait for a new government to be formed

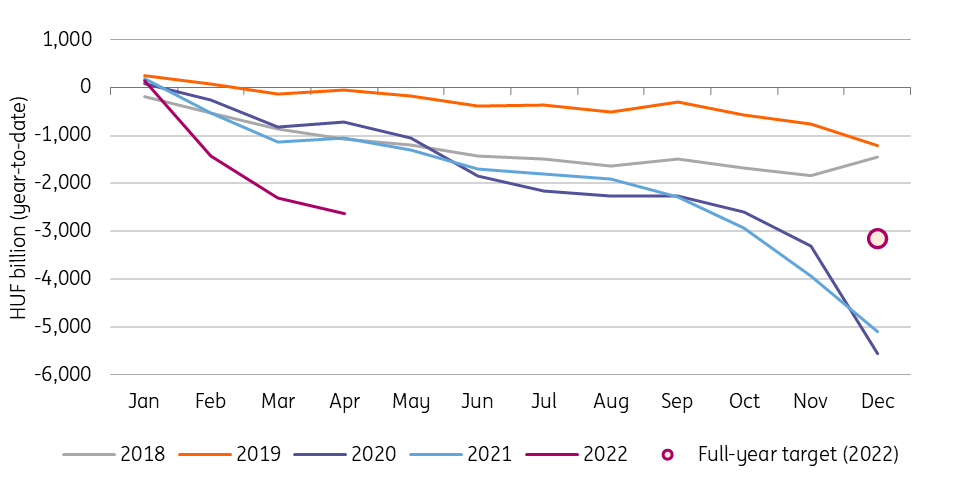

The Hungarian budget posted a HUF 326bn deficit in the month of April. We can say this is something of a mild surprise, at least in the wake of the past three years, when the budget closed with a monthly surplus in the fourth month of the year. The 2022 Year-to-Date deficit accumulation now sits at HUF 2,636bn, equating to 84% of the full-year cash-flow based deficit target. So, no matter what data we see (monthly, year-to-date or pro-rated deficit), all of it screams for fiscal adjustment.

Cash-flow based central budget balance

Year-to-Date

Given the recent extreme circumstances, it is not overly surprising to see this slippage in the budget. What makes the situation more delicate - and less sustainable - is the frontloaded (pre-election) budget spending. In this regard, we think that the government needs to tailor a rebalancing package eventually. However, the issue is that Hungary is still waiting for a government to be formed. According to the latest information, the fifth Orbán government will see things very differently compared to the previous one. According to unanimous opinion, the new government should be in place by the end of May. Thus, we could see an announcement of a fiscal tightening in June at the earliest.

The Ministry of Finance’s statement highlights the need to improve balance indicators and pledges to preserve Hungary’s stability in the unpredictable global economic environment caused by the Ukraine war. This can be seen as a message to soothe investors' nerves, showing the government is in control. On the other hand, it could mean something much more specific, for example, forward guidance for an upcoming austerity package.

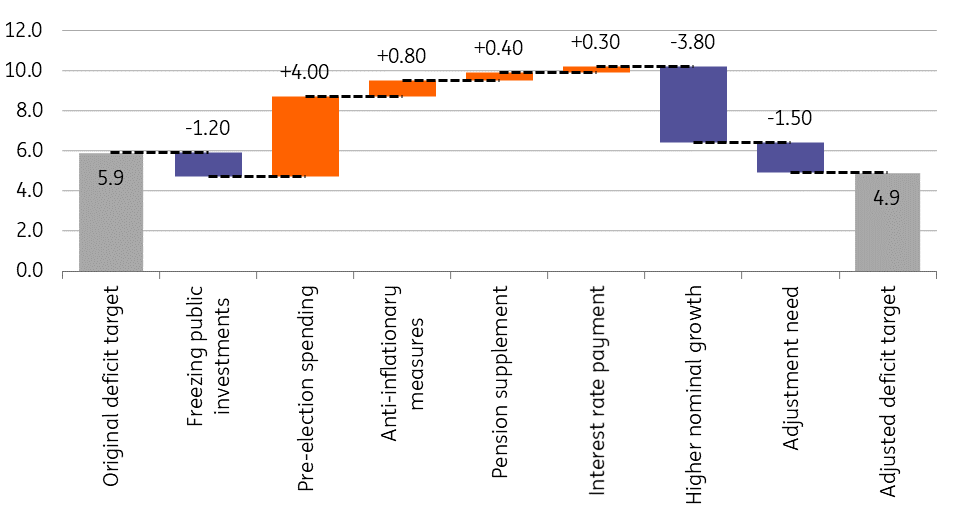

If the government is willing to comply with its recent 4.9% of GDP deficit target, we see more truth in the latter explanation of this statement. According to our calculations, the government is facing an adjustment need of around HUF 1,000bn (roughly 1.5% of expected 2022 GDP). This is roughly double what we calculated in the previous month, mainly due to incoming data. Yet, it is not an insurmountable task to manage, although there is no doubt that it will require some creativity.

ING's estimation of slippages in the 2022 budget

% of GDP

The deficit target could be achieved by cuts in public spending related to investment projects and drawing up new regulations to improve tax collection, spurring a further retreat in the shadow economy. To complement these measures government could levy or increase taxes to boost revenues. We wouldn’t expect measures affecting the tax burden on labour but rather some changes in special taxation (in sectors such as banking, insurance, telecommunication and/or retail). The caveat with all that could be that companies could pass on the costs to households which would therefore strengthen already elevated price pressures.

In the short run, we see the government and the debt management agency operating in a “business as usual” capacity in May. In the meantime, some background work is in the making, probably tailoring the menu of rebalancing. And in case of extra financing needs, we see the debt agency raising funds via a new round of Eurobond issuance.

Download

Download snap