Briefing Romania

Busy day again on the primary market

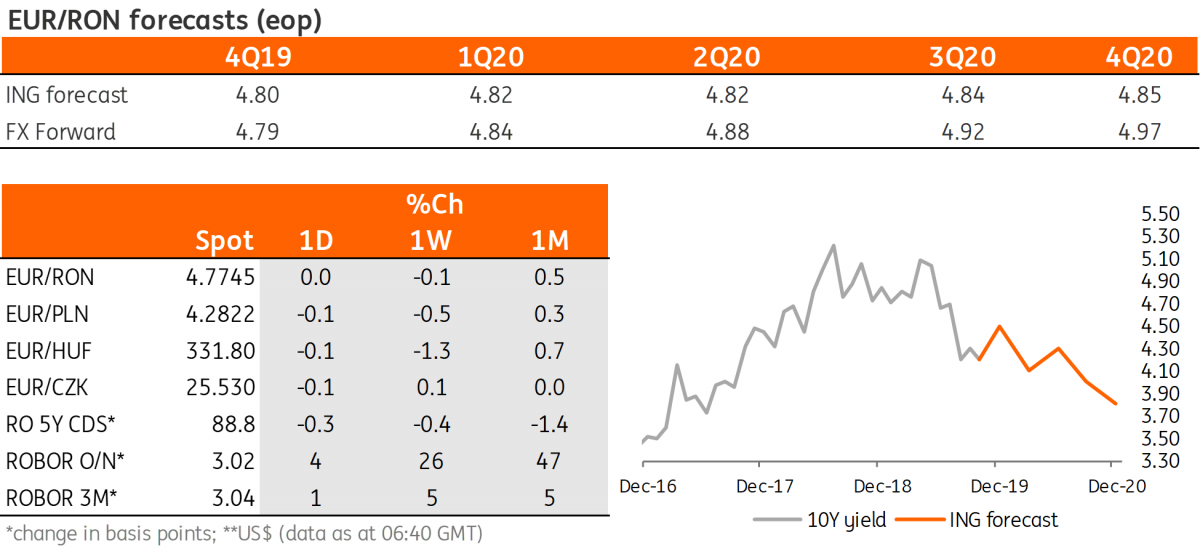

EUR/RON

Trading interest in EUR/RON seems to be gradually fading away. The trading range has shifted slightly away from 4.7800, with the pair trading in a narrow 4.7740-4.7760 range for most of the day yesterday. In these conditions, with the upper bound apparently fixed somewhere above but close to 4.7800, the market could try to test the downside potential as well. For now though, we expect the pair to remain in the 4.7700-4.7800 range.

Government bonds

It was a relatively quiet day for Romanian government bonds, with most of the market dynamics subject to external factors. Hence, a bit of bear steepening across the curve, in line with regional developments.

The two auctions we have today should enjoy good demand. The RON500 million in 6M T-Bills, in particular, could go very well if the Ministry of Finance follows last month's pattern and pays yields in line with the FX Swap market implied yields, which is around 3.40%.

The RON500 million in Sep-2023, on the other hand, could be approached more cautiously considering the latest Aug-2022 auction outcome. Hence, yields should come in around the upper bound of the secondary market levels – about 4.10%.

Money market

As expected, liquidity conditions seem to be gradually improving as cash rates consolidate below 4.00%. Some better offers appeared in the longer tenors as well, shifting the entire curve as much as 10 basis points lower.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap