BriefING Romania

Largest NBR repo allotment on record

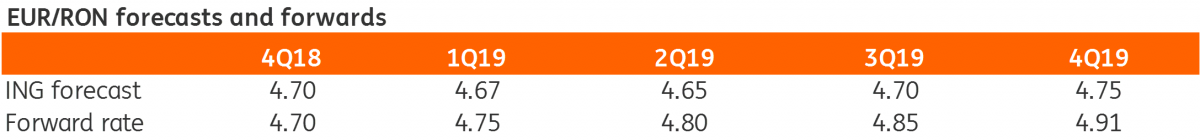

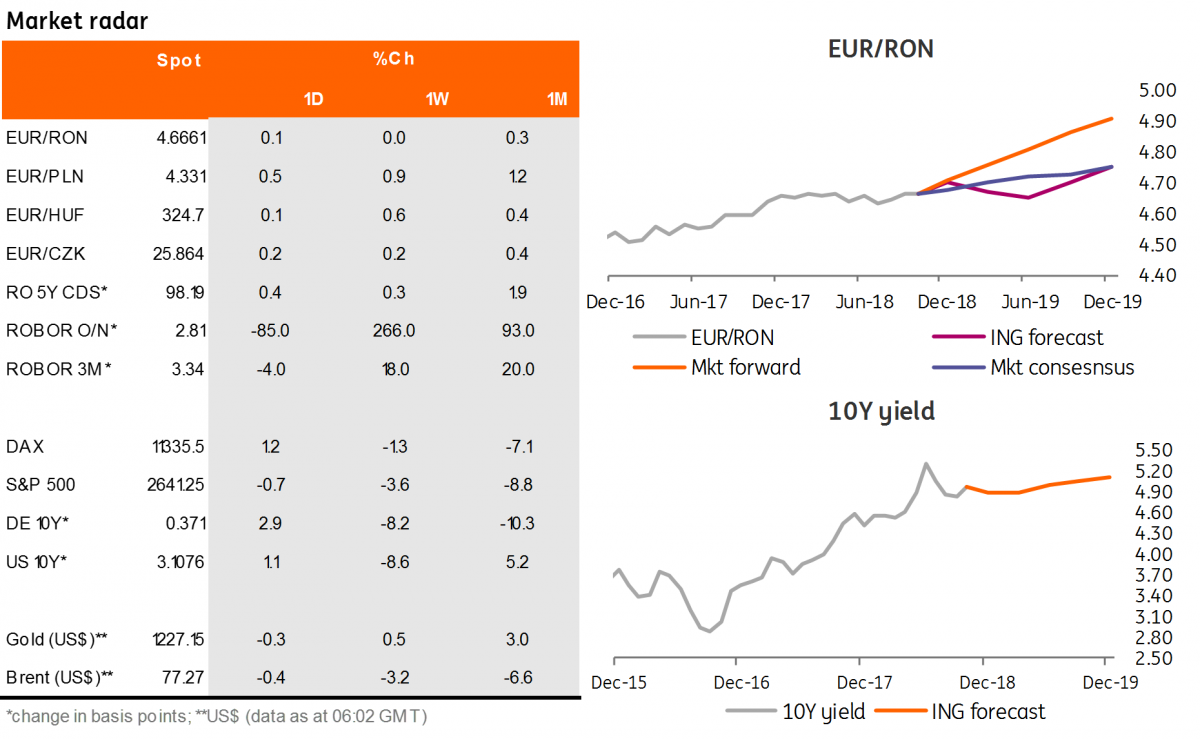

EUR/RON

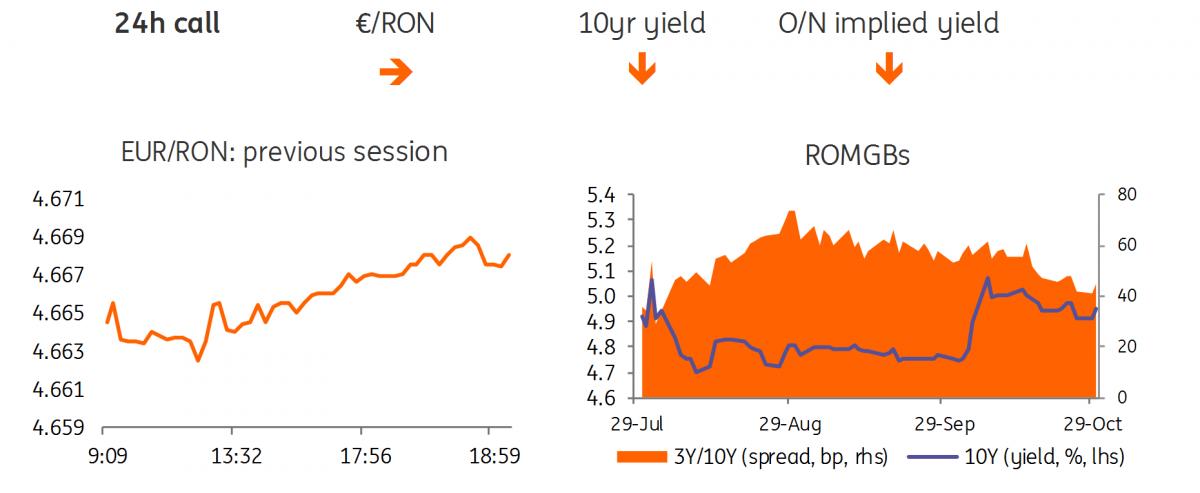

The EUR/RON inched slightly higher yesterday, tracking regional currency pairs, on below-average turnover and closed the day in the upper half of the 4.6600-4.6700 range. The same range is likely to hold today with a likely test to the upper bound as RON’s regional peers are trading at relatively weaker levels against the single currency. With a better mood across the stock market and strong offers seen in the past around 4.6700, this level is likely to hold for some time.

Government bonds

The ROMGBs yield curve bull-steepened yesterday after the National Bank of Romania's repo announcement. Back-end yields adjusted by a couple of basis points lower, while 5Y yields dropped by around 5 basis points as buying interest seems to be clustered on this segment of the curve. The Ministry of Finance yesterday sold RON170 million in 1Y T-bills versus RON600 million auctioned with total demand just below the announcement. As the MinFin decided not to pay up the market, average/cut-off yields printed below our expectations, at 3.46%/3.49%.

Money Market

The O/N implied yields dropped sharply after the NBR full allotment repo auction announcement, closing the day near 3.05%. The whole money market curve steepened as front-end rates dropped the most after the liquidity injection from the central bank. This was the largest repo allotment on record, with 14 banks taking RON16.7 billion in 1-week at the key rate level of 2.50%. The NBR Monthly Bulletin due 5 November will shed more light on the liquidity backdrop after the large end-October payments to the state budget after the banking system posted an average daily liquidity deficit of RON3.9 billion for September.