Briefing Romania

EUR/RON finding a top

EUR/RON

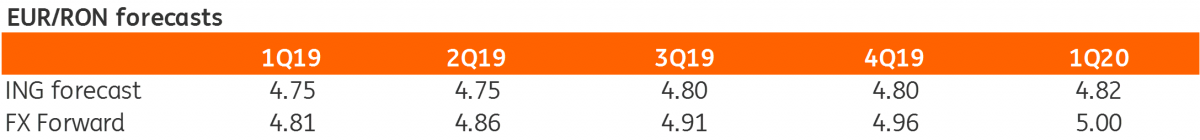

It was a calmer day again for the Romanian leu as volatility seems to be diminishing somewhat, with the EUR/RON apparently settling into a new comfort zone. Strong offers in EUR/RON were noted around the 4.7700 area, hence the currency pair turned lower at the close of day around 4.7600. Abnormally high carry rates have likely helped as well so it might still be too early to call for a new range. FX developments should become more relevant once market rates align with policy rates again.

Government bonds

We’ve had quite a sharp bull flattening move in ROMGBs after the Finance Minister was quoted by domestic media saying that he had ordered the Treasury to stop borrowing money from banks, with funds in Treasury accounts sufficient to ensure financing needs for at least six months. Yields dropped by as much as 25 basis points in the long end on an already traditional thin market. Usually, either today or tomorrow the Ministry of Finance releases its issuance calendar for February, which could be more tilted towards shorter issuance after the weak January auctions.

Money Market

The money market implied yields are gradually calming down, though we are still above the Lombard rate in all tenors up to 1Y. The trend though is obviously towards improved liquidity conditions, hence we expect the gradual decline to continue.

Download

Download snap