Briefing Romania

7Y bond auction in sight

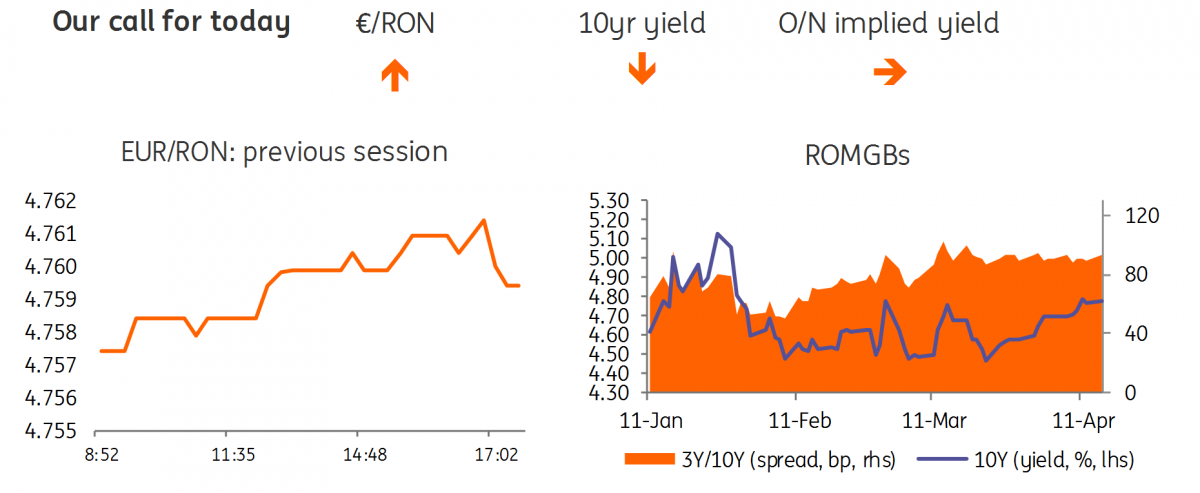

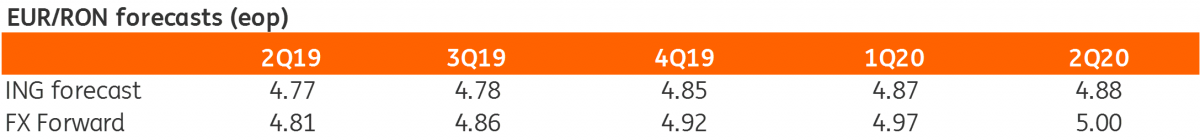

EUR/RON

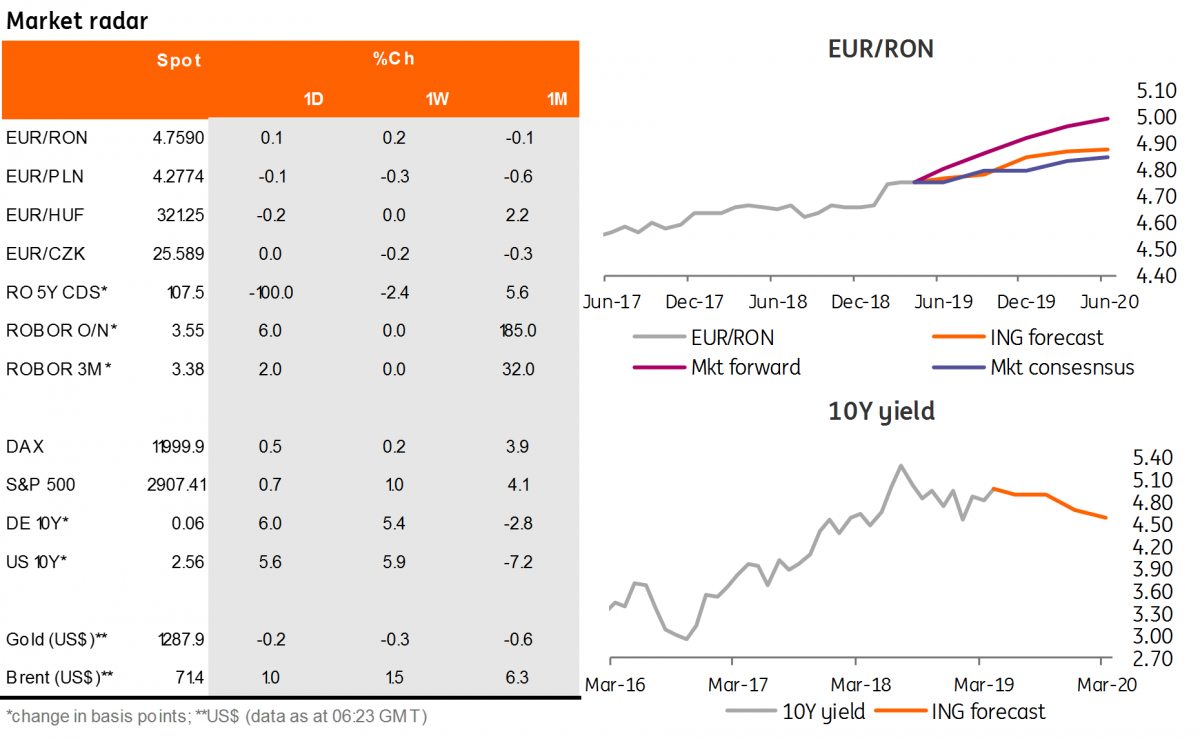

The EUR/RON saw quite a dull trading session on Friday, on very low turnover. The weak current account data didn’t seem to impress the market and the pair closed around the opening level of 4.7600.

Government bonds

Quiet day for Romanian government bonds as well, with no particular interest on any side. Today the Ministry of Finance auctions RON400 million in Apr-2026 bonds. The secondary market trades around 4.75%, which should be an interesting enough yield for investors. It just remains to be seen whether the demand will cover the Ministry of Finance’s target amount.

Money Market

Front end yields continue to trade around the 3.50% Lombard rate as volatility appears to have smoothed in recent days. We should have a few more days of tranquillity and a bumpy road ahead afterwards, as all tenors above 1W trade higher than 4.00%, despite a RON8.8bn bond redemption on 29 April.

The week ahead

In the US, we have retail sales data, which we expect to be robust. Strong auto sales (volumes rose to an annualised 17.5 million in March from 16.56 million in February) and rising gasoline prices should boost the value of retail sales. Other categories are likely to post more modest gains, but in general we expect to see solid growth after a soft -0.2% month-on-month outcome in February. It will be a relatively quiet one for the German economy, with only the ZEW index due for release. We will probably see another small improvement here on the back of stronger financial markets and central banks' dovishness. In Poland, the final CPI reading should provide further information about the increase in core inflation in March – from 1.0% to 1.3% year-on-year.

With no important data on the local front, we expect the EUR/RON to trade within 4.7550-4.7750 range with an upward bias.

Download

Download snap