Briefing Romania

Busy day again in the primary market

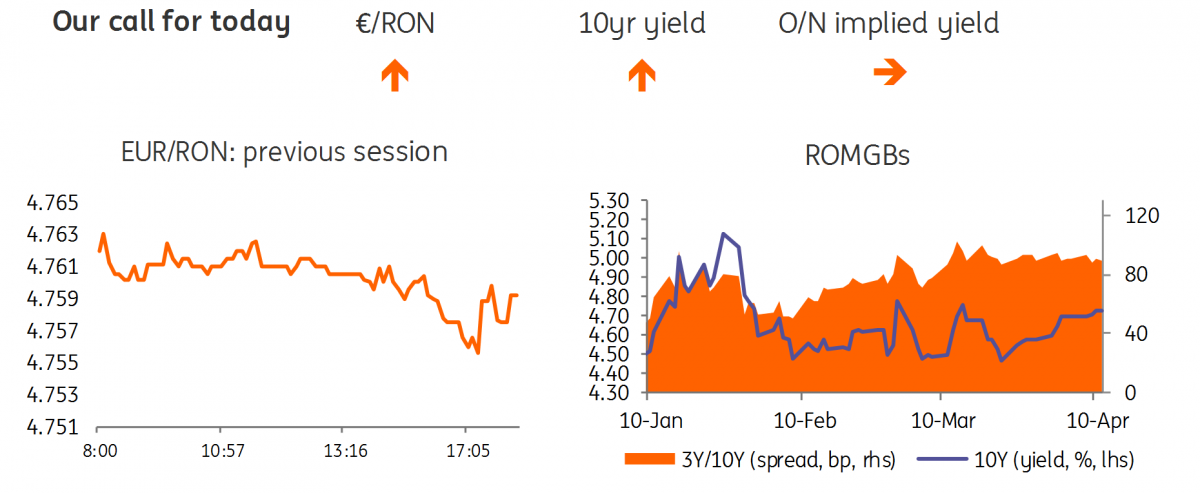

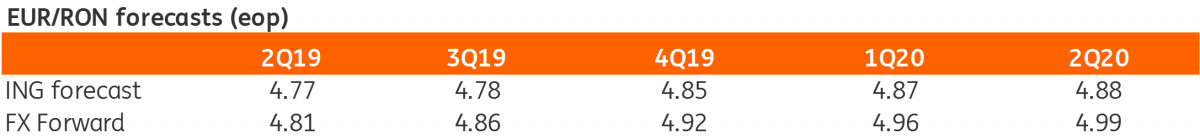

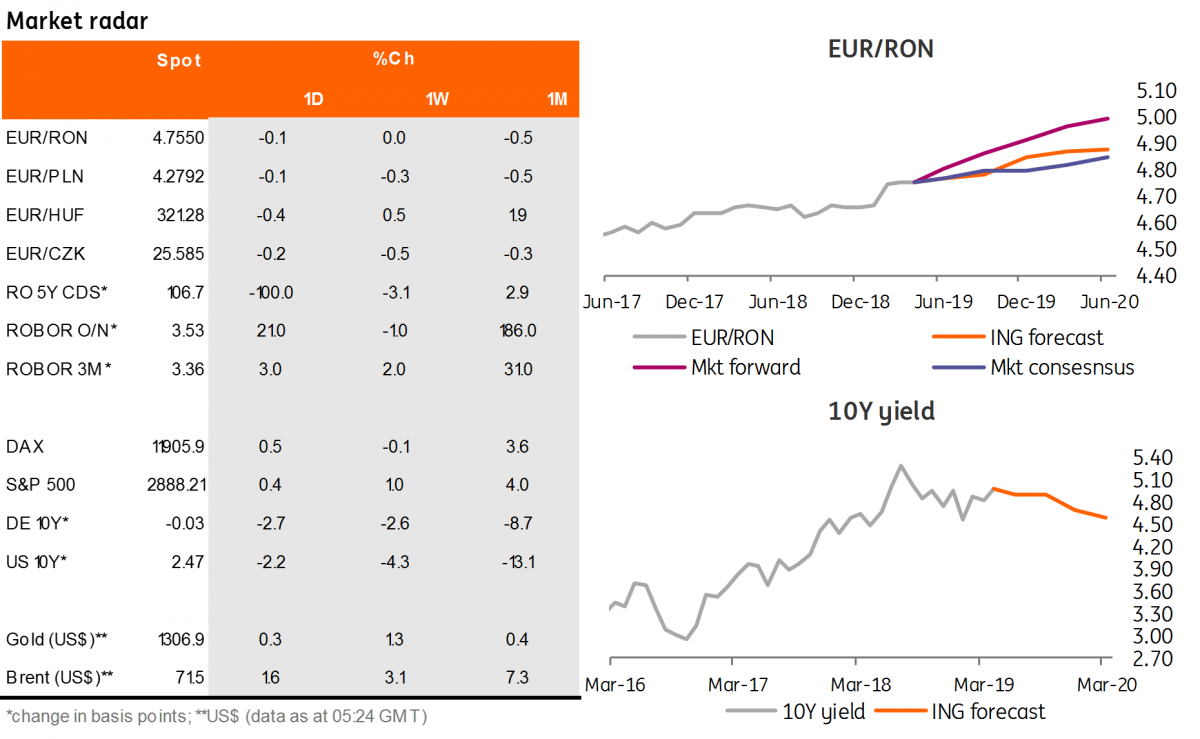

EUR/RON

The EUR/RON traded broadly flat yesterday on decent turnover, closing just shy of 4.7600. We maintain our call for upward tests, with the National Bank of Romania likely standing ready to defend the leu in the 4.7700-4.7800 area.

Government bonds

The above average CPI print prompted some more aggressive offers in government bonds, particularly in the mid and long segments of the curve. Yield-wise, the market closed around 10 basis points higher. Today, the Ministry of Finance auctions TON400million in 1Y T-bills and RON300 million in Feb-2029 bonds. Not the best timing for any of these. Nevertheless, with the Feb-2029 trading again above 5.0% on the secondary market, the yield should be attractive enough for some investors. The 1Y T-bills usually print levels quite decoupled from the FX Swap market (which trades around 4.10% for this tenor) but somewhat correlated with the 1Y ROBOR. We see allocation (potentially partial) around 3.40% for these T-bills.

Money Market

Finally a calmer day on the money market, at least compared to previous days. Carry stays around 3.50% while the rest of the curve is above 4.00%. There are few reasons to be optimistic about the prospects for lower rates after yesterday's inflation data.

Download

Download snap