BriefING Romania

RON500 million for sale in October 2020 auction

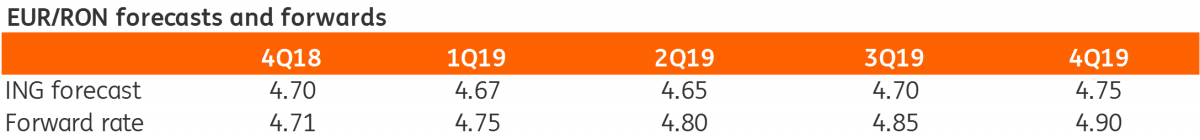

EUR/RON

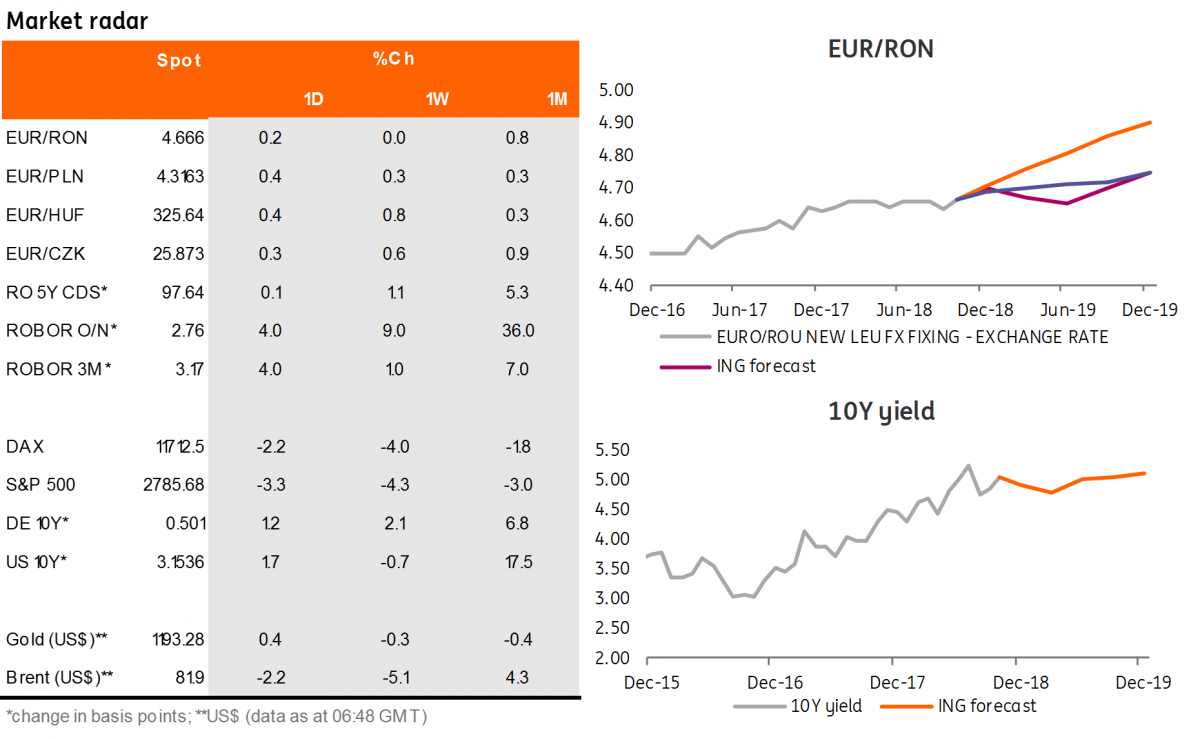

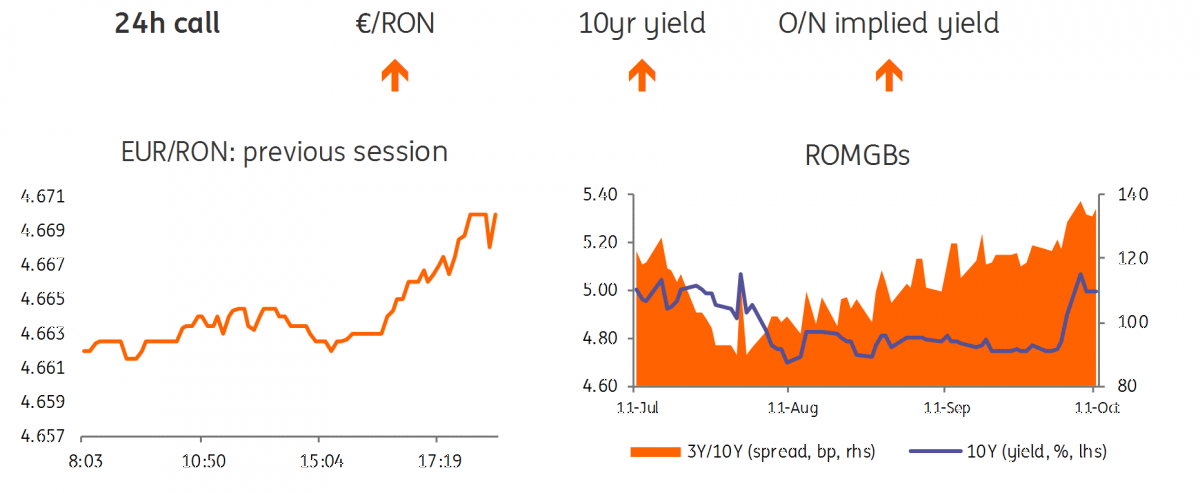

A relatively calm day for the EUR/RON as the pair traded rather quietly between 4.6620 and 4.6650 for most of the day, only to spike towards 4.6700 in the last few trading hours. The external backdrop remains quite negative, hence we expect the upside pressure to resume and the pair to test 4.6700 again today where it will likely meet strong offers.

Government bonds

Despite the September CPI surprising quite sharply to the upside yesterday, the ROMGBs closed only 1-2 basis points higher as the current levels are starting to look attractive again for some players. Today, the MinFin auctions RON500 million in Oct-2020 bonds. The tenor is short enough to attract sufficient demand but with the funding market moving south again we are not likely to see overly aggressive bids. We look for an allocation in the 4.08-4.10% area, marginally above the current secondary market bids.

Money Market

On the money market, the implied cash rates continue to trade close to but below 3.00% as the market liquidity seems somewhat comfortable for now. In the longer tenors, however, the upside move continued, with the entire 1M-1Y curve shifting 8-10 basis points higher. Minutes from the National Bank of Romania yesterday mentioned “the importance of an adequate dosage and pace of adjustment of the monetary policy stance”, which could suggest that further tightening might still be deployed, with firmer liquidity management likely a first option.