Briefing Romania

The Ministry of Finance sells bonds with the longest maturity on the government bond curve

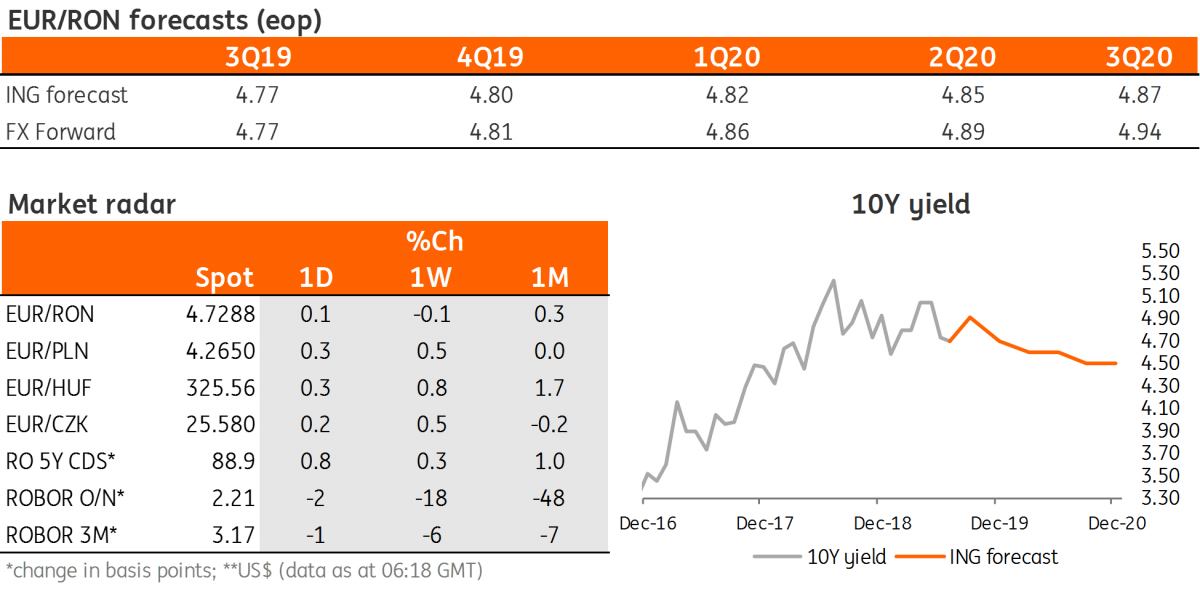

EUR/RON

The EUR/RON continued its upward move yesterday, in line with regional crosses, closing just below 4.7350 on good turnover for a summer's day. The range for today: 4.7250-4.7350. The NBR governor reiterated yesterday that in the absence of structural reforms and fiscal tightening, a “controlled depreciation”, “reasonable, below 5%” is one option to avoid a “rapid deterioration” in the current account deficit.

Government bonds

The ROMGB yield curve saw a mild flattening yesterday as some buying interest emerged in the belly segment after the release of the CPI, while back-end yields were flat as offshore investors seem to be waiting for the Moody’s review on Friday. We do not expect any change from the rating agency. MinFin today sells RON400 million in September-2031 bonds, the longest maturity on the ROMGB curve. We expect a cut-off yield near 4.90% and possible partial allocation, as some investors might wait for Moody’s reaction to the pension bill.

Money market

The cash rates inched c.25bp higher yesterday but remained below the NBR key rate of 2.50%, as market participants didn’t park all the surplus liquidity at the central bank on Monday.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap