Briefing Romania

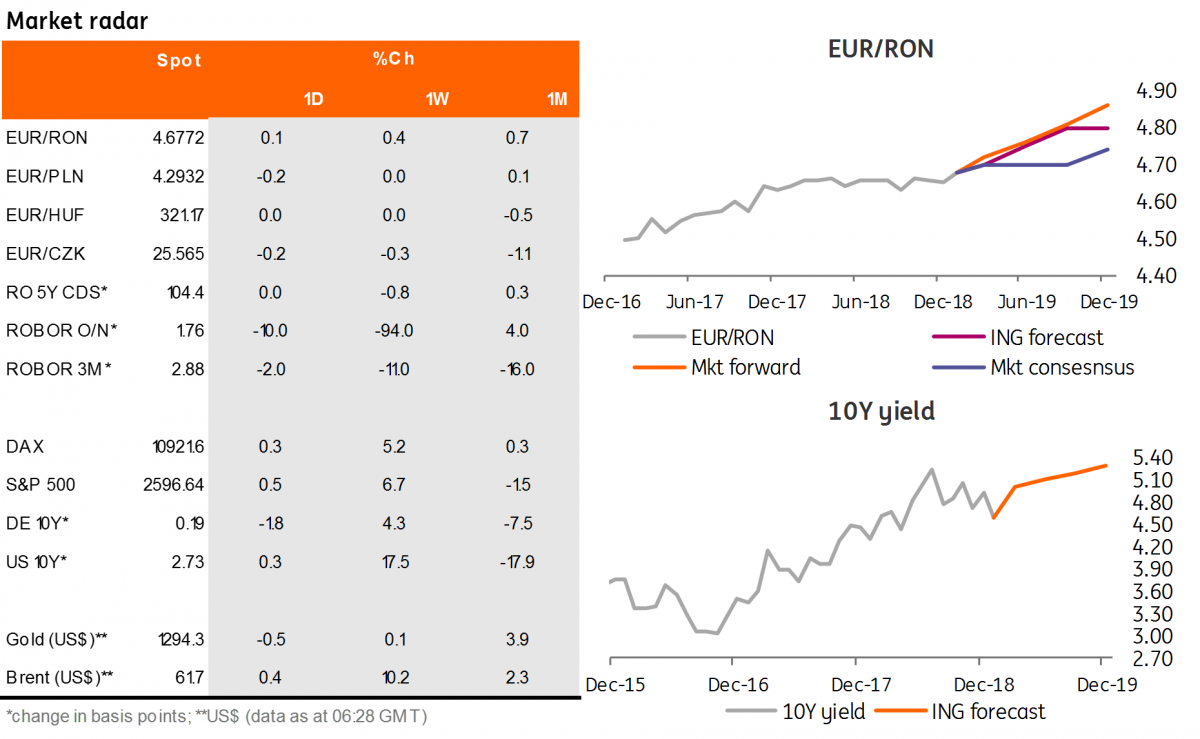

First unsuccessful MinFin auction in a while

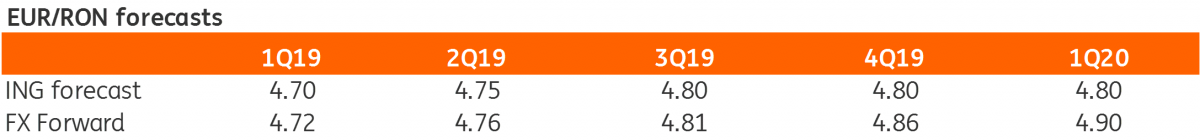

EUR/RON

The EUR/RON continued to test new levels yesterday. The official fixing printed another historical high. Though the actual depreciation of the leu was only a mere 42pips compared to the previous day, it still made it into the breaking news of the main domestic news channels. The turnover remains above average, but it doesn’t necessarily look one-sided. Regional currencies have been on an appreciation path lately, which likely helped the Romanian leu to avoid a more significant depreciation. Hence, the EUR/RON failed to consolidate above the 4.6800 handle. Nevertheless, the market will probably try to test the limit of the central bank’s tolerance and thus establish some broad guidance of a new comfort zone for the pair.

Government bonds

The first serious test of the year for the primary market didn’t go as planned for the Ministry of Finance. Its RON400 million April 2026 auction received a total demand of only RON333 million, suggesting that the recent ROMGBs rally has most likely come to an end for now. The MinFin issued RON246 million at a 4.51% average and 4.53% maximum yield, slightly above our expectations. Otherwise, the curve steepened again, as the front-end posted a 5-6 basis point drop supported by surplus money market liquidity, while the longer-end inched 3-4 basis points higher.

Money Market

The upside move in the EUR/RON triggered some paying interest along the FX swap curve yesterday. Implied yields above 1M inched c.20 basis points higher, suggesting a relatively thin market on the offer side. Cash rates continued to move towards the 1.50% deposit facility and are now trading only marginally above it, which should be the case for the rest of the current reserve period.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap