Australian shoppers defy housing slowdown

Despite house prices falling across the country, and modest wages growth, Australians are still confident enough to keep shopping, or is this just retail therapy?

Shoppers defy the housing gloom

Household goods and clothing were the strongest gainers amongst retail components in the November release, items that typically can't easily be shrugged off as seasonal quirks (food) or statistical aberrations (both these components have registered strong gains since October).

Yet in the background of this, yet another index is pointing towards sickness in the Australian property market.

| 0.4%MoM |

Australian Retail Sales0.3% expected |

| Better than expected | |

Construction outlook worsens

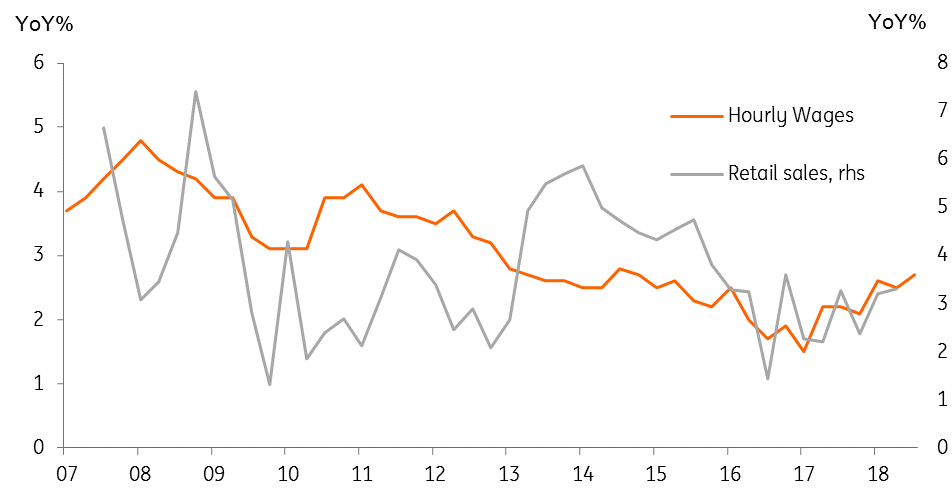

The AIG performance of construction index for December fell a further 1.9 points to a dismal 42.6 in December. You have to go back to June 2013 to match figures this bad. Helping offset the gloom from the housing market, Australian wages growth is slowly recovering. At 2.7%YoY currently, it is way off its 4.8%YoY peak in 2008. But it is also a decent pick up from the 1.5%YoY trough in 1Q 2017.

Labour data remains quite strong, and the unemployment rate low, so this could well be providing the offset to the housing market that is keeping the household sector alive and kicking, and keeping the Reserve Bank of Australia (RBA) maintaining its uneasy no-change policy, with markets divided on what direction their next move will be.

A little further AUD weakness wouldn't hurt, and we continue to think that the RBA will be relaxed if we see the AUD return to its flash-crash levels of sub 0.70.

Australian wages and retail sales growth

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

11 January 2019

Good MornING Asia - 14 January 2019 This bundle contains 4 Articles