BriefING Romania

EUR/RON trading above 4.6700

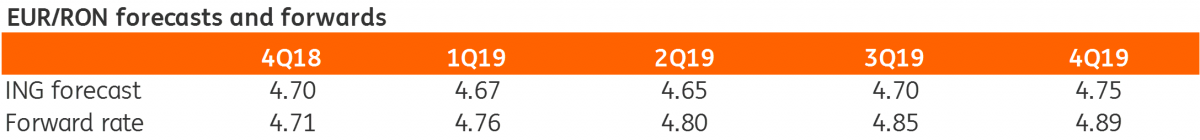

EUR/RON

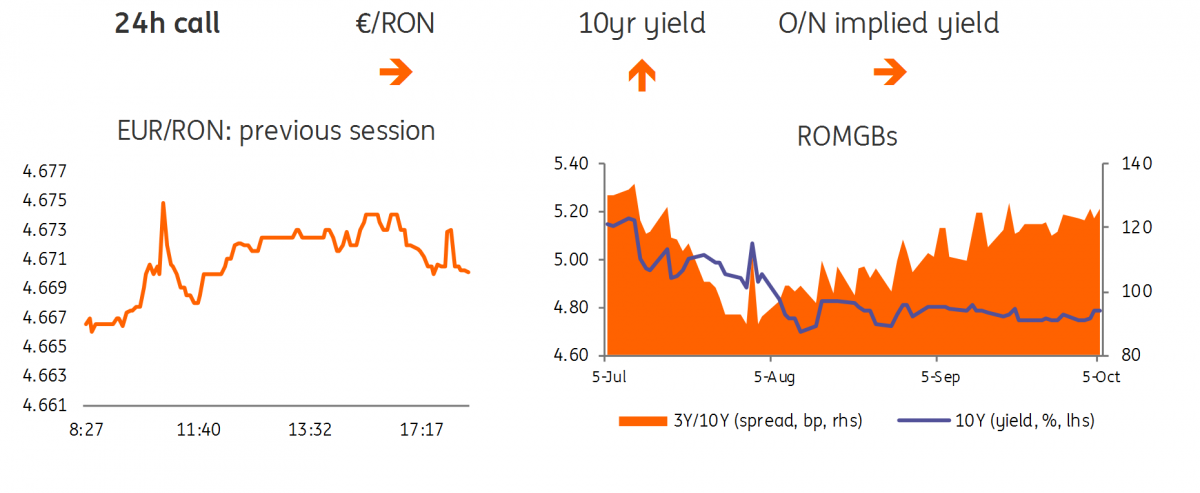

Slightly surprising, the EUR/RON traded above 4.6700 for most of yesterday’s trading session, closing the day around 4.6710. The somewhat sharp appreciation of the leu around the fixing time suggests that the NBR stands ready to act if needed and may not be willing yet to allow the EUR/RON to move above 4.6700, which would be a first. The regional currencies have also been under pressure and we expect a similar scenario for today, with the EUR/RON trading above 4.6700 for most of the day and likely dipping below it around fixing time.

Government bonds

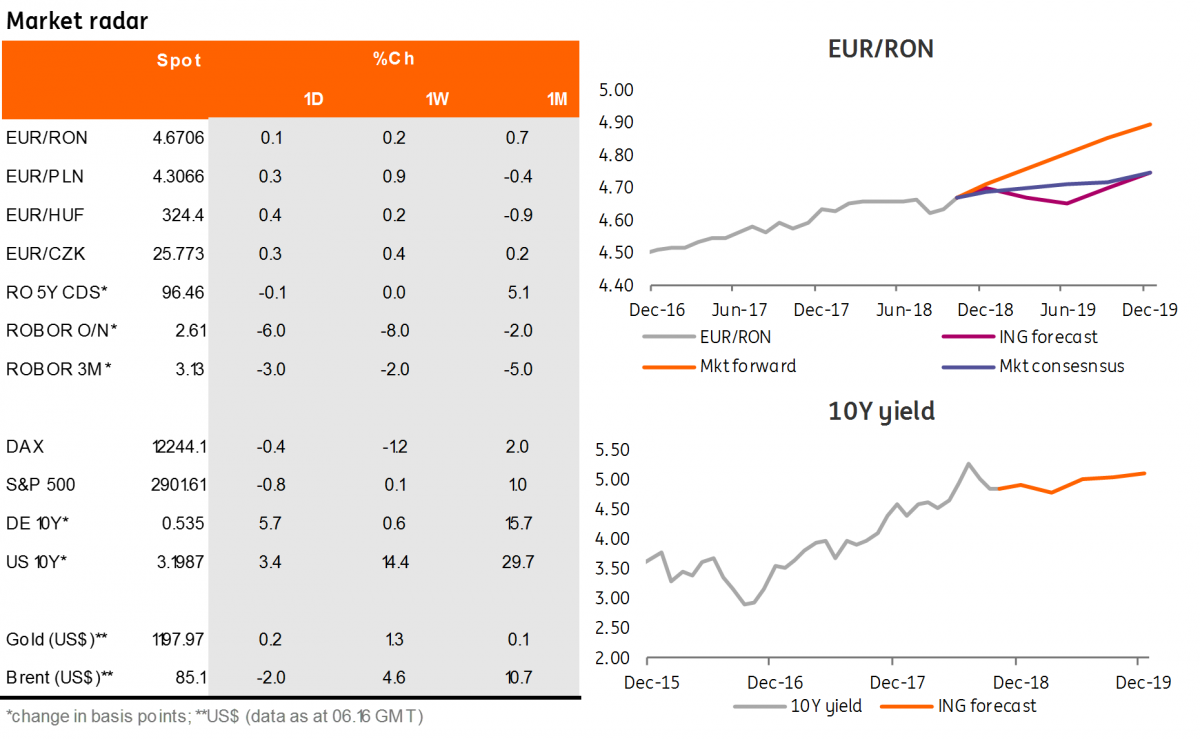

It was kind of a busy day for the Romanian bond market as the government re-tapped external markets issuing EUR1.15 billion in 10Y and EUR600 million in 20Y papers at MS+195 basis points and MS+270 basis points respectively. With combined books standing around EUR3.0 billion, tightening versus the initial IPT of MS+210/+215 for 10Y and MS+280 for 20Y was rather insignificant, leading to a decent premium compared to current maturities. Not a lot to cheer about the result but given the somewhat negative external backdrop, we can call it a fair result. On the local market, the 6M T-bill auction was surprisingly successful with a bid-to-cover of 2.99x. The MinFin allocated RON370 million versus the initial RON300 million target at 3.02% average and 3.05% maximum, well below our expectations.

Money Market

Cash rates continued to drop another 10-15 basis points with overnight now slightly below the 2.50% key rate. In fact, all maturities covering the current reserve period are now at or below 2.50% suggesting that along with the NBR’s repo auctions, liquidity has been added via exogenous factors, most likely MinFin spending.

Download

Download snap