Briefing Romania

RON 400 million targeted in the April 2026 auction is the highlight of Monday's Romanian market action

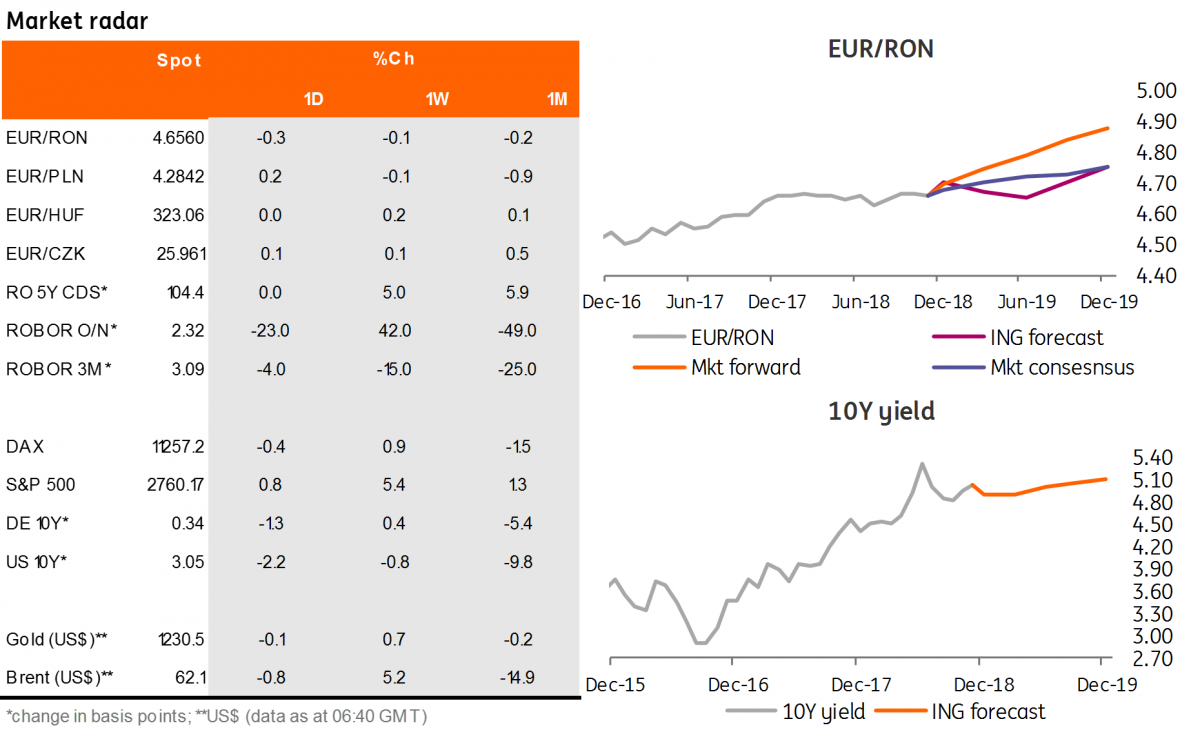

EUR/RON

The EUR/RON tested the lower end of its latest 4.6500-4.6600 range but rebounded from around 4.6520 to 4.6570 area towards the end of the trading session. For today the 4.6500-4.6600 range is likely to hold.

Government bonds

The positive sentiment in Romanian government bonds continued as monthly inflows into private pension funds are likely to have generated more interest in the secondary market. Today, the Ministry of Finance plans to sell RON 400 million in the April 2026 auction. This is the only tenor between five and ten years auctioned in December. Hence, we expect good demand and an average yield of around 4.65%

Money Market

The overnight implied yield remained just below the central bank's key rate of 2.50% as the liquidity backdrop remains supportive. A repo auction doesn’t look necessary in these conditions, particularly when considering the usual accelerated spending from the Ministry of Finance into the year-end.

The week ahead

For the week ahead, the US ISM indices are likely to remain close to their recent levels. As for the jobs market, unemployment is likely to remain at a 49-year low, and this is likely to see continued upward pressure on wages. We look for annual wage growth to stay at 3.1% this month, but given growing evidence of pay pressures in various surveys, we look for wage growth to pick up again in coming months.

Also this week, Fed Chair Jerome Powell will be testifying on monetary policy. October industrial data will be an important barometer of the state of the German economy in the final quarter of the year. The latest Ifo reading has already dented optimism about a V-shaped rebound after a disappointing third quarter performance.

On the local front, we expect the EUR/RON in the same 4.6500-4.6700 range.