BriefING Romania

The Ministry of Finance auctions September 2031 bonds

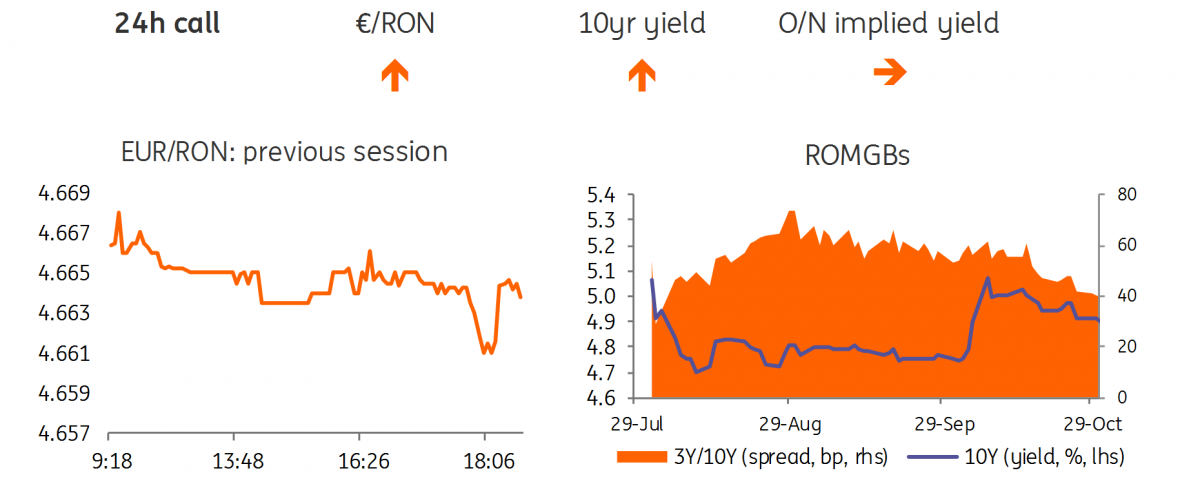

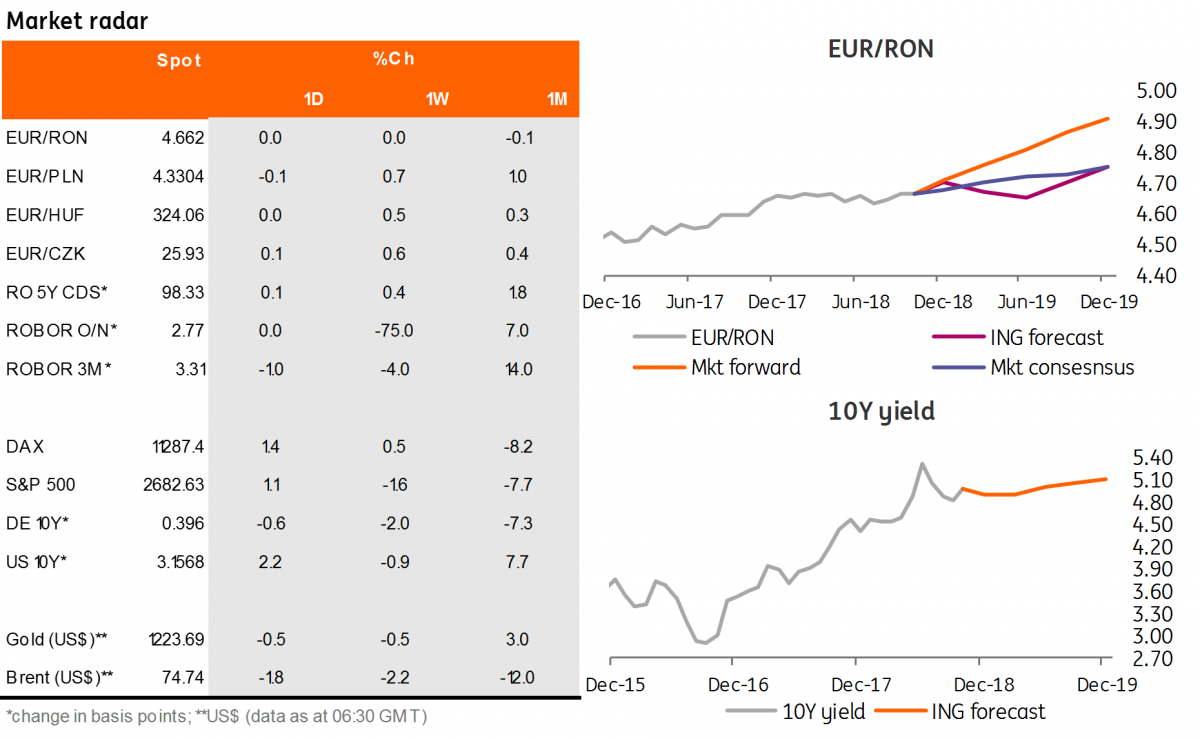

EUR/RON

Some appreciation bias for the Romanian leu yesterday on slightly higher volumes pushed the EUR/RON briefly towards 4.6600 but the pair bounced back towards 4.6640 in the last part of the trading session. We expect 4.6600-4.6700 range to hold today as well in EUR/RON.

Government bonds

ROMGBs yield curve moved another 1-2 basis points lower yesterday on some end-of-month residual buying interest. The November issuance calendar starts today with a Sep-2031 bond auction, with a RON200 million target. We expect the cut-off yield to print near 5.45% if the MinFin does not cut the issuance.

Money Market

Implied funding rates continued to trade around 3.00% yesterday, this time with a slight upside bias as we are still early into the current reserve period and banks still don’t have a clear image of the system’s liquidity outlook. On this topic, central bank’s governor Mugur Isarescu stated yesterday that some RON20 billion have been paid to the state budget around the 25th of last month, higher than the usual average of RON14-15 billion, due to quarterly payments. More interestingly, however, was that “one bank alone took almost half of the RON16 billion” injected on Monday by the National Bank of Romania via repo auction.

Download

Download snap