Bank of Korea delivers 25bp hike with hawkish tone

The Bank of Korea raised its policy rate by 25bp today with a hawkish tilt, expecting inflation to remain higher than its target of 2% throughout next year. But, given the falling pipeline prices and growing concerns over growth, we believe that the BoK is close to its final destination in raising interest rates

| 3.25% |

BoK's 7-Day Repo Rate |

| As expected | |

Terminal rate debate will be continued

The Monetary Policy Board unanimously decided to raise rates by 25bp today. Compared to the previous month, volatility in the FX market has calmed significantly and the credit squeeze in the short-term money market has worsened, thus the BoK returned to a normal rate hike pace. However, the board seems to have quite different views on the terminal rate - one for 3.25%, three for 3.5%, and two for 3.5%-3.75%, not including Governor Rhee Chang-yong's own opinions.

Regarding future policy decisions, Governor Rhee mentioned that as CPI inflation over the next two months is expected to fall due to the high base last year, the BoK will be cautious about reading into those figures and will wait to see whether inflation rebounds again in January and February. Also, the Korean won has appreciated meaningfully but external factors such as the Federal Reserve's December rate hike and China's Covid policy stance are uncertain, so FX moves in the coming months are another factor to consider in future policy decisions.

We are maintaining our call for a 25bp increase in 1Q23, and now see a better chance of a rate hike in February rather than January unless the Fed surprises the market with another large step in December. As inflation is expected to slow in the future, we believe that financial market stability and growth should be the focus of the BoK from now on. Also, the BoK is expected to adjust its hiking pace as there is limited room for further rate hikes.

The BoK has downgraded its 2023 GDP and CPI inflation forecasts

The BoK revised down quite meaningfully its GDP forecast for 2023 from 2.1% to 1.7%. Most of the downward adjustments come from the external demand component, with growth in major trading partners such as the US (0.3%), the EU (-0.2%) and China (4.5%) expected to slow down in 2023.

Meanwhile, the BoK forecast that next year's inflation would be only marginally lower, at 3.6% from 3.7%. The accumulated pressure to raise prices is expected to continue until next year, offsetting much of the weakening pressure on the demand side due to the economic slowdown. For the next couple of months, base effects will play a major role in inflation thus CPI inflation is expected to fall to the 4% level temporarily but rebound to the 5% level in January. The BoK expects prices for gas, electricity, and manufactured food to rise further early next year, thus headline inflation is expected to stay above 4% in the first half of next year.

What we see similarly to BoK's outlook

First, Korea's growth is largely dependent on the external demand condition. Both ING and BoK have a cloudy global outlook, which is expected to negatively affect Korea's growth next year.

Second, the semiconductor cycle is expected to bottom out in the second half of next year. The recent slump in exports is mainly driven by sluggish semiconductor exports, but exports should rebound in the second half of next year.

Third, investment is expected to fall due to tight financial conditions and the bleak outlook for the construction sector.

Fourth, although credit tightening in the short-term money market and some market jitters will likely continue, this shouldn't threaten the overall financial system. We think some losses are expected in the Project Financing and construction industry, but the shock is expected to be contained within the sector. (Please see "South Korea: corporate debt is a concern for the economy).

What we see differently to the BoK's outlook

First of all, ING's 2023 GDP forecasts for the US and the EU are -0.4% and -0.7% year-on-year, respectively, which is weak compared to the BoK's own forecasts of 0.3% in the US and -0.2% in the EU. As mentioned earlier, considering Korea's high dependency on external demand, we see a bigger negative impact on Korea's exports and overall growth.

Second, private consumption is expected to shrink in the first half of next year as the debt service burden increases, while the BoK expects consumption to continue to recover. More than 70% of household debt is based on floating interest rates and more than 65% of households are indebted. We have been seeing the deleveraging of household debt mostly in personal loans for several months which is a good sign for long-term growth but, in the short term, the propensity of households to spend should weaken. In addition, the wealth effect of Korean households is expected to weaken as real estate prices will likely continue to adjust further. These are the reasons that we foresee sluggish private consumption in 1H23.

Third, we believe that inflation will decline faster than the BoK's forecast. It is true that there have been accumulated price pressures in utilities and other service prices and Korea's CPI is more sensitive to supply-side inflation factors. But, we think the price declines in rent and housing should have a bigger impact in leading to a sharp decline while price hikes from reopening will likely dissipate as well.

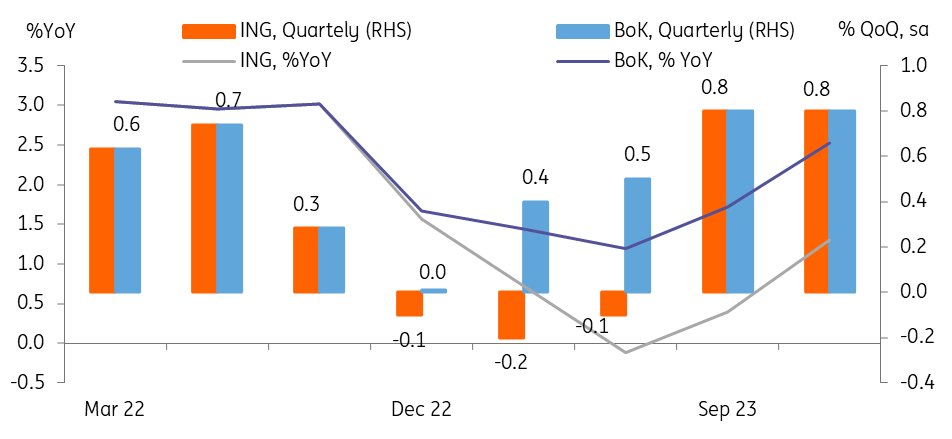

ING vs BoK's outlook

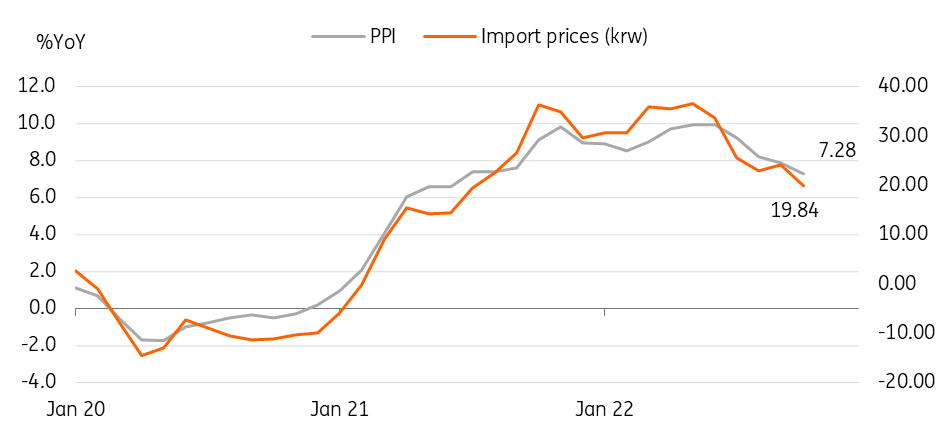

Forward-looking price components point to further deceleration in coming months

In a separate report, the BoK announced its Producer Price Index for October. Headline PPI inflation slowed to 7.3% YoY in October (vs 7.9% in September) with goods prices down the most. Goods prices such as fresh food (4.1% vs 7.1% Sept) and industrial products (7.7% vs 9.6% Sept) all declined due to good harvesting of winter vegetables and the drop in gasoline prices. Meanwhile, utility (32.4% vs 25.2% Sept) and services prices (3.4% vs 3.3% Sept) continued to rise, reflecting the recent gas/electricity rates hike. The utility rate hike will have some lingering effects, pushing up service prices in a few months, but we believe that headline prices will continue to decelerate as demand-side pressures are expected to turn weak with higher interest rates.

We expect CPI inflation to decline quite sharply to 5.1% YoY in November (vs 5.7% in October) for the following reasons. The Korean won significantly stabilised compared to October, gasoline prices continued to decline, and fresh vegetable prices came down meaningfully during the month. Also, we believe that inflation will likely decelerate to the 4% level in 1Q23 although there will be additional utility rate hikes next year.

Pipeline prices continued to drop since early summer

Download

Download snap