Austria: Inflation keeps rising, as consumers like to spend

Although prices are on the rise, Austrians keep on spending

Significant increases in fuel prices and higher costs for housing, water and energy pushed June’s headline inflation rate to 2% year on year, from 1.9% YoY in March. According to the harmonised European definition (HICP), headline inflation was even higher, coming in at 2.3% YoY, from 2.1% in May. Strong price increases for restaurants and hotels (higher weightings in the HICP than in the CPI) significantly raised the HICP vis-à-vis the CPI.

Daily life became noticeably more expensive as well. The micro basket, or out-of-the-pocket inflation measure, which represents typical daily shopping purchases, increased by 3.3% year-on-year in June (May 3.8%), while the mini basket, representing weekly purchases and also containing fuel, became 5.5% more expensive in June compared with June last year.

Although prices are on the rise, Austrians keep on spending.

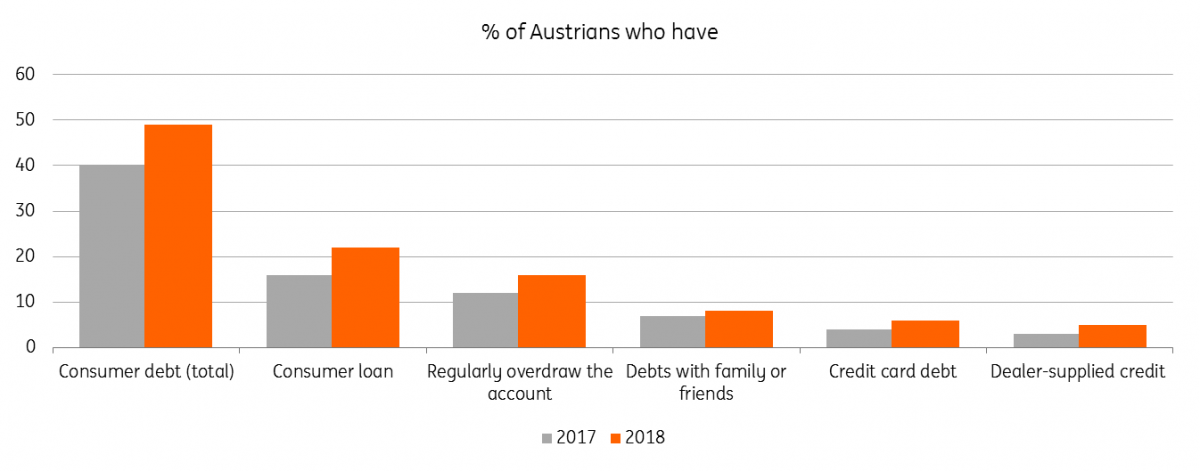

According to a recent ING International Survey, consumer debt is high. The percentage of those claiming to be privately indebted increased by 9% compared to a year before to a total of 49%. Even though official data from the Bank of International Settlement shows that credit to households and non-profit institutions serving households decreased from 50.4% to 49.1%.

According to the survey, Austrians increased indebtedness in all possible instruments, with consumer loans and bank overdraws taking the lion’s share. However, there are regional differences: while the fewest private debtors live in Vienna (44%), 57% of Carinthian households are in debt.

With the economy booming, consumers are likely to continue spending, as a result of which private consumption should remain a strong growth driver throughout the year.